Free Online Invoicing & GST Billing Software for Small Businesses

VISIT : https://hire.digitalscholar.in/candidate/gst-invoice-sofware

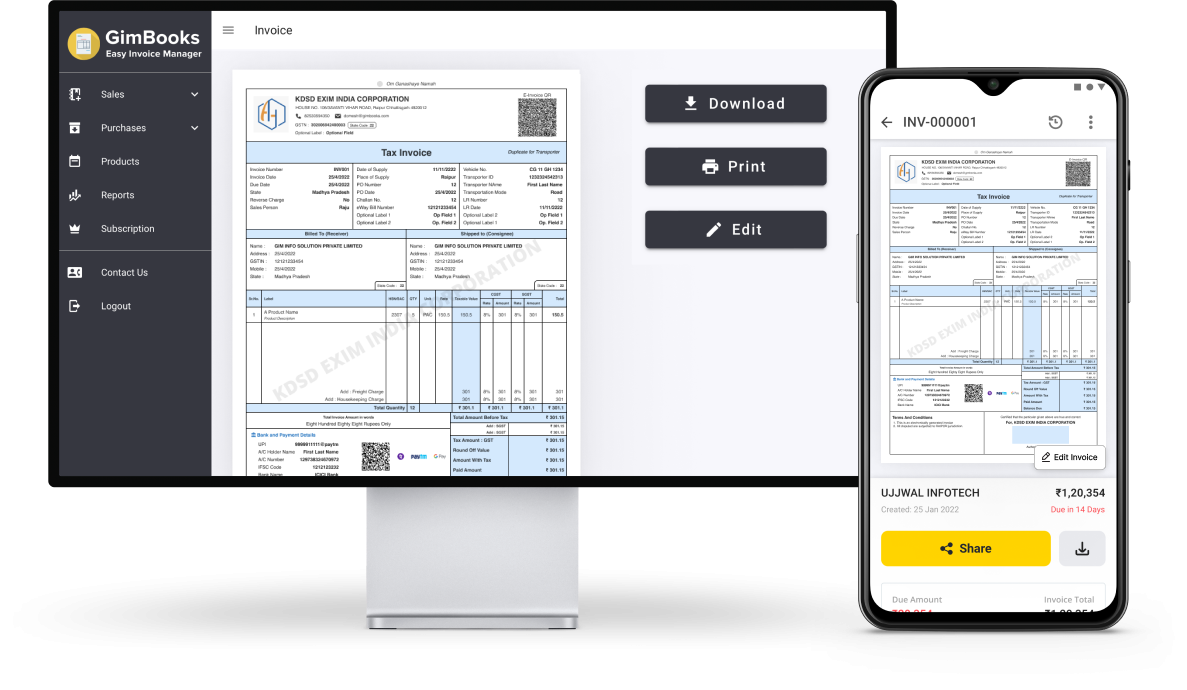

Managing finances is one of the most critical yet time-consuming tasks for small business owners. From sending invoices to tracking payments and staying compliant with GST regulations, the process can quickly become complex. That’s why free online invoicing and GST billing software is a game-changer for small businesses.

Why Small Businesses Need Invoicing Software

Small businesses often operate with limited resources, which means every tool they use must offer maximum value. Free invoicing software allows business owners to generate professional invoices, manage customer data, and track payments—all from a single dashboard. It reduces manual work and helps maintain accurate financial records.

Stay GST-Compliant with Ease

GST compliance is non-negotiable for businesses in India. Free GST billing software ensures that every invoice you generate includes correct tax calculations, HSN/SAC codes, and GSTIN details. This not only keeps your business on the right side of tax regulations but also simplifies monthly and annual return filings.

Go Digital and Save Time

Traditional invoicing methods like paper bills or spreadsheets are not only outdated but also error-prone. Online billing software automates repetitive tasks such as recurring invoices, payment reminders, and tax calculations. Cloud access also means you can invoice clients from anywhere—whether you're at the office or on the move.

VISIT : https://hire.digitalscholar.in/candidate/gst-invoice-sofware

Managing finances is one of the most critical yet time-consuming tasks for small business owners. From sending invoices to tracking payments and staying compliant with GST regulations, the process can quickly become complex. That’s why free online invoicing and GST billing software is a game-changer for small businesses.

Why Small Businesses Need Invoicing Software

Small businesses often operate with limited resources, which means every tool they use must offer maximum value. Free invoicing software allows business owners to generate professional invoices, manage customer data, and track payments—all from a single dashboard. It reduces manual work and helps maintain accurate financial records.

Stay GST-Compliant with Ease

GST compliance is non-negotiable for businesses in India. Free GST billing software ensures that every invoice you generate includes correct tax calculations, HSN/SAC codes, and GSTIN details. This not only keeps your business on the right side of tax regulations but also simplifies monthly and annual return filings.

Go Digital and Save Time

Traditional invoicing methods like paper bills or spreadsheets are not only outdated but also error-prone. Online billing software automates repetitive tasks such as recurring invoices, payment reminders, and tax calculations. Cloud access also means you can invoice clients from anywhere—whether you're at the office or on the move.

Free Online Invoicing & GST Billing Software for Small Businesses

VISIT : https://hire.digitalscholar.in/candidate/gst-invoice-sofware

Managing finances is one of the most critical yet time-consuming tasks for small business owners. From sending invoices to tracking payments and staying compliant with GST regulations, the process can quickly become complex. That’s why free online invoicing and GST billing software is a game-changer for small businesses.

Why Small Businesses Need Invoicing Software

Small businesses often operate with limited resources, which means every tool they use must offer maximum value. Free invoicing software allows business owners to generate professional invoices, manage customer data, and track payments—all from a single dashboard. It reduces manual work and helps maintain accurate financial records.

Stay GST-Compliant with Ease

GST compliance is non-negotiable for businesses in India. Free GST billing software ensures that every invoice you generate includes correct tax calculations, HSN/SAC codes, and GSTIN details. This not only keeps your business on the right side of tax regulations but also simplifies monthly and annual return filings.

Go Digital and Save Time

Traditional invoicing methods like paper bills or spreadsheets are not only outdated but also error-prone. Online billing software automates repetitive tasks such as recurring invoices, payment reminders, and tax calculations. Cloud access also means you can invoice clients from anywhere—whether you're at the office or on the move.

0 Commentarii

·0 Distribuiri

·233 Views

·0 previzualizare