Patrocinados

Actualizaciones Recientes

-

What is a GST Invoice Generator? A Complete Guide for Businesses

Goods and Services Tax (GST) has transformed taxation in India, making invoicing an essential part of business operations. A GST Invoice Generator is a tool that helps businesses create GST-compliant invoices quickly and accurately. Whether you are a small business owner, freelancer, or enterprise, using GST Invoice Software can simplify tax compliance, reduce errors, and save time.

In this guide, we will explain what a GST Invoice Generator is, how it works, and why businesses need it. We will also cover the benefits of using an Online GST Invoice Generator and how it compares to manual invoicing.

What is a GST Invoice Generator?

A GST Invoice Generator is a digital tool that helps businesses generate GST invoices with all necessary details, such as invoice number, GSTIN, buyer and seller details, tax breakup, and total amount. These tools ensure that invoices comply with GST regulations, reducing errors and avoiding penalties.

Key Features of a GST Invoice Generator:

1. Automated GST calculations – Ensures accurate tax computation.

2. Pre-designed templates – Offers ready-to-use GST invoice templates for professional invoicing.

3. Multi-tax support – Handles CGST, SGST, IGST, and UTGST calculations.

4. E-invoicing under GST – Supports real-time invoice generation for compliance with government regulations.

5. Integration with accounting software – Syncs with GST filing software for seamless tax return filing.

Why is a GST Invoice Generator Important for Businesses?

For businesses of all sizes, a GST Invoice Generator provides multiple benefits:

1. Saves Time and Effort: Manually creating invoices can be time-consuming. An Online GST Invoice Generator automates the process, allowing businesses to focus on growth rather than paperwork.

2. Reduces Errors: Errors in invoices can lead to penalties. A Tax Invoice Generator ensures accuracy by applying the correct tax rates and following GST guidelines.

3. Improves Compliance: Using a GST Invoice Software ensures that all invoices meet the legal requirements, reducing the risk of compliance issues.

4. Professional and Organized Billing: A Digital Invoice Creation tool allows businesses to issue well-structured, professional invoices that enhance credibility and trust.

How to Generate a GST Invoice?

Generating a GST invoice manually can be challenging, but using a Free GST Invoice Generator makes it simple. Here’s how:

1. Enter Business Details: Add your business name, GSTIN, and address.

2. Add Buyer Details: Enter the buyer’s name, GSTIN, and address.

3. Include Invoice Details: Mention the invoice number, date, and due date.

4. Add Product/Service Details: Include the description, quantity, unit price, and tax rate.

5. Calculate GST Automatically: The tool applies CGST, SGST, or IGST based on the buyer’s location.

6. Download or Print Invoice: Save the invoice as a PDF or email it directly to the client.

GST Billing Process: Step-by-Step

1. Create Invoice – Use an Online GST Invoice Generator to input transaction details.

2. Apply GST Rates – Automatically calculate CGST, SGST, or IGST.

3. Issue Invoice to Customer – Send via email or print for record-keeping.

4. File GST Returns – Sync with GST filing software for easy tax submission.

5. Maintain Records – Store invoices digitally for future reference and audits.

Market Data: Why Businesses are Shifting to Digital Invoicing

1. According to a 2023 survey, 70% of Indian businesses use GST Invoice Software for compliance.

2. The digital invoicing market in India is growing at 12% annually, driven by GST regulations.

3. Over 80% of SMEs prefer Free GST Invoice Generators before switching to paid solutions.

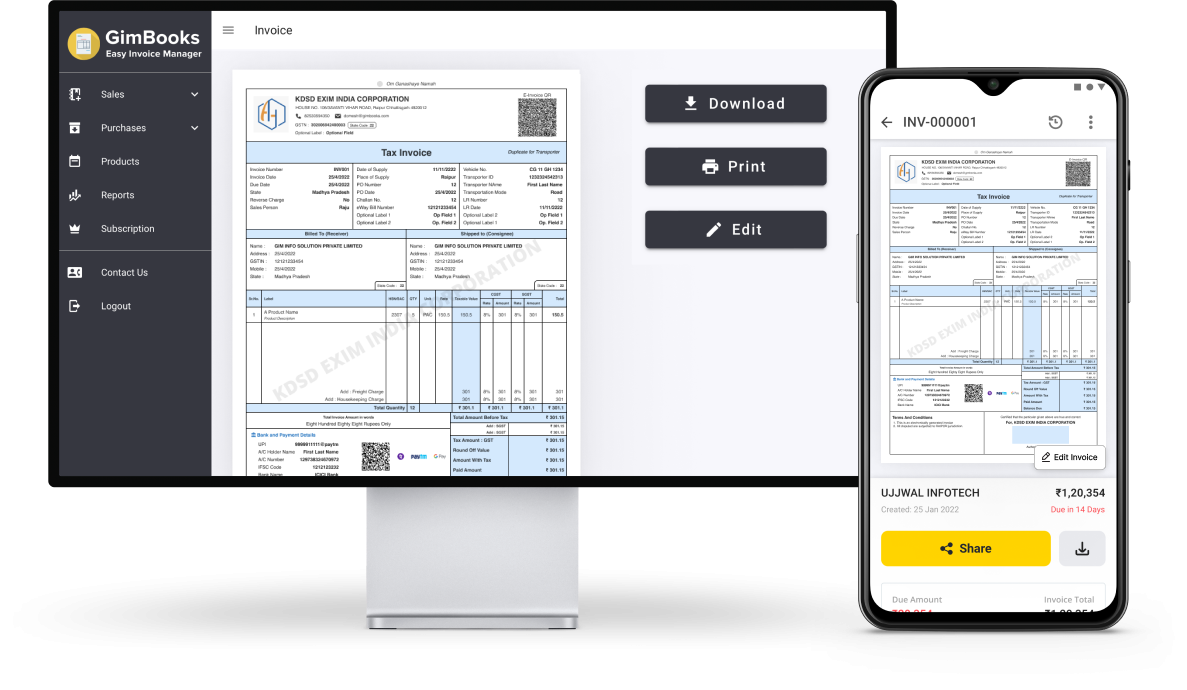

GimBook: The Smart GST Invoice Solution

GimBook is a powerful GST Invoice Generator designed for businesses of all sizes. It provides a user-friendly interface, automated GST calculations, and customizable invoice templates. With GimBook, you can:

1. Generate GST invoices in seconds

2. Access pre-designed GST invoice templates

3. Use cloud-based storage for invoices

4. Integrate with accounting software for GST filing

Whether you’re a freelancer, small business, or enterprise, GimBook ensures hassle-free invoicing and compliance.

Boost Your Business with GimBook – Create GST Invoices Hassle-Free! https://gimbooks.com/

A GST Invoice Generator is a must-have tool for businesses in India. It streamlines invoicing, reduces errors, and ensures compliance with GST regulations. Whether you choose a Free GST Invoice Generator or a paid Best GST Invoice Software, the key is to find a solution that meets your business needs. Start using a GST Invoice Generator today and simplify your billing process effortlessly!

#GST_Invoice_Software #GST_Invoice_GeneratorWhat is a GST Invoice Generator? A Complete Guide for Businesses Goods and Services Tax (GST) has transformed taxation in India, making invoicing an essential part of business operations. A GST Invoice Generator is a tool that helps businesses create GST-compliant invoices quickly and accurately. Whether you are a small business owner, freelancer, or enterprise, using GST Invoice Software can simplify tax compliance, reduce errors, and save time. In this guide, we will explain what a GST Invoice Generator is, how it works, and why businesses need it. We will also cover the benefits of using an Online GST Invoice Generator and how it compares to manual invoicing. What is a GST Invoice Generator? A GST Invoice Generator is a digital tool that helps businesses generate GST invoices with all necessary details, such as invoice number, GSTIN, buyer and seller details, tax breakup, and total amount. These tools ensure that invoices comply with GST regulations, reducing errors and avoiding penalties. Key Features of a GST Invoice Generator: 1. Automated GST calculations – Ensures accurate tax computation. 2. Pre-designed templates – Offers ready-to-use GST invoice templates for professional invoicing. 3. Multi-tax support – Handles CGST, SGST, IGST, and UTGST calculations. 4. E-invoicing under GST – Supports real-time invoice generation for compliance with government regulations. 5. Integration with accounting software – Syncs with GST filing software for seamless tax return filing. Why is a GST Invoice Generator Important for Businesses? For businesses of all sizes, a GST Invoice Generator provides multiple benefits: 1. Saves Time and Effort: Manually creating invoices can be time-consuming. An Online GST Invoice Generator automates the process, allowing businesses to focus on growth rather than paperwork. 2. Reduces Errors: Errors in invoices can lead to penalties. A Tax Invoice Generator ensures accuracy by applying the correct tax rates and following GST guidelines. 3. Improves Compliance: Using a GST Invoice Software ensures that all invoices meet the legal requirements, reducing the risk of compliance issues. 4. Professional and Organized Billing: A Digital Invoice Creation tool allows businesses to issue well-structured, professional invoices that enhance credibility and trust. How to Generate a GST Invoice? Generating a GST invoice manually can be challenging, but using a Free GST Invoice Generator makes it simple. Here’s how: 1. Enter Business Details: Add your business name, GSTIN, and address. 2. Add Buyer Details: Enter the buyer’s name, GSTIN, and address. 3. Include Invoice Details: Mention the invoice number, date, and due date. 4. Add Product/Service Details: Include the description, quantity, unit price, and tax rate. 5. Calculate GST Automatically: The tool applies CGST, SGST, or IGST based on the buyer’s location. 6. Download or Print Invoice: Save the invoice as a PDF or email it directly to the client. GST Billing Process: Step-by-Step 1. Create Invoice – Use an Online GST Invoice Generator to input transaction details. 2. Apply GST Rates – Automatically calculate CGST, SGST, or IGST. 3. Issue Invoice to Customer – Send via email or print for record-keeping. 4. File GST Returns – Sync with GST filing software for easy tax submission. 5. Maintain Records – Store invoices digitally for future reference and audits. Market Data: Why Businesses are Shifting to Digital Invoicing 1. According to a 2023 survey, 70% of Indian businesses use GST Invoice Software for compliance. 2. The digital invoicing market in India is growing at 12% annually, driven by GST regulations. 3. Over 80% of SMEs prefer Free GST Invoice Generators before switching to paid solutions. GimBook: The Smart GST Invoice Solution GimBook is a powerful GST Invoice Generator designed for businesses of all sizes. It provides a user-friendly interface, automated GST calculations, and customizable invoice templates. With GimBook, you can: 1. Generate GST invoices in seconds 2. Access pre-designed GST invoice templates 3. Use cloud-based storage for invoices 4. Integrate with accounting software for GST filing Whether you’re a freelancer, small business, or enterprise, GimBook ensures hassle-free invoicing and compliance. Boost Your Business with GimBook – Create GST Invoices Hassle-Free! https://gimbooks.com/ A GST Invoice Generator is a must-have tool for businesses in India. It streamlines invoicing, reduces errors, and ensures compliance with GST regulations. Whether you choose a Free GST Invoice Generator or a paid Best GST Invoice Software, the key is to find a solution that meets your business needs. Start using a GST Invoice Generator today and simplify your billing process effortlessly! #GST_Invoice_Software #GST_Invoice_Generator0 Commentarios ·0 Acciones ·334 Views ·0 Vista previa -

How AI & Automation Are Revolutionizing Online GST Billing Software

In today's digital era, businesses are rapidly adopting technology to simplify their operations. One such game-changing advancement is the integration of Artificial Intelligence (AI) and Automation in GST Billing Software. This technology is transforming how businesses manage their tax calculations, invoicing, and compliance.

If you are a business owner or accountant, understanding how AI in GST billing software can improve efficiency and accuracy is essential. In this blog, we will explore how Online GST Billing Software powered by AI is reshaping the future of taxation.

The Role of AI in GST Billing Software

Artificial Intelligence (AI) helps businesses automate repetitive tasks, reducing manual effort and errors. Here’s how GST software with AI is improving the billing process:

1. Real-Time Tax Computation: Traditional billing software requires manual input for tax calculations. With AI, tax rates are automatically applied based on business type, location, and category of goods/services. This ensures real-time tax computation, minimizing errors and saving time.

2. Automated Invoice Generation: AI can automatically generate GST-compliant invoices based on past transaction history. E-invoicing automation ensures that invoices follow GST rules, reducing compliance risks.

3. GST Compliance Automation: Keeping up with frequent GST updates can be difficult. AI-powered GST compliance automation ensures that your business follows the latest tax regulations. It alerts you to any compliance issues before they become major problems.

4. Fraud Detection & Error Prevention: AI can detect unusual billing patterns that might indicate tax fraud or data entry errors. Businesses can use AI-powered analytics to identify mistakes in invoices and fix them before submission.

Why Online GST Billing Software Is the Future

With the rise of cloud technology, businesses are moving from traditional desktop-based software to cloud-based GST software. Let’s look at why this shift is happening:

1. Accessibility Anytime, Anywhere: Unlike GST Billing Software for PC, which requires installation on a single device, Online GST Billing Software allows users to access data from any device with an internet connection.

2. Data Security & Backup: Cloud storage ensures that your data is safe and backed up regularly. Even if a system crashes, your invoices and tax records remain secure.

3. Seamless Integration with Other Tools: Online GST billing software can integrate with accounting software, payment gateways, and ERP systems, ensuring a smooth workflow.

How AI is Transforming GST Billing Software for Businesses

Businesses, whether small or large, benefit greatly from AI-powered GST billing software for businesses. Here’s how:

1. Faster Return Filing: AI-driven software can automatically prepare tax returns, making it easy for businesses to file GST on time.

2. Predictive Analytics: AI can analyze past transactions and suggest ways to optimize tax savings. Businesses can use predictive analytics to forecast future tax liabilities.

3. Reduced Operational Costs: Automation reduces the need for additional manpower, saving businesses money in the long run.

The Future of AI in Billing Software

The Future of AI in billing software is exciting. Here are some trends we can expect:

1. AI-powered Chatbots: Businesses will be able to interact with AI assistants to generate invoices, answer GST-related queries, and resolve compliance issues instantly.

2. Voice-Based Commands: Users will soon be able to generate invoices using voice commands.

3. Blockchain Integration: Secure and tamper-proof transactions will be possible with AI and blockchain working together.

Data & Statistics on AI Adoption in GST Billing

Here are some facts to highlight the impact of AI in GST billing:

1. According to a report by PwC, AI-powered accounting software can reduce tax compliance costs by 30-50%.

2. A survey by Deloitte found that 82% of businesses using AI in taxation saw a significant reduction in tax-related errors.

3. India's GST Network (GSTN) has been working on AI-driven analytics to identify fraud cases, saving thousands of crores in tax evasion.

GimBook: Your AI-Powered GST Billing Solution

GimBook is a cutting-edge GST Billing Software designed to simplify tax compliance with AI-driven automation. It offers real-time tax computation, e-invoicing automation, and cloud-based accessibility, making it the perfect choice for businesses of all sizes. With AI in GST billing software, GimBook ensures error-free invoicing, seamless GST compliance automation, and effortless tax filing. Whether you need a GST Billing Software for PC or an Online GST Billing Software, GimBook provides a user-friendly and efficient solution to manage your finances with ease.

Experience the future of billing—switch to GimBook today, https://gimbooks.com/

AI and automation are transforming the way businesses handle GST billing. With AI in GST billing software, companies can enjoy real-time tax computation, E-invoicing automation, and GST compliance automation.

As businesses continue to embrace Online GST billing software and cloud-based GST software, the future of AI in billing software looks promising. Now is the perfect time to switch to an AI-powered billing system and make your GST compliance smoother and error-free.

Are you ready to take your business to the next level with AI-driven GST billing software? Start today and experience the future of automated taxation!

#GST_Billing_Software_for_PC #GST_Billing_Software #Online_GST_Billing_Software

How AI & Automation Are Revolutionizing Online GST Billing Software In today's digital era, businesses are rapidly adopting technology to simplify their operations. One such game-changing advancement is the integration of Artificial Intelligence (AI) and Automation in GST Billing Software. This technology is transforming how businesses manage their tax calculations, invoicing, and compliance. If you are a business owner or accountant, understanding how AI in GST billing software can improve efficiency and accuracy is essential. In this blog, we will explore how Online GST Billing Software powered by AI is reshaping the future of taxation. The Role of AI in GST Billing Software Artificial Intelligence (AI) helps businesses automate repetitive tasks, reducing manual effort and errors. Here’s how GST software with AI is improving the billing process: 1. Real-Time Tax Computation: Traditional billing software requires manual input for tax calculations. With AI, tax rates are automatically applied based on business type, location, and category of goods/services. This ensures real-time tax computation, minimizing errors and saving time. 2. Automated Invoice Generation: AI can automatically generate GST-compliant invoices based on past transaction history. E-invoicing automation ensures that invoices follow GST rules, reducing compliance risks. 3. GST Compliance Automation: Keeping up with frequent GST updates can be difficult. AI-powered GST compliance automation ensures that your business follows the latest tax regulations. It alerts you to any compliance issues before they become major problems. 4. Fraud Detection & Error Prevention: AI can detect unusual billing patterns that might indicate tax fraud or data entry errors. Businesses can use AI-powered analytics to identify mistakes in invoices and fix them before submission. Why Online GST Billing Software Is the Future With the rise of cloud technology, businesses are moving from traditional desktop-based software to cloud-based GST software. Let’s look at why this shift is happening: 1. Accessibility Anytime, Anywhere: Unlike GST Billing Software for PC, which requires installation on a single device, Online GST Billing Software allows users to access data from any device with an internet connection. 2. Data Security & Backup: Cloud storage ensures that your data is safe and backed up regularly. Even if a system crashes, your invoices and tax records remain secure. 3. Seamless Integration with Other Tools: Online GST billing software can integrate with accounting software, payment gateways, and ERP systems, ensuring a smooth workflow. How AI is Transforming GST Billing Software for Businesses Businesses, whether small or large, benefit greatly from AI-powered GST billing software for businesses. Here’s how: 1. Faster Return Filing: AI-driven software can automatically prepare tax returns, making it easy for businesses to file GST on time. 2. Predictive Analytics: AI can analyze past transactions and suggest ways to optimize tax savings. Businesses can use predictive analytics to forecast future tax liabilities. 3. Reduced Operational Costs: Automation reduces the need for additional manpower, saving businesses money in the long run. The Future of AI in Billing Software The Future of AI in billing software is exciting. Here are some trends we can expect: 1. AI-powered Chatbots: Businesses will be able to interact with AI assistants to generate invoices, answer GST-related queries, and resolve compliance issues instantly. 2. Voice-Based Commands: Users will soon be able to generate invoices using voice commands. 3. Blockchain Integration: Secure and tamper-proof transactions will be possible with AI and blockchain working together. Data & Statistics on AI Adoption in GST Billing Here are some facts to highlight the impact of AI in GST billing: 1. According to a report by PwC, AI-powered accounting software can reduce tax compliance costs by 30-50%. 2. A survey by Deloitte found that 82% of businesses using AI in taxation saw a significant reduction in tax-related errors. 3. India's GST Network (GSTN) has been working on AI-driven analytics to identify fraud cases, saving thousands of crores in tax evasion. GimBook: Your AI-Powered GST Billing Solution GimBook is a cutting-edge GST Billing Software designed to simplify tax compliance with AI-driven automation. It offers real-time tax computation, e-invoicing automation, and cloud-based accessibility, making it the perfect choice for businesses of all sizes. With AI in GST billing software, GimBook ensures error-free invoicing, seamless GST compliance automation, and effortless tax filing. Whether you need a GST Billing Software for PC or an Online GST Billing Software, GimBook provides a user-friendly and efficient solution to manage your finances with ease. Experience the future of billing—switch to GimBook today, https://gimbooks.com/ AI and automation are transforming the way businesses handle GST billing. With AI in GST billing software, companies can enjoy real-time tax computation, E-invoicing automation, and GST compliance automation. As businesses continue to embrace Online GST billing software and cloud-based GST software, the future of AI in billing software looks promising. Now is the perfect time to switch to an AI-powered billing system and make your GST compliance smoother and error-free. Are you ready to take your business to the next level with AI-driven GST billing software? Start today and experience the future of automated taxation! #GST_Billing_Software_for_PC #GST_Billing_Software #Online_GST_Billing_Software0 Commentarios ·0 Acciones ·336 Views ·0 Vista previa -

GST Billing Software for E-Commerce: The Key to Seamless Online Transactions

In today’s fast-paced world of online shopping, businesses need to keep up with technology to ensure their operations run smoothly. One crucial tool that every e-commerce business must have is GST Billing Software. Whether you're a small online seller or a large e-commerce platform, having the right invoicing tools can make all the difference in managing your finances and complying with tax regulations. Let’s dive into why GST Billing & Invoicing Software is essential for seamless online transactions and how it benefits your e-commerce business.

What is GST Billing Software?

GST Billing Software is a tool that helps businesses create GST-compliant invoices, manage taxes, and streamline their billing processes. It automates tax calculations, generates accurate invoices, and ensures that your business complies with the Goods and Services Tax (GST) regulations. For e-commerce businesses, this software is particularly useful as it simplifies the complex tax processes associated with online transactions.

Why is GST Billing Software Important for E-Commerce?

Running an e-commerce business involves handling multiple orders, payments, and returns daily. With such high volumes of transactions, managing taxes manually can be time-consuming and error-prone. Here’s why GST software for e-commerce is essential:

1. Simplifies Tax Compliance: E-commerce businesses often sell products across different states, which means dealing with varying tax rates. GST Bill Invoice Software automatically calculates the correct tax rates based on the buyer's location, ensuring compliance with GST rules.

2. Speeds Up Invoicing: Creating invoices manually for every order can be tedious. With GST Billing & Invoicing Software, you can generate GST-compliant invoices in just a few clicks, saving time and reducing errors.

3. Handles Multiple Transactions Efficiently: Online businesses process numerous orders daily. GST Billing Software can manage bulk invoicing, making it easier to handle a large volume of transactions without delays.

4. Reduces Human Errors: Manual calculations often lead to mistakes, which can result in tax penalties. Automated tools like Best GST Bill Invoice Software ensure accurate calculations, leaving no room for errors.

Features to Look for in GST Billing Software for E-Commerce

When choosing the best GST Bill Invoice Software for your e-commerce business, ensure it offers the following features:

1. GST-Compliant Invoicing Tools: The software should generate GST-compliant invoices, including essential details like GSTIN, tax rates, HSN codes, and buyer’s location.

2. Automated Tax Calculations: Look for software that automatically calculates CGST, SGST, and IGST based on the transaction location.

3. Integration with E-Commerce Platforms: Choose software that can seamlessly integrate with your online store, whether it’s on Shopify, Amazon, Flipkart, or your custom-built website.

4. Multi-Currency Support: If you sell internationally, opt for a tool that supports multiple currencies and calculates taxes accordingly.

5. Bulk Invoicing: For businesses handling numerous orders, bulk invoicing capabilities can save time and effort.

6. Cloud-Based Accessibility: Cloud-based GST Billing Software allows you to access your data anytime, anywhere, making it perfect for e-commerce businesses.

Benefits of Using GST Billing Software for E-Commerce

Using the right GST software for e-commerce can transform how you manage your business. Here are the key benefits:

1. Enhanced Efficiency: Automating invoicing and tax calculations frees up time for you to focus on growing your business.

2. Better Tax Compliance: The software ensures that all your transactions comply with GST regulations, reducing the risk of penalties.

3. Seamless Online Transactions: Quick and accurate invoicing improves the customer experience, leading to higher satisfaction and loyalty.

4. Cost Savings: While the upfront cost of software might seem high, the time and resources you save in the long run make it a worthy investment.

5. Data Security: Cloud-based solutions ensure your business data is safe and backed up, protecting you from data loss.

Popular GST Billing Software for E-Commerce Businesses

Here are some of the best GST Bill Invoice Software options available in the market:

1. GimBook: A comprehensive tool tailored for e-commerce businesses, offering GST-compliant invoicing, seamless integrations, and real-time tax calculations.

2. Zoho Books: A cloud-based tool offering GST-compliant invoicing, inventory management, and integration with e-commerce platforms.

3. TallyPrime: Known for its robust accounting features, TallyPrime also provides GST billing solutions for small and medium businesses.

4. ClearTax: A user-friendly tool that simplifies GST compliance, invoicing, and tax filing.

5. Vyapar: A budget-friendly option for startups and small businesses, offering GST invoicing tools and inventory management.

6. Marg ERP: Perfect for e-commerce businesses looking for integrated billing, accounting, and inventory management features.

GimBook: A Smart Solution for GST Billing

If you’re searching for an efficient and user-friendly tool for your e-commerce business, GimBook is worth considering. This comprehensive GST Billing Software is designed to simplify invoicing and tax management for online businesses of all sizes. With features like automated GST calculations, customizable invoice templates, and seamless integration with popular e-commerce platforms, GimBook ensures smooth and accurate online transactions. Its cloud-based accessibility allows you to manage your business from anywhere, making it a smart choice for entrepreneurs who value efficiency and accuracy.

Stay on top of your invoices anytime, anywhere. Download the GimBook app today! https://gimbooks.com/

Conclusion

In the ever-growing world of e-commerce, staying compliant with tax regulations while managing numerous transactions can be a daunting task. This is where GST Billing Software becomes an invaluable asset. With its ability to automate tax calculations, generate GST-compliant invoices, and streamline your billing processes, it ensures seamless online transactions and helps your business grow without worries. Invest in the Best GST Bill Invoice Software today and experience the ease of managing your e-commerce business efficiently.

#GST_Billing_Software #GST_Bill_Invoice_Software #GST_Billing_&_Invoicing_Software

GST Billing Software for E-Commerce: The Key to Seamless Online Transactions In today’s fast-paced world of online shopping, businesses need to keep up with technology to ensure their operations run smoothly. One crucial tool that every e-commerce business must have is GST Billing Software. Whether you're a small online seller or a large e-commerce platform, having the right invoicing tools can make all the difference in managing your finances and complying with tax regulations. Let’s dive into why GST Billing & Invoicing Software is essential for seamless online transactions and how it benefits your e-commerce business. What is GST Billing Software? GST Billing Software is a tool that helps businesses create GST-compliant invoices, manage taxes, and streamline their billing processes. It automates tax calculations, generates accurate invoices, and ensures that your business complies with the Goods and Services Tax (GST) regulations. For e-commerce businesses, this software is particularly useful as it simplifies the complex tax processes associated with online transactions. Why is GST Billing Software Important for E-Commerce? Running an e-commerce business involves handling multiple orders, payments, and returns daily. With such high volumes of transactions, managing taxes manually can be time-consuming and error-prone. Here’s why GST software for e-commerce is essential: 1. Simplifies Tax Compliance: E-commerce businesses often sell products across different states, which means dealing with varying tax rates. GST Bill Invoice Software automatically calculates the correct tax rates based on the buyer's location, ensuring compliance with GST rules. 2. Speeds Up Invoicing: Creating invoices manually for every order can be tedious. With GST Billing & Invoicing Software, you can generate GST-compliant invoices in just a few clicks, saving time and reducing errors. 3. Handles Multiple Transactions Efficiently: Online businesses process numerous orders daily. GST Billing Software can manage bulk invoicing, making it easier to handle a large volume of transactions without delays. 4. Reduces Human Errors: Manual calculations often lead to mistakes, which can result in tax penalties. Automated tools like Best GST Bill Invoice Software ensure accurate calculations, leaving no room for errors. Features to Look for in GST Billing Software for E-Commerce When choosing the best GST Bill Invoice Software for your e-commerce business, ensure it offers the following features: 1. GST-Compliant Invoicing Tools: The software should generate GST-compliant invoices, including essential details like GSTIN, tax rates, HSN codes, and buyer’s location. 2. Automated Tax Calculations: Look for software that automatically calculates CGST, SGST, and IGST based on the transaction location. 3. Integration with E-Commerce Platforms: Choose software that can seamlessly integrate with your online store, whether it’s on Shopify, Amazon, Flipkart, or your custom-built website. 4. Multi-Currency Support: If you sell internationally, opt for a tool that supports multiple currencies and calculates taxes accordingly. 5. Bulk Invoicing: For businesses handling numerous orders, bulk invoicing capabilities can save time and effort. 6. Cloud-Based Accessibility: Cloud-based GST Billing Software allows you to access your data anytime, anywhere, making it perfect for e-commerce businesses. Benefits of Using GST Billing Software for E-Commerce Using the right GST software for e-commerce can transform how you manage your business. Here are the key benefits: 1. Enhanced Efficiency: Automating invoicing and tax calculations frees up time for you to focus on growing your business. 2. Better Tax Compliance: The software ensures that all your transactions comply with GST regulations, reducing the risk of penalties. 3. Seamless Online Transactions: Quick and accurate invoicing improves the customer experience, leading to higher satisfaction and loyalty. 4. Cost Savings: While the upfront cost of software might seem high, the time and resources you save in the long run make it a worthy investment. 5. Data Security: Cloud-based solutions ensure your business data is safe and backed up, protecting you from data loss. Popular GST Billing Software for E-Commerce Businesses Here are some of the best GST Bill Invoice Software options available in the market: 1. GimBook: A comprehensive tool tailored for e-commerce businesses, offering GST-compliant invoicing, seamless integrations, and real-time tax calculations. 2. Zoho Books: A cloud-based tool offering GST-compliant invoicing, inventory management, and integration with e-commerce platforms. 3. TallyPrime: Known for its robust accounting features, TallyPrime also provides GST billing solutions for small and medium businesses. 4. ClearTax: A user-friendly tool that simplifies GST compliance, invoicing, and tax filing. 5. Vyapar: A budget-friendly option for startups and small businesses, offering GST invoicing tools and inventory management. 6. Marg ERP: Perfect for e-commerce businesses looking for integrated billing, accounting, and inventory management features. GimBook: A Smart Solution for GST Billing If you’re searching for an efficient and user-friendly tool for your e-commerce business, GimBook is worth considering. This comprehensive GST Billing Software is designed to simplify invoicing and tax management for online businesses of all sizes. With features like automated GST calculations, customizable invoice templates, and seamless integration with popular e-commerce platforms, GimBook ensures smooth and accurate online transactions. Its cloud-based accessibility allows you to manage your business from anywhere, making it a smart choice for entrepreneurs who value efficiency and accuracy. Stay on top of your invoices anytime, anywhere. Download the GimBook app today! https://gimbooks.com/ Conclusion In the ever-growing world of e-commerce, staying compliant with tax regulations while managing numerous transactions can be a daunting task. This is where GST Billing Software becomes an invaluable asset. With its ability to automate tax calculations, generate GST-compliant invoices, and streamline your billing processes, it ensures seamless online transactions and helps your business grow without worries. Invest in the Best GST Bill Invoice Software today and experience the ease of managing your e-commerce business efficiently. #GST_Billing_Software #GST_Bill_Invoice_Software #GST_Billing_&_Invoicing_Software0 Commentarios ·0 Acciones ·295 Views ·0 Vista previa -

Can a GST Bill Generator Boost Your Business Efficiency? Find Out!

In today’s fast-paced business world, managing time and efficiency is more important than ever. For businesses, creating GST-compliant invoices can sometimes be a tedious task, especially if done manually. However, with tools like GST Bill Generators, this process becomes not only quicker but also more accurate.

What is a GST Bill Generator?

A GST Bill Generator is a software tool designed to help businesses create GST-compliant invoices easily and quickly. These tools ensure that your invoices include all necessary details such as:

1. GSTIN (Goods and Services Tax Identification Number)

2. HSN (Harmonized System of Nomenclature) code

3. Tax breakup (CGST, SGST, or IGST)

4. Invoice date and number

5. Customer and business details

How Does a GST Bill Generator Improve Business Efficiency?

Let’s take a closer look at how this tool can benefit your business:

1. Saves Time: One of the biggest benefits of a GST Bill Generator is that it helps you save time. Manually creating invoices can be a slow process, especially if you handle multiple customers daily. With a GST Bill Generator, you can generate invoices within minutes.

2. Reduces Errors: Manual billing increases the risk of errors in calculations or missing details. A Best GST Bill Generator ensures that all calculations are accurate and compliant with GST regulations, reducing the chance of penalties.

3. Improves Billing Processes: Automating invoicing with a Bill Generator streamlines your billing process. You can easily manage customer data, generate recurring invoices, and track payments—all from one place.

4. Increases Business Productivity: With efficient billing processes and reduced manual effort, you can focus more on growing your business rather than worrying about paperwork. This is how business efficiency tools like GST Bill Generators contribute to productivity.

Why Should You Switch to the Best GST Bill Generator?

If you are still wondering whether a GST Bill Generator is the right choice for your business, consider these additional benefits:

1. Cost-Effective: Many GST Bill Generators come with affordable pricing or even free plans for small businesses.

2. Customization: Create professional invoices tailored to your brand with custom logos and layouts.

3. Compliance Assurance: Stay updated with the latest GST rules and ensure your invoices always meet regulatory standards.

Data Insights: The Impact of Using GST Bill Generators

According to a recent survey:

1. 75% of small businesses using GST Bill Generators reported significant time savings in invoicing.

2. 68% of businesses reduced billing errors by switching to automated invoicing tools.

3. Businesses using billing software saw a 40% improvement in payment collection time.

4. 85% of users found that automated GST invoicing tools simplified tax compliance and filing.

5. Companies with recurring invoicing needs saved an average of 20 hours per month using such tools.

Key Features to Look for in a GST Bill Generator

When selecting the Best GST Bill Generator, consider these essential features:

1. User-Friendly Interface: Look for software that is easy to use, even for beginners.

2. Mobile Accessibility: A tool with a mobile app ensures you can generate invoices on the go.

3. Tax Calculation Automation: Automatic calculation of CGST, SGST, and IGST saves time.

4. Multi-User Access: If you have a team, choose software that allows multiple users to access and create invoices.

5. Customer Support: Reliable customer support can be a lifesaver if you encounter any issues.

Top GST Bill Generators in India (2025)

Here’s a list of some of the most popular GST Bill Generators that you can explore:

1. Zoho Invoice: Offers a free plan for small businesses and robust features.

2. TallyPrime: A trusted name with extensive GST compliance tools.

3. Vyapar: Best suited for small and medium businesses with an easy-to-use mobile app.

4. Marg ERP: A comprehensive solution for invoicing and accounting.

5. Gimbook: A user-friendly tool tailored for efficient GST billing and compliance.

Gimbook: The Smarter Choice for GST Billing

Gimbook is an emerging player in the world of GST Bill Generators, offering an intuitive platform designed to simplify GST invoicing for businesses of all sizes. With features like automated tax calculations, customizable invoice templates, and seamless integration with accounting tools, Gimbook ensures accurate and efficient billing. Its user-friendly interface makes it a top choice for small and medium enterprises looking to streamline their billing processes and enhance compliance.

Let us help you streamline your GST billing process. Get started with Gimbook today! https://gimbooks.com/

Conclusion

Using a GST Bill Generator is no longer a luxury but a necessity for businesses that aim to stay competitive and efficient. These tools not only improve billing processes but also ensure compliance, save time, and enhance productivity. Whether you are a small business owner or manage a large enterprise, the Best GST Bill Generator can be a game-changer for your business efficiency.

#Best_GST_Bill_Generator #GST_Bill_Generator #Best_Bill_Generator #Bill_Generator

Can a GST Bill Generator Boost Your Business Efficiency? Find Out! In today’s fast-paced business world, managing time and efficiency is more important than ever. For businesses, creating GST-compliant invoices can sometimes be a tedious task, especially if done manually. However, with tools like GST Bill Generators, this process becomes not only quicker but also more accurate. What is a GST Bill Generator? A GST Bill Generator is a software tool designed to help businesses create GST-compliant invoices easily and quickly. These tools ensure that your invoices include all necessary details such as: 1. GSTIN (Goods and Services Tax Identification Number) 2. HSN (Harmonized System of Nomenclature) code 3. Tax breakup (CGST, SGST, or IGST) 4. Invoice date and number 5. Customer and business details How Does a GST Bill Generator Improve Business Efficiency? Let’s take a closer look at how this tool can benefit your business: 1. Saves Time: One of the biggest benefits of a GST Bill Generator is that it helps you save time. Manually creating invoices can be a slow process, especially if you handle multiple customers daily. With a GST Bill Generator, you can generate invoices within minutes. 2. Reduces Errors: Manual billing increases the risk of errors in calculations or missing details. A Best GST Bill Generator ensures that all calculations are accurate and compliant with GST regulations, reducing the chance of penalties. 3. Improves Billing Processes: Automating invoicing with a Bill Generator streamlines your billing process. You can easily manage customer data, generate recurring invoices, and track payments—all from one place. 4. Increases Business Productivity: With efficient billing processes and reduced manual effort, you can focus more on growing your business rather than worrying about paperwork. This is how business efficiency tools like GST Bill Generators contribute to productivity. Why Should You Switch to the Best GST Bill Generator? If you are still wondering whether a GST Bill Generator is the right choice for your business, consider these additional benefits: 1. Cost-Effective: Many GST Bill Generators come with affordable pricing or even free plans for small businesses. 2. Customization: Create professional invoices tailored to your brand with custom logos and layouts. 3. Compliance Assurance: Stay updated with the latest GST rules and ensure your invoices always meet regulatory standards. Data Insights: The Impact of Using GST Bill Generators According to a recent survey: 1. 75% of small businesses using GST Bill Generators reported significant time savings in invoicing. 2. 68% of businesses reduced billing errors by switching to automated invoicing tools. 3. Businesses using billing software saw a 40% improvement in payment collection time. 4. 85% of users found that automated GST invoicing tools simplified tax compliance and filing. 5. Companies with recurring invoicing needs saved an average of 20 hours per month using such tools. Key Features to Look for in a GST Bill Generator When selecting the Best GST Bill Generator, consider these essential features: 1. User-Friendly Interface: Look for software that is easy to use, even for beginners. 2. Mobile Accessibility: A tool with a mobile app ensures you can generate invoices on the go. 3. Tax Calculation Automation: Automatic calculation of CGST, SGST, and IGST saves time. 4. Multi-User Access: If you have a team, choose software that allows multiple users to access and create invoices. 5. Customer Support: Reliable customer support can be a lifesaver if you encounter any issues. Top GST Bill Generators in India (2025) Here’s a list of some of the most popular GST Bill Generators that you can explore: 1. Zoho Invoice: Offers a free plan for small businesses and robust features. 2. TallyPrime: A trusted name with extensive GST compliance tools. 3. Vyapar: Best suited for small and medium businesses with an easy-to-use mobile app. 4. Marg ERP: A comprehensive solution for invoicing and accounting. 5. Gimbook: A user-friendly tool tailored for efficient GST billing and compliance. Gimbook: The Smarter Choice for GST Billing Gimbook is an emerging player in the world of GST Bill Generators, offering an intuitive platform designed to simplify GST invoicing for businesses of all sizes. With features like automated tax calculations, customizable invoice templates, and seamless integration with accounting tools, Gimbook ensures accurate and efficient billing. Its user-friendly interface makes it a top choice for small and medium enterprises looking to streamline their billing processes and enhance compliance. Let us help you streamline your GST billing process. Get started with Gimbook today! https://gimbooks.com/ Conclusion Using a GST Bill Generator is no longer a luxury but a necessity for businesses that aim to stay competitive and efficient. These tools not only improve billing processes but also ensure compliance, save time, and enhance productivity. Whether you are a small business owner or manage a large enterprise, the Best GST Bill Generator can be a game-changer for your business efficiency. #Best_GST_Bill_Generator #GST_Bill_Generator #Best_Bill_Generator #Bill_Generator0 Commentarios ·0 Acciones ·239 Views ·0 Vista previa -

0 Commentarios ·0 Acciones ·186 Views ·0 Vista previa

-

0 Commentarios ·0 Acciones ·233 Views ·0 Vista previa

-

0 Commentarios ·0 Acciones ·301 Views ·0 Vista previa

-

0 Commentarios ·0 Acciones ·254 Views ·0 Vista previa

-

0 Commentarios ·0 Acciones ·251 Views ·0 Vista previa

-

0 Commentarios ·0 Acciones ·323 Views ·0 Vista previa

-

0 Commentarios ·0 Acciones ·268 Views ·0 Vista previa

-

0 Commentarios ·0 Acciones ·272 Views ·0 Vista previa

Quizás te interese…