Fraud Detection and Prevention Market To Witness over $25,000.0-Million Growth by 2030

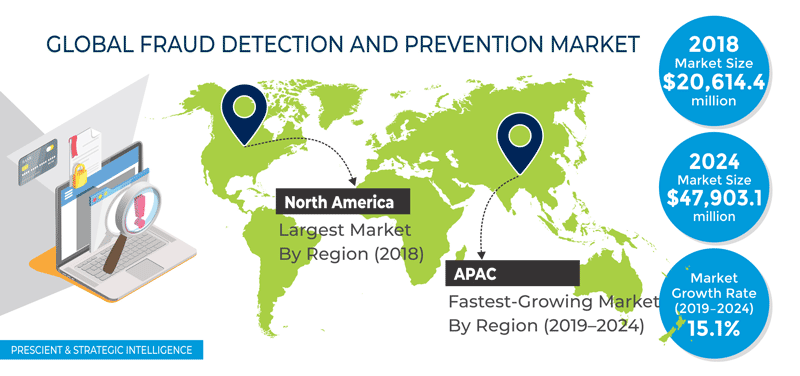

The strongest factors propelling the demand for fraud detection and prevention solutions are the rising adoption of artificial intelligence (AI) and machine learning (ML) to mitigate fraud, increasing need to counter mobile frauds, surging number of the elderly being phone-scammed, and escalating need to safeguard the online banking sector. Due to these factors, the fraud detection and prevention market value, which stood at $20,614.4 million in 2018, is projected to witness a 15.1% CAGR during 2019–2024 (forecast period, to reach $47,903.1 million by 2024.

Based on offering, the market is bifurcated into software and service, of which the software bifurcation held the larger share in 2018. This was due to the rising adoption of fraud analytics, governance, risk, and compliance (GRC), and authentication software by companies to mitigate cyber fraud and adhere to the data protection rules of governments. During the forecast period, the higher CAGR will be witnessed by the service bifurcation. With the increasing adoption of fraud detection and prevention solutions, the demand for various managed and professional services is rising too.

The bifurcations of the deployment type segment of the fraud detection and prevention market are on-premises and cloud-based. During the historical period (2014–2018), the market was dominated by the cloud-based bifurcation, which is also expected to witness the faster growth till 2024. Compared to on-premises deployment, cloud deployment is cheaper, as it eliminates the need to procure expensive hardware and maintain on-site servers. Moreover, the cloud allows users to track their operations in real time and scale up or down the data storage capacity without much effort.

Presently, hybrid approaches are trending in the fraud detection and prevention market, as they integrate various aspects of the process into one solution. Such an approach integrates multiple aspects of a potential fraud, analyzes each aspect as an individual malicious activity, and detects known, complex, unknown, and associative link patterns. Additionally, hybrid solutions involve the usage of rule-based algorithms, improved data integration, anomaly detection, social media analysis (SMA), and predictive modeling tools for a more-effective detection and prevention of frauds.

The major fraud detection and prevention market driver is the burgeoning number of mobile frauds around the world. Compared to 30% in 2018, 49% of all the risky transactions that took place around the world in 2019 were carried out via mobile phones. Scammers are using mobile emulators on their PCs and laptops to mimic a range of Android- and iOS-based mobile phones. These emulators allow users to breach the basic device recognition software by mimicking different mobile device software and hardware functionalities, thus making effective fraud detection and prevention solutions necessary.

A key opportunity area for the fraud detection and prevention market players is the usage of the blockchain technology for this purpose in supply chain. As the supply chain involves numerous stages of production, people, technologies, and the products themselves, it becomes an easy target for fraudsters. Therefore, companies are using blockchains, which are difficult to manipulate without the agreement of all the stakeholders. Blockchains also allow the products to be traced through the entire process, beginning from the procurement of raw materials to the delivery of the final product.

In 2018, North America was the largest fraud detection and prevention market owing to the rapid adoption of the cloud technology by small and large companies, which is enabling fraudsters to target them. Moreover, technological advancements and the integration of the internet of things (IoT) in such solutions will drive the regional market. The fastest growth during the forecast period will be seen in Asia-Pacific (APAC) due to the swift economic prosperity, increasing number of large companies, advancing IT sector, surging popularity of cloud computing, and stringent government data protection laws.

Hence, with the rapid digitization leading to the rising number of cyber frauds, the demand for solutions that can detect and prevent such mishaps will continue to burgeon.

Read More: https://www.psmarketresearch.com/market-analysis/fraud-detection-and-prevention-market

The strongest factors propelling the demand for fraud detection and prevention solutions are the rising adoption of artificial intelligence (AI) and machine learning (ML) to mitigate fraud, increasing need to counter mobile frauds, surging number of the elderly being phone-scammed, and escalating need to safeguard the online banking sector. Due to these factors, the fraud detection and prevention market value, which stood at $20,614.4 million in 2018, is projected to witness a 15.1% CAGR during 2019–2024 (forecast period, to reach $47,903.1 million by 2024.

Based on offering, the market is bifurcated into software and service, of which the software bifurcation held the larger share in 2018. This was due to the rising adoption of fraud analytics, governance, risk, and compliance (GRC), and authentication software by companies to mitigate cyber fraud and adhere to the data protection rules of governments. During the forecast period, the higher CAGR will be witnessed by the service bifurcation. With the increasing adoption of fraud detection and prevention solutions, the demand for various managed and professional services is rising too.

The bifurcations of the deployment type segment of the fraud detection and prevention market are on-premises and cloud-based. During the historical period (2014–2018), the market was dominated by the cloud-based bifurcation, which is also expected to witness the faster growth till 2024. Compared to on-premises deployment, cloud deployment is cheaper, as it eliminates the need to procure expensive hardware and maintain on-site servers. Moreover, the cloud allows users to track their operations in real time and scale up or down the data storage capacity without much effort.

Presently, hybrid approaches are trending in the fraud detection and prevention market, as they integrate various aspects of the process into one solution. Such an approach integrates multiple aspects of a potential fraud, analyzes each aspect as an individual malicious activity, and detects known, complex, unknown, and associative link patterns. Additionally, hybrid solutions involve the usage of rule-based algorithms, improved data integration, anomaly detection, social media analysis (SMA), and predictive modeling tools for a more-effective detection and prevention of frauds.

The major fraud detection and prevention market driver is the burgeoning number of mobile frauds around the world. Compared to 30% in 2018, 49% of all the risky transactions that took place around the world in 2019 were carried out via mobile phones. Scammers are using mobile emulators on their PCs and laptops to mimic a range of Android- and iOS-based mobile phones. These emulators allow users to breach the basic device recognition software by mimicking different mobile device software and hardware functionalities, thus making effective fraud detection and prevention solutions necessary.

A key opportunity area for the fraud detection and prevention market players is the usage of the blockchain technology for this purpose in supply chain. As the supply chain involves numerous stages of production, people, technologies, and the products themselves, it becomes an easy target for fraudsters. Therefore, companies are using blockchains, which are difficult to manipulate without the agreement of all the stakeholders. Blockchains also allow the products to be traced through the entire process, beginning from the procurement of raw materials to the delivery of the final product.

In 2018, North America was the largest fraud detection and prevention market owing to the rapid adoption of the cloud technology by small and large companies, which is enabling fraudsters to target them. Moreover, technological advancements and the integration of the internet of things (IoT) in such solutions will drive the regional market. The fastest growth during the forecast period will be seen in Asia-Pacific (APAC) due to the swift economic prosperity, increasing number of large companies, advancing IT sector, surging popularity of cloud computing, and stringent government data protection laws.

Hence, with the rapid digitization leading to the rising number of cyber frauds, the demand for solutions that can detect and prevent such mishaps will continue to burgeon.

Read More: https://www.psmarketresearch.com/market-analysis/fraud-detection-and-prevention-market

Fraud Detection and Prevention Market To Witness over $25,000.0-Million Growth by 2030

The strongest factors propelling the demand for fraud detection and prevention solutions are the rising adoption of artificial intelligence (AI) and machine learning (ML) to mitigate fraud, increasing need to counter mobile frauds, surging number of the elderly being phone-scammed, and escalating need to safeguard the online banking sector. Due to these factors, the fraud detection and prevention market value, which stood at $20,614.4 million in 2018, is projected to witness a 15.1% CAGR during 2019–2024 (forecast period, to reach $47,903.1 million by 2024.

Based on offering, the market is bifurcated into software and service, of which the software bifurcation held the larger share in 2018. This was due to the rising adoption of fraud analytics, governance, risk, and compliance (GRC), and authentication software by companies to mitigate cyber fraud and adhere to the data protection rules of governments. During the forecast period, the higher CAGR will be witnessed by the service bifurcation. With the increasing adoption of fraud detection and prevention solutions, the demand for various managed and professional services is rising too.

The bifurcations of the deployment type segment of the fraud detection and prevention market are on-premises and cloud-based. During the historical period (2014–2018), the market was dominated by the cloud-based bifurcation, which is also expected to witness the faster growth till 2024. Compared to on-premises deployment, cloud deployment is cheaper, as it eliminates the need to procure expensive hardware and maintain on-site servers. Moreover, the cloud allows users to track their operations in real time and scale up or down the data storage capacity without much effort.

Presently, hybrid approaches are trending in the fraud detection and prevention market, as they integrate various aspects of the process into one solution. Such an approach integrates multiple aspects of a potential fraud, analyzes each aspect as an individual malicious activity, and detects known, complex, unknown, and associative link patterns. Additionally, hybrid solutions involve the usage of rule-based algorithms, improved data integration, anomaly detection, social media analysis (SMA), and predictive modeling tools for a more-effective detection and prevention of frauds.

The major fraud detection and prevention market driver is the burgeoning number of mobile frauds around the world. Compared to 30% in 2018, 49% of all the risky transactions that took place around the world in 2019 were carried out via mobile phones. Scammers are using mobile emulators on their PCs and laptops to mimic a range of Android- and iOS-based mobile phones. These emulators allow users to breach the basic device recognition software by mimicking different mobile device software and hardware functionalities, thus making effective fraud detection and prevention solutions necessary.

A key opportunity area for the fraud detection and prevention market players is the usage of the blockchain technology for this purpose in supply chain. As the supply chain involves numerous stages of production, people, technologies, and the products themselves, it becomes an easy target for fraudsters. Therefore, companies are using blockchains, which are difficult to manipulate without the agreement of all the stakeholders. Blockchains also allow the products to be traced through the entire process, beginning from the procurement of raw materials to the delivery of the final product.

In 2018, North America was the largest fraud detection and prevention market owing to the rapid adoption of the cloud technology by small and large companies, which is enabling fraudsters to target them. Moreover, technological advancements and the integration of the internet of things (IoT) in such solutions will drive the regional market. The fastest growth during the forecast period will be seen in Asia-Pacific (APAC) due to the swift economic prosperity, increasing number of large companies, advancing IT sector, surging popularity of cloud computing, and stringent government data protection laws.

Hence, with the rapid digitization leading to the rising number of cyber frauds, the demand for solutions that can detect and prevent such mishaps will continue to burgeon.

Read More: https://www.psmarketresearch.com/market-analysis/fraud-detection-and-prevention-market

0 Comments

·0 Shares

·1K Views

·0 Reviews