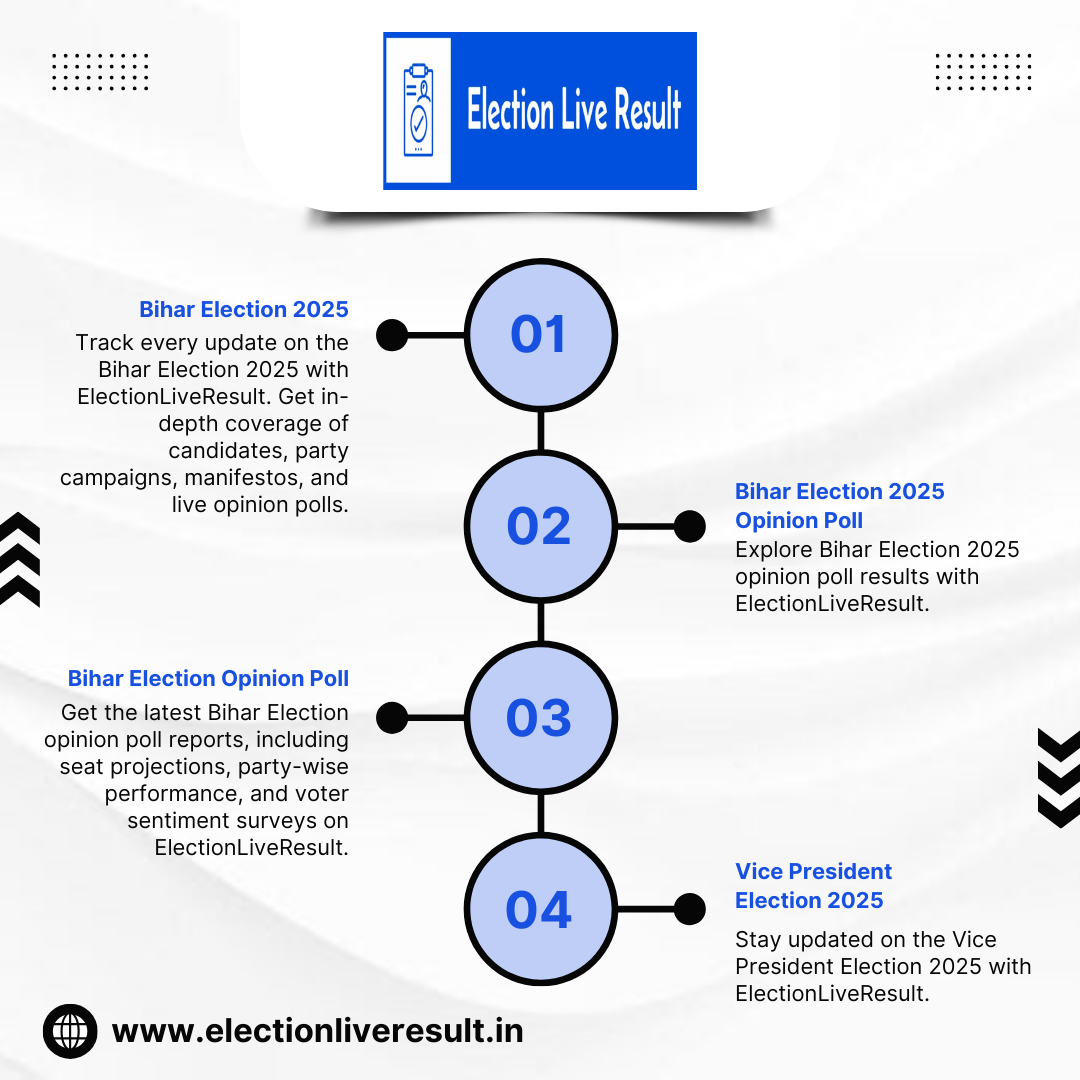

Get the latest Bihar Election opinion poll reports, including seat projections, party-wise performance, and voter sentiment surveys on ElectionLiveResult. Stay informed with detailed analysis and expert insights that shape the upcoming elections.

Visit us :- https://www.electionliveresult.in/news/bihar-election-2025-date-schedule-phases-and-latest-updates

Visit us :- https://www.electionliveresult.in/news/bihar-election-2025-date-schedule-phases-and-latest-updates

Get the latest Bihar Election opinion poll reports, including seat projections, party-wise performance, and voter sentiment surveys on ElectionLiveResult. Stay informed with detailed analysis and expert insights that shape the upcoming elections.

Visit us :- https://www.electionliveresult.in/news/bihar-election-2025-date-schedule-phases-and-latest-updates

0 التعليقات

·0 المشاركات

·24 مشاهدة

·0 معاينة