Global Fortified Rice Market | Emerging Trends to Watch

Report Overview:

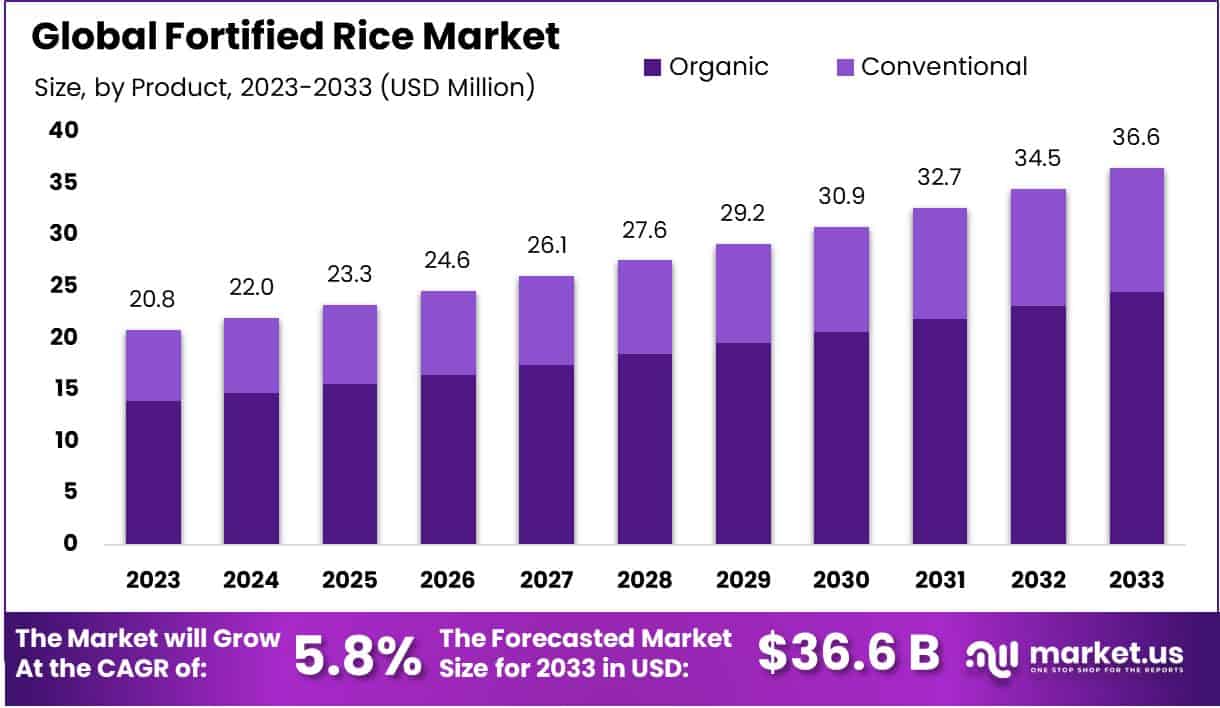

The global Fortified rice market is projected to grow significantly over the next decade. It is estimated to reach approximately USD 36.6 billion by 2033, up from USD 20.8 billion in 2023. This represents a compound annual growth rate (CAGR) of 5.8% between 2024 and 2033, reflecting increasing demand for nutrient-enriched food products worldwide.

Rice is a vital staple for over half the world’s population, particularly in Asia and Africa, where it provides a major source of daily calories. In 2023, global rice production reached approximately 800 million tonnes, driven largely by China and India, which together account for over 50% of this output. Urbanization and rising disposable incomes are transforming diets, leading to richer demand for specialty rice varieties like basmati, jasmine, and black rice, as well as convenient formats such as ready-to-eat rice and rice-based snacks.

Key Takeaways:

The Global Fortified Rice Market size is expected to be worth around USD 36.6 Billion by 2033, from USD 20.8 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

Conventional fortified rice dominates, holding 67.7% of the market, outpacing organic growth.

Vitamins dominated the Fortified Rice Market’s Micronutrient segment with a 45.5% share.

Coating dominated the Fortified Rice Market’s By Technology segment with a 39.5% share.

Zinc-fortified rice dominated the Fortified Rice Market with a 39.5% share.

Hot or warm extrusion dominates the Fortified Rice Market with a 43.2% share.

Supermarkets held a dominant market position in the distribution segment of the Fortified Rice Market, capturing more than a 45% share.

Commercial segment held a dominant market position in the fortified rice market, capturing more than a 65% share.

APAC dominates the global fortified rice market, holding a 39.3% share, valued at $8.1 billion.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/fortified-rice-market/free-sample/

Key Market Segments:

By Nature

Organic

Conventional

By Micronutrient

Vitamins

Minerals Others.

By Technology

Coating

Encapsulation

Hot Extrusion

Drying

Others

By Type

Zinc-Fortified Rice

Vitamin A-Fortified Rice

Multiple Micronutrient Fortified Rice

Others

By Processing Method

Hot or warm extrusion

Dusting

Coating

By Distribution Channel

Supermarkets

Convenience store

Brick-and-Mortar

Others

By End User

Commercial

Residential

Drivers

Rice remains a staple for over half the world's population, especially in Asia-Pacific, which produced more than 90% of global output in 2023. Rapid urbanization and rising incomes are fueling the demand for premium and processed rice varieties, such as Basmati, jasmine, and ready-to-eat formats.

Governments in major producer countries use subsidies and minimum support prices to stabilize production and protect farmers, which in turn ensures rice supply remains robust. These policies have helped maintain stable supply during volatile weather and geopolitical disruptions. Increasing awareness of micronutrient deficiencies, particularly in developing countries, is a key market driver. Rice provides 20–70% of daily calories in some regions . Government programs such as those in India use fortified rice in welfare schemes to address anemia and other deficiencies, spurring demand.

Restraining Factors

Water scarcity and climate variability present significant hurdles. Rice cultivation is highly water-intensive (approx. 2,500 L/kg) and vulnerable to droughts especially in regions reliant on monsoon rains . Soil degradation and salinity further reduce yields in major rice-growing areas . Land constraints and rising labor costs are additional obstacles, particularly where farming populations are aging or migrating to cities .

Trade policies like export bans introduce volatility: for instance, India lifted rice curbs in 2024 causing a global price drop, straining incomes for farmers elsewhere. These regulatory shifts pose risks to supply stability and pricing. Cost sensitivity remains a key restraint, as fortified rice can cost 0.5–3% more than regular rice. Inconsistent consumer awareness, especially where fortified foods are less common, limits uptake. Regulatory barriers and limited long-term research evidence, particularly around benefits, can hamper both supply growth and consumer trust.

Opportunities

A key opportunity is the shift toward value-added rice products: fortified, organic, specialty, and convenience-focused offerings are gaining traction among health-conscious consumers. Fortified and functional rice addresses micronutrient gaps, while organic and non-GMO varieties support sustainability goals. Expanding e-commerce and online retail platforms provide rice producers with new channels, especially reaching urban and remote consumers . Furthermore, blockchain-based traceability systems support higher price premiums and food safety compliance in export markets.

Technology-driven improvements in seed variety, irrigation, and precision farming can boost yields and lower production costs There’s room to expand fortified rice into more markets through enhanced public-private partnerships, especially in Africa and Latin America. Clean-label innovation creating fortified rice without artificial additives can drive acceptance in health-conscious segments. New nutrient blends, targeting local dietary needs, offer tailored solutions. E-commerce and supermarket distribution hold promise the former is growing fastest, and the latter currently holds 45%+ market share.

Trends

Premium and specialty rice growth: Varieties like Basmati, organic, and fortified rice are gaining premium segment share, especially in North America and Europe.

Convenience and processed formats: There's rising consumer interest in instant rice, rice snacks, and ready-to-eat packages, catering to busy lifestyles.

Sustainable farming practices: Adoption of water-saving methods like alternate wetting and drying (AWD), hybrid seeds, and methane-reducing techniques addresses climate concerns.

Supply chain innovations: Traceability via blockchain and expansion of e-commerce are improving access, transparency, and food safety in rice distribution .

Geopolitical supply shifts: With India releasing export restrictions and expected to export a record 22 M tonnes in 2025, global trade dynamics are shifting firmly in its favor.

Market Key Players:

Amoli International

Aroma Fields

BASF SE

Bunge Ltd

Cargill Incorporated

Daawat

General Mills Inc

Hain Celestial (Tida Rice)

Hexagon Nutrition Ltd.

KRBL Ltd

LT Foods

Nutriso

Oliria

Radiance Global

REI Agro Ltd

Relishum Foods

Sarwa Food

Willmar International Ltd

Zippy Edibles

Conclusion

Fortified rice is set to drive nutritional impact while delivering strong economic growth doubling in value by 2033. The blend of public health initiatives, technological progress, and rising consumer health awareness creates a fertile environment. Especially in staple-consuming regions, fortified rice can play a significant role in reducing nutrient deficiencies. Looking ahead, success lies in affordability, trust-building, and tailored innovation.

Cost-effective fortification methods, clean-label formulations, and diverse nutrient blends aligned with local needs can broaden adoption. Strengthening partnerships among government, industry, and NGOs will ensure supply and outreach especially in underserved markets. Meanwhile, scalable fortification models like extrusion and coating, alongside modern retail and digital traceability, will support transparency and confidence. Overall, fortified rice is emerging as a powerful tool at the intersection of health, technology, and food security poised to deliver meaningful impact globally.

Report Overview:

The global Fortified rice market is projected to grow significantly over the next decade. It is estimated to reach approximately USD 36.6 billion by 2033, up from USD 20.8 billion in 2023. This represents a compound annual growth rate (CAGR) of 5.8% between 2024 and 2033, reflecting increasing demand for nutrient-enriched food products worldwide.

Rice is a vital staple for over half the world’s population, particularly in Asia and Africa, where it provides a major source of daily calories. In 2023, global rice production reached approximately 800 million tonnes, driven largely by China and India, which together account for over 50% of this output. Urbanization and rising disposable incomes are transforming diets, leading to richer demand for specialty rice varieties like basmati, jasmine, and black rice, as well as convenient formats such as ready-to-eat rice and rice-based snacks.

Key Takeaways:

The Global Fortified Rice Market size is expected to be worth around USD 36.6 Billion by 2033, from USD 20.8 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

Conventional fortified rice dominates, holding 67.7% of the market, outpacing organic growth.

Vitamins dominated the Fortified Rice Market’s Micronutrient segment with a 45.5% share.

Coating dominated the Fortified Rice Market’s By Technology segment with a 39.5% share.

Zinc-fortified rice dominated the Fortified Rice Market with a 39.5% share.

Hot or warm extrusion dominates the Fortified Rice Market with a 43.2% share.

Supermarkets held a dominant market position in the distribution segment of the Fortified Rice Market, capturing more than a 45% share.

Commercial segment held a dominant market position in the fortified rice market, capturing more than a 65% share.

APAC dominates the global fortified rice market, holding a 39.3% share, valued at $8.1 billion.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/fortified-rice-market/free-sample/

Key Market Segments:

By Nature

Organic

Conventional

By Micronutrient

Vitamins

Minerals Others.

By Technology

Coating

Encapsulation

Hot Extrusion

Drying

Others

By Type

Zinc-Fortified Rice

Vitamin A-Fortified Rice

Multiple Micronutrient Fortified Rice

Others

By Processing Method

Hot or warm extrusion

Dusting

Coating

By Distribution Channel

Supermarkets

Convenience store

Brick-and-Mortar

Others

By End User

Commercial

Residential

Drivers

Rice remains a staple for over half the world's population, especially in Asia-Pacific, which produced more than 90% of global output in 2023. Rapid urbanization and rising incomes are fueling the demand for premium and processed rice varieties, such as Basmati, jasmine, and ready-to-eat formats.

Governments in major producer countries use subsidies and minimum support prices to stabilize production and protect farmers, which in turn ensures rice supply remains robust. These policies have helped maintain stable supply during volatile weather and geopolitical disruptions. Increasing awareness of micronutrient deficiencies, particularly in developing countries, is a key market driver. Rice provides 20–70% of daily calories in some regions . Government programs such as those in India use fortified rice in welfare schemes to address anemia and other deficiencies, spurring demand.

Restraining Factors

Water scarcity and climate variability present significant hurdles. Rice cultivation is highly water-intensive (approx. 2,500 L/kg) and vulnerable to droughts especially in regions reliant on monsoon rains . Soil degradation and salinity further reduce yields in major rice-growing areas . Land constraints and rising labor costs are additional obstacles, particularly where farming populations are aging or migrating to cities .

Trade policies like export bans introduce volatility: for instance, India lifted rice curbs in 2024 causing a global price drop, straining incomes for farmers elsewhere. These regulatory shifts pose risks to supply stability and pricing. Cost sensitivity remains a key restraint, as fortified rice can cost 0.5–3% more than regular rice. Inconsistent consumer awareness, especially where fortified foods are less common, limits uptake. Regulatory barriers and limited long-term research evidence, particularly around benefits, can hamper both supply growth and consumer trust.

Opportunities

A key opportunity is the shift toward value-added rice products: fortified, organic, specialty, and convenience-focused offerings are gaining traction among health-conscious consumers. Fortified and functional rice addresses micronutrient gaps, while organic and non-GMO varieties support sustainability goals. Expanding e-commerce and online retail platforms provide rice producers with new channels, especially reaching urban and remote consumers . Furthermore, blockchain-based traceability systems support higher price premiums and food safety compliance in export markets.

Technology-driven improvements in seed variety, irrigation, and precision farming can boost yields and lower production costs There’s room to expand fortified rice into more markets through enhanced public-private partnerships, especially in Africa and Latin America. Clean-label innovation creating fortified rice without artificial additives can drive acceptance in health-conscious segments. New nutrient blends, targeting local dietary needs, offer tailored solutions. E-commerce and supermarket distribution hold promise the former is growing fastest, and the latter currently holds 45%+ market share.

Trends

Premium and specialty rice growth: Varieties like Basmati, organic, and fortified rice are gaining premium segment share, especially in North America and Europe.

Convenience and processed formats: There's rising consumer interest in instant rice, rice snacks, and ready-to-eat packages, catering to busy lifestyles.

Sustainable farming practices: Adoption of water-saving methods like alternate wetting and drying (AWD), hybrid seeds, and methane-reducing techniques addresses climate concerns.

Supply chain innovations: Traceability via blockchain and expansion of e-commerce are improving access, transparency, and food safety in rice distribution .

Geopolitical supply shifts: With India releasing export restrictions and expected to export a record 22 M tonnes in 2025, global trade dynamics are shifting firmly in its favor.

Market Key Players:

Amoli International

Aroma Fields

BASF SE

Bunge Ltd

Cargill Incorporated

Daawat

General Mills Inc

Hain Celestial (Tida Rice)

Hexagon Nutrition Ltd.

KRBL Ltd

LT Foods

Nutriso

Oliria

Radiance Global

REI Agro Ltd

Relishum Foods

Sarwa Food

Willmar International Ltd

Zippy Edibles

Conclusion

Fortified rice is set to drive nutritional impact while delivering strong economic growth doubling in value by 2033. The blend of public health initiatives, technological progress, and rising consumer health awareness creates a fertile environment. Especially in staple-consuming regions, fortified rice can play a significant role in reducing nutrient deficiencies. Looking ahead, success lies in affordability, trust-building, and tailored innovation.

Cost-effective fortification methods, clean-label formulations, and diverse nutrient blends aligned with local needs can broaden adoption. Strengthening partnerships among government, industry, and NGOs will ensure supply and outreach especially in underserved markets. Meanwhile, scalable fortification models like extrusion and coating, alongside modern retail and digital traceability, will support transparency and confidence. Overall, fortified rice is emerging as a powerful tool at the intersection of health, technology, and food security poised to deliver meaningful impact globally.

Global Fortified Rice Market | Emerging Trends to Watch

Report Overview:

The global Fortified rice market is projected to grow significantly over the next decade. It is estimated to reach approximately USD 36.6 billion by 2033, up from USD 20.8 billion in 2023. This represents a compound annual growth rate (CAGR) of 5.8% between 2024 and 2033, reflecting increasing demand for nutrient-enriched food products worldwide.

Rice is a vital staple for over half the world’s population, particularly in Asia and Africa, where it provides a major source of daily calories. In 2023, global rice production reached approximately 800 million tonnes, driven largely by China and India, which together account for over 50% of this output. Urbanization and rising disposable incomes are transforming diets, leading to richer demand for specialty rice varieties like basmati, jasmine, and black rice, as well as convenient formats such as ready-to-eat rice and rice-based snacks.

Key Takeaways:

The Global Fortified Rice Market size is expected to be worth around USD 36.6 Billion by 2033, from USD 20.8 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

Conventional fortified rice dominates, holding 67.7% of the market, outpacing organic growth.

Vitamins dominated the Fortified Rice Market’s Micronutrient segment with a 45.5% share.

Coating dominated the Fortified Rice Market’s By Technology segment with a 39.5% share.

Zinc-fortified rice dominated the Fortified Rice Market with a 39.5% share.

Hot or warm extrusion dominates the Fortified Rice Market with a 43.2% share.

Supermarkets held a dominant market position in the distribution segment of the Fortified Rice Market, capturing more than a 45% share.

Commercial segment held a dominant market position in the fortified rice market, capturing more than a 65% share.

APAC dominates the global fortified rice market, holding a 39.3% share, valued at $8.1 billion.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/fortified-rice-market/free-sample/

Key Market Segments:

By Nature

Organic

Conventional

By Micronutrient

Vitamins

Minerals Others.

By Technology

Coating

Encapsulation

Hot Extrusion

Drying

Others

By Type

Zinc-Fortified Rice

Vitamin A-Fortified Rice

Multiple Micronutrient Fortified Rice

Others

By Processing Method

Hot or warm extrusion

Dusting

Coating

By Distribution Channel

Supermarkets

Convenience store

Brick-and-Mortar

Others

By End User

Commercial

Residential

Drivers

Rice remains a staple for over half the world's population, especially in Asia-Pacific, which produced more than 90% of global output in 2023. Rapid urbanization and rising incomes are fueling the demand for premium and processed rice varieties, such as Basmati, jasmine, and ready-to-eat formats.

Governments in major producer countries use subsidies and minimum support prices to stabilize production and protect farmers, which in turn ensures rice supply remains robust. These policies have helped maintain stable supply during volatile weather and geopolitical disruptions. Increasing awareness of micronutrient deficiencies, particularly in developing countries, is a key market driver. Rice provides 20–70% of daily calories in some regions . Government programs such as those in India use fortified rice in welfare schemes to address anemia and other deficiencies, spurring demand.

Restraining Factors

Water scarcity and climate variability present significant hurdles. Rice cultivation is highly water-intensive (approx. 2,500 L/kg) and vulnerable to droughts especially in regions reliant on monsoon rains . Soil degradation and salinity further reduce yields in major rice-growing areas . Land constraints and rising labor costs are additional obstacles, particularly where farming populations are aging or migrating to cities .

Trade policies like export bans introduce volatility: for instance, India lifted rice curbs in 2024 causing a global price drop, straining incomes for farmers elsewhere. These regulatory shifts pose risks to supply stability and pricing. Cost sensitivity remains a key restraint, as fortified rice can cost 0.5–3% more than regular rice. Inconsistent consumer awareness, especially where fortified foods are less common, limits uptake. Regulatory barriers and limited long-term research evidence, particularly around benefits, can hamper both supply growth and consumer trust.

Opportunities

A key opportunity is the shift toward value-added rice products: fortified, organic, specialty, and convenience-focused offerings are gaining traction among health-conscious consumers. Fortified and functional rice addresses micronutrient gaps, while organic and non-GMO varieties support sustainability goals. Expanding e-commerce and online retail platforms provide rice producers with new channels, especially reaching urban and remote consumers . Furthermore, blockchain-based traceability systems support higher price premiums and food safety compliance in export markets.

Technology-driven improvements in seed variety, irrigation, and precision farming can boost yields and lower production costs There’s room to expand fortified rice into more markets through enhanced public-private partnerships, especially in Africa and Latin America. Clean-label innovation creating fortified rice without artificial additives can drive acceptance in health-conscious segments. New nutrient blends, targeting local dietary needs, offer tailored solutions. E-commerce and supermarket distribution hold promise the former is growing fastest, and the latter currently holds 45%+ market share.

Trends

Premium and specialty rice growth: Varieties like Basmati, organic, and fortified rice are gaining premium segment share, especially in North America and Europe.

Convenience and processed formats: There's rising consumer interest in instant rice, rice snacks, and ready-to-eat packages, catering to busy lifestyles.

Sustainable farming practices: Adoption of water-saving methods like alternate wetting and drying (AWD), hybrid seeds, and methane-reducing techniques addresses climate concerns.

Supply chain innovations: Traceability via blockchain and expansion of e-commerce are improving access, transparency, and food safety in rice distribution .

Geopolitical supply shifts: With India releasing export restrictions and expected to export a record 22 M tonnes in 2025, global trade dynamics are shifting firmly in its favor.

Market Key Players:

Amoli International

Aroma Fields

BASF SE

Bunge Ltd

Cargill Incorporated

Daawat

General Mills Inc

Hain Celestial (Tida Rice)

Hexagon Nutrition Ltd.

KRBL Ltd

LT Foods

Nutriso

Oliria

Radiance Global

REI Agro Ltd

Relishum Foods

Sarwa Food

Willmar International Ltd

Zippy Edibles

Conclusion

Fortified rice is set to drive nutritional impact while delivering strong economic growth doubling in value by 2033. The blend of public health initiatives, technological progress, and rising consumer health awareness creates a fertile environment. Especially in staple-consuming regions, fortified rice can play a significant role in reducing nutrient deficiencies. Looking ahead, success lies in affordability, trust-building, and tailored innovation.

Cost-effective fortification methods, clean-label formulations, and diverse nutrient blends aligned with local needs can broaden adoption. Strengthening partnerships among government, industry, and NGOs will ensure supply and outreach especially in underserved markets. Meanwhile, scalable fortification models like extrusion and coating, alongside modern retail and digital traceability, will support transparency and confidence. Overall, fortified rice is emerging as a powerful tool at the intersection of health, technology, and food security poised to deliver meaningful impact globally.

0 Commentarii

·0 Distribuiri

·15 Views

·0 previzualizare