Sponsor

Actueel

-

Navigating the Global Trade Landscape: Growth and Trends in the Letter of Credit Confirmation Market

The global Letter of Credit (LC) Confirmation market is experiencing steady growth, with an estimated value of USD 4,539.77 million in 2024. This market is projected to grow from USD 4,685.97 million in 2025 to USD 6,232.80 million by 2034, reflecting a compound annual growth rate (CAGR) of 3.2% during the forecast period from 2025 to 2034. The increasing globalization of trade, the need for secure payment mechanisms, and rising demand for risk mitigation strategies are key drivers behind the growth of the LC confirmation market. This report provides an analysis of the factors driving market growth, key trends, challenges, and the future outlook for the Letter of Credit Confirmation industry.

Here is the sample report on thr above topic : https://www.marketresearchfuture.com/sample_request/23174

Market Drivers:

Growth in Global Trade: The increasing volume of global trade, particularly in emerging markets, is one of the primary factors driving demand for letter of credit confirmations. A letter of credit (LC) is an essential tool in international trade, ensuring that payments are made once the seller has fulfilled their contractual obligations. As international trade continues to expand, businesses rely on LC confirmations to secure transactions and reduce the risks associated with cross-border payments.

Risk Mitigation in International Transactions: As businesses continue to engage in global trade, the need to mitigate risks associated with foreign transactions, such as payment defaults or political instability, has become increasingly important. Confirmed letters of credit provide an additional layer of security for both buyers and sellers. This ensures that the payment is guaranteed by the confirming bank, which reduces the risk of non-payment and fraud. The growing demand for risk reduction in global transactions is driving the need for LC confirmations.

Increasing Demand for Trade Finance Solutions: The ongoing demand for trade finance solutions, including letters of credit, is a significant driver of market growth. Letters of credit are used to facilitate trade transactions, offering both buyers and sellers financial security and reducing the risk of payment disputes. As international trade volume continues to rise, the need for such instruments, particularly confirmed letters of credit, is expected to increase as businesses seek secure financial products to support trade activities.

Evolving Regulatory Environment: Increasingly stringent regulatory requirements for international transactions have led companies to rely more on trade finance products like letters of credit. These regulations, such as anti-money laundering (AML) and Know Your Customer (KYC) laws, are pushing businesses to adopt more secure and transparent payment methods. The letter of credit confirmation market benefits from this regulatory shift as confirmed LCs help meet compliance and risk mitigation needs.

Digital Transformation in Trade Finance: The ongoing digital transformation in the financial services and trade sectors is also boosting the demand for digital letters of credit and digital confirmation processes. Digitalization allows for faster processing, reduced costs, and more secure transactions, making confirmed letters of credit more accessible to businesses globally. Blockchain technology and other fintech innovations are also helping streamline the LC confirmation process, reducing the time and complexity involved in traditional methods.

Market Segmentation:

The Letter of Credit Confirmation market can be segmented based on type, application, and region.

By Type:

Import LC Confirmations: These types of letters of credit are commonly used by importers to guarantee payment for goods and services purchased from foreign suppliers. The demand for import LC confirmations is expected to remain high as cross-border trade continues to grow, particularly in emerging markets.

Export LC Confirmations: Exporters rely on LC confirmations to secure payment for goods shipped internationally. These confirmations reduce the risk of non-payment and provide assurance that the transaction will proceed smoothly, which is critical for businesses in international trade.

By Application:

Manufacturing: Manufacturing businesses engaged in international trade frequently use letter of credit confirmations to ensure that payments for large transactions are made securely and on time. The manufacturing sector is likely to continue to be a major consumer of LC confirmations, particularly in industries such as automotive, machinery, and electronics.

Trade Finance: The trade finance sector includes financial institutions, such as banks, which play a pivotal role in issuing and confirming letters of credit. The growing adoption of LC confirmations in this sector is driven by the need for secure, trusted trade finance solutions in the global marketplace.

*** & Gas and Energy: The *** & gas and energy sectors also rely heavily on confirmed letters of credit for large transactions, particularly given the high value of equipment, commodities, and supplies involved. This sector is expected to maintain strong demand for LC confirmations as the energy trade continues to grow.

By Region:

North America: North America, particularly the United States, is a leading market for letter of credit confirmations due to its large financial institutions and active role in global trade. The region’s sophisticated banking infrastructure and high levels of international transactions make it a key player in the LC confirmation market.

Europe: Europe is another significant market for LC confirmations, with a high volume of international trade transactions and a well-established banking system. The European Union’s trade policies and regulatory environment continue to drive demand for trade finance products like confirmed letters of credit.

Asia-Pacific: The Asia-Pacific region, particularly countries like China, India, and Japan, is witnessing significant growth in international trade and export-driven industries. As trade expands, the need for LC confirmations in this region is expected to increase. Additionally, the growing adoption of digital trade finance solutions in Asia-Pacific will further contribute to the market’s growth.

Latin America and Middle East & Africa: These regions are emerging as significant markets for letter of credit confirmations as international trade increases. Political and economic instability in some countries has driven the demand for secure payment methods like LC confirmations, ensuring businesses can mitigate risks in cross-border transactions.

Challenges:

Despite the positive growth outlook, the letter of credit confirmation market faces several challenges:

Complexity of the LC Process: The traditional process of confirming letters of credit can be complex and time-consuming. This may discourage some businesses from using LCs, particularly smaller firms that lack the resources to navigate the process. The need for greater automation and digitization is critical to overcoming this challenge.

High Costs: The cost of obtaining confirmed letters of credit, including fees charged by banks for issuing and confirming LCs, can be prohibitive for some businesses, especially small and medium-sized enterprises (SMEs). This can limit their ability to take advantage of these secure payment solutions.

Fraud and Security Risks: Although letters of credit are designed to reduce the risk of fraud in international transactions, there are still instances of fraud and mismanagement in the trade finance sector. Ensuring robust security protocols, particularly in the digital LC space, is essential to maintaining trust in the system.

Technological Advancements:

Several technological developments are expected to shape the future of the LC confirmation market:

Blockchain Technology: Blockchain is being explored to streamline the LC process, providing greater transparency, faster processing, and enhanced security. Blockchain-based platforms allow for the creation of digital letters of credit, making the entire process more efficient and reducing the risk of fraud.

Artificial Intelligence (AI) and Automation: AI and automation are revolutionizing the trade finance industry by improving the speed, accuracy, and efficiency of confirming letters of credit. Automated platforms can help reduce human error, accelerate processing times, and lower costs for businesses.

Digital Trade Finance Platforms: Digital platforms that offer end-to-end trade finance solutions, including LC confirmations, are growing in popularity. These platforms simplify the process, provide real-time tracking, and enable secure communication between buyers, sellers, and financial institutions.

Unsecured Business Loans Market

https://www.marketresearchfuture.com/reports/unsecured-business-loans-market-24673

Supply Chain Finance Market

https://www.marketresearchfuture.com/reports/supply-chain-finance-market-24696

Forex Prepaid Card Market

https://www.marketresearchfuture.com/reports/forex-prepaid-card-market-24849

Conclusion:

The Letter of Credit Confirmation market is projected to grow from USD 4,685.97 million in 2025 to USD 6,232.80 million by 2034, driven by the increasing volume of global trade, the need for secure payment mechanisms, and the demand for risk mitigation in international transactions. As businesses continue to expand into new markets, confirmed letters of credit will remain a critical tool for ensuring payment security and mitigating the risks associated with cross-border trade. The ongoing digital transformation, including the integration of blockchain and AI, will continue to shape the future of the market, making the LC confirmation process more efficient, secure, and accessible to businesses worldwide. Despite challenges related to cost and complexity, the market is poised for steady growth, with key opportunities for innovation and expansion in emerging markets.

Navigating the Global Trade Landscape: Growth and Trends in the Letter of Credit Confirmation Market The global Letter of Credit (LC) Confirmation market is experiencing steady growth, with an estimated value of USD 4,539.77 million in 2024. This market is projected to grow from USD 4,685.97 million in 2025 to USD 6,232.80 million by 2034, reflecting a compound annual growth rate (CAGR) of 3.2% during the forecast period from 2025 to 2034. The increasing globalization of trade, the need for secure payment mechanisms, and rising demand for risk mitigation strategies are key drivers behind the growth of the LC confirmation market. This report provides an analysis of the factors driving market growth, key trends, challenges, and the future outlook for the Letter of Credit Confirmation industry. Here is the sample report on thr above topic : https://www.marketresearchfuture.com/sample_request/23174 Market Drivers: Growth in Global Trade: The increasing volume of global trade, particularly in emerging markets, is one of the primary factors driving demand for letter of credit confirmations. A letter of credit (LC) is an essential tool in international trade, ensuring that payments are made once the seller has fulfilled their contractual obligations. As international trade continues to expand, businesses rely on LC confirmations to secure transactions and reduce the risks associated with cross-border payments. Risk Mitigation in International Transactions: As businesses continue to engage in global trade, the need to mitigate risks associated with foreign transactions, such as payment defaults or political instability, has become increasingly important. Confirmed letters of credit provide an additional layer of security for both buyers and sellers. This ensures that the payment is guaranteed by the confirming bank, which reduces the risk of non-payment and fraud. The growing demand for risk reduction in global transactions is driving the need for LC confirmations. Increasing Demand for Trade Finance Solutions: The ongoing demand for trade finance solutions, including letters of credit, is a significant driver of market growth. Letters of credit are used to facilitate trade transactions, offering both buyers and sellers financial security and reducing the risk of payment disputes. As international trade volume continues to rise, the need for such instruments, particularly confirmed letters of credit, is expected to increase as businesses seek secure financial products to support trade activities. Evolving Regulatory Environment: Increasingly stringent regulatory requirements for international transactions have led companies to rely more on trade finance products like letters of credit. These regulations, such as anti-money laundering (AML) and Know Your Customer (KYC) laws, are pushing businesses to adopt more secure and transparent payment methods. The letter of credit confirmation market benefits from this regulatory shift as confirmed LCs help meet compliance and risk mitigation needs. Digital Transformation in Trade Finance: The ongoing digital transformation in the financial services and trade sectors is also boosting the demand for digital letters of credit and digital confirmation processes. Digitalization allows for faster processing, reduced costs, and more secure transactions, making confirmed letters of credit more accessible to businesses globally. Blockchain technology and other fintech innovations are also helping streamline the LC confirmation process, reducing the time and complexity involved in traditional methods. Market Segmentation: The Letter of Credit Confirmation market can be segmented based on type, application, and region. By Type: Import LC Confirmations: These types of letters of credit are commonly used by importers to guarantee payment for goods and services purchased from foreign suppliers. The demand for import LC confirmations is expected to remain high as cross-border trade continues to grow, particularly in emerging markets. Export LC Confirmations: Exporters rely on LC confirmations to secure payment for goods shipped internationally. These confirmations reduce the risk of non-payment and provide assurance that the transaction will proceed smoothly, which is critical for businesses in international trade. By Application: Manufacturing: Manufacturing businesses engaged in international trade frequently use letter of credit confirmations to ensure that payments for large transactions are made securely and on time. The manufacturing sector is likely to continue to be a major consumer of LC confirmations, particularly in industries such as automotive, machinery, and electronics. Trade Finance: The trade finance sector includes financial institutions, such as banks, which play a pivotal role in issuing and confirming letters of credit. The growing adoption of LC confirmations in this sector is driven by the need for secure, trusted trade finance solutions in the global marketplace. Oil & Gas and Energy: The oil & gas and energy sectors also rely heavily on confirmed letters of credit for large transactions, particularly given the high value of equipment, commodities, and supplies involved. This sector is expected to maintain strong demand for LC confirmations as the energy trade continues to grow. By Region: North America: North America, particularly the United States, is a leading market for letter of credit confirmations due to its large financial institutions and active role in global trade. The region’s sophisticated banking infrastructure and high levels of international transactions make it a key player in the LC confirmation market. Europe: Europe is another significant market for LC confirmations, with a high volume of international trade transactions and a well-established banking system. The European Union’s trade policies and regulatory environment continue to drive demand for trade finance products like confirmed letters of credit. Asia-Pacific: The Asia-Pacific region, particularly countries like China, India, and Japan, is witnessing significant growth in international trade and export-driven industries. As trade expands, the need for LC confirmations in this region is expected to increase. Additionally, the growing adoption of digital trade finance solutions in Asia-Pacific will further contribute to the market’s growth. Latin America and Middle East & Africa: These regions are emerging as significant markets for letter of credit confirmations as international trade increases. Political and economic instability in some countries has driven the demand for secure payment methods like LC confirmations, ensuring businesses can mitigate risks in cross-border transactions. Challenges: Despite the positive growth outlook, the letter of credit confirmation market faces several challenges: Complexity of the LC Process: The traditional process of confirming letters of credit can be complex and time-consuming. This may discourage some businesses from using LCs, particularly smaller firms that lack the resources to navigate the process. The need for greater automation and digitization is critical to overcoming this challenge. High Costs: The cost of obtaining confirmed letters of credit, including fees charged by banks for issuing and confirming LCs, can be prohibitive for some businesses, especially small and medium-sized enterprises (SMEs). This can limit their ability to take advantage of these secure payment solutions. Fraud and Security Risks: Although letters of credit are designed to reduce the risk of fraud in international transactions, there are still instances of fraud and mismanagement in the trade finance sector. Ensuring robust security protocols, particularly in the digital LC space, is essential to maintaining trust in the system. Technological Advancements: Several technological developments are expected to shape the future of the LC confirmation market: Blockchain Technology: Blockchain is being explored to streamline the LC process, providing greater transparency, faster processing, and enhanced security. Blockchain-based platforms allow for the creation of digital letters of credit, making the entire process more efficient and reducing the risk of fraud. Artificial Intelligence (AI) and Automation: AI and automation are revolutionizing the trade finance industry by improving the speed, accuracy, and efficiency of confirming letters of credit. Automated platforms can help reduce human error, accelerate processing times, and lower costs for businesses. Digital Trade Finance Platforms: Digital platforms that offer end-to-end trade finance solutions, including LC confirmations, are growing in popularity. These platforms simplify the process, provide real-time tracking, and enable secure communication between buyers, sellers, and financial institutions. Unsecured Business Loans Market https://www.marketresearchfuture.com/reports/unsecured-business-loans-market-24673 Supply Chain Finance Market https://www.marketresearchfuture.com/reports/supply-chain-finance-market-24696 Forex Prepaid Card Market https://www.marketresearchfuture.com/reports/forex-prepaid-card-market-24849 Conclusion: The Letter of Credit Confirmation market is projected to grow from USD 4,685.97 million in 2025 to USD 6,232.80 million by 2034, driven by the increasing volume of global trade, the need for secure payment mechanisms, and the demand for risk mitigation in international transactions. As businesses continue to expand into new markets, confirmed letters of credit will remain a critical tool for ensuring payment security and mitigating the risks associated with cross-border trade. The ongoing digital transformation, including the integration of blockchain and AI, will continue to shape the future of the market, making the LC confirmation process more efficient, secure, and accessible to businesses worldwide. Despite challenges related to cost and complexity, the market is poised for steady growth, with key opportunities for innovation and expansion in emerging markets.Sample Request for Letter of Credit Confirmation Market Size, Share Report and Growth 2034www.marketresearchfuture.comSample Request - Letter of Credit Confirmation Market is projected to register a CAGR of 3.2 % to reach USD 6232.80 Million by the end of 2034, Global Letter of Credit Confirmation Industry Analysis by Confirmation Type, Size of Letter, Tenor & Region0 Reacties ·0 aandelen ·366 Views ·0 voorbeeld -

The Evolving Leadership Development Market: Trends, Drivers, and Future Outlook

The global leadership development market is witnessing significant growth, with the market size estimated at USD 106,571.47 million in 2024. It is expected to grow from USD 117,463.33 million in 2025 to USD 282,003.53 million by 2034, reflecting a robust compound annual growth rate (CAGR) of 10.2% during the forecast period from 2025 to 2034. As organizations worldwide face increasingly complex challenges in a dynamic business environment, the demand for effective leadership development programs has never been greater. This report explores the drivers, trends, challenges, and opportunities in the leadership development market.

Here is the sample link for the above topic : https://www.marketresearchfuture.com/sample_request/23196

Market Drivers: Several factors are fueling the growth of the leadership development market:

Increasing Focus on Organizational Agility: As businesses are confronted with rapidly changing market conditions, technological advancements, and global competition, there is an increasing need for leaders who can adapt and guide their organizations through periods of transformation. Leadership development programs are becoming essential for fostering agility, resilience, and effective decision-making within organizations, particularly in industries such as technology, finance, healthcare, and manufacturing.

Growing Demand for Soft Skills: In today’s fast-paced business environment, technical skills are no longer enough for leaders to succeed. There is an increasing emphasis on developing soft skills such as communication, emotional intelligence, problem-solving, and conflict resolution. These skills are crucial for leaders to inspire teams, manage change, and build strong relationships within and outside of the organization. As a result, leadership development programs are evolving to integrate both hard and soft skills training.

Emphasis on Diversity and Inclusion: Organizations are increasingly focusing on creating diverse and inclusive workplaces, and leadership development programs play a critical role in this effort. Leaders with a deep understanding of diversity and inclusion principles are better equipped to lead diverse teams, make inclusive decisions, and create a culture of belonging. This has led to a rise in leadership development programs that address issues such as unconscious bias, inclusive leadership, and cultural competency.

The Rise of Digital Transformation: As digital transformation reshapes industries and business models, leaders must be equipped with the skills to navigate and leverage emerging technologies. This includes a deep understanding of data analytics, artificial intelligence, automation, and digital communication tools. Leadership development programs that offer training in these areas are becoming increasingly important for organizations seeking to stay competitive in the digital age.

Talent Retention and Succession Planning: As the global talent pool becomes more competitive, organizations are investing in leadership development to retain top talent and ensure strong succession planning. By offering robust leadership development programs, companies can nurture internal talent, reduce turnover, and build a pipeline of future leaders. Organizations recognize that investing in leadership development not only enhances organizational performance but also contributes to employee engagement and satisfaction.

Growth Projections: The leadership development market is expected to grow at a CAGR of 10.2% during the forecast period (2025–2034), reaching USD 282,003.53 million by 2034. This growth is driven by the increasing demand for leadership skills across industries, the shift towards more comprehensive leadership training programs, and the expansion of digital learning platforms.

Market Segmentation: The leadership development market can be segmented based on delivery mode, end-user industry, and region:

By Delivery Mode:

Instructor-Led Training (ILT): Instructor-led training continues to be a popular mode of delivery for leadership development, particularly in corporate settings. It allows for personalized interaction, mentorship, and team-building exercises. However, ILT is often complemented by digital learning platforms in hybrid training models.

E-Learning and Online Training: The growing adoption of digital learning solutions is reshaping the leadership development landscape. E-learning platforms provide scalable, flexible, and cost-effective solutions that allow leaders to access training at their convenience. Online training programs and virtual leadership coaching are expected to see significant growth, especially with the shift towards remote and hybrid work environments.

Blended Learning: Many organizations are opting for blended learning models that combine face-to-face instructor-led sessions with online modules. This approach offers flexibility while still providing the in-depth engagement of in-person learning experiences.

By End-User Industry:

Corporate Enterprises: Large corporations are the primary adopters of leadership development programs, with a focus on enhancing executive leadership, middle management, and high-potential employees. Companies in sectors such as finance, technology, and manufacturing are particularly invested in leadership development to drive innovation and manage change effectively.

Small and Medium Enterprises (SMEs): SMEs are also increasingly investing in leadership development to enhance organizational growth and competitive advantage. As SMEs scale, they recognize the importance of developing strong leaders who can navigate the complexities of expanding operations and managing diverse teams.

Public Sector and Government: Leadership development programs are also crucial in the public sector, where leaders must address public policy challenges, manage public resources, and deliver essential services. Government agencies worldwide are adopting leadership training programs to build strong leaders capable of driving change in public administration.

Education and Non-Profit Organizations: Educational institutions and non-profit organizations are increasingly offering leadership development programs to prepare the next generation of leaders. These programs focus on values-driven leadership and empowering individuals to make positive social impacts.

By Region:

North America: North America is expected to maintain its dominance in the leadership development market, driven by the presence of large corporations, extensive training infrastructure, and a high demand for executive coaching and leadership training services. The U.S. and Canada are key markets for leadership development programs.

Europe: Europe is also a significant market, with strong demand for leadership development across various sectors, including finance, healthcare, and public services. Companies are increasingly focusing on digital leadership training and building diverse leadership teams.

Asia-Pacific: The Asia-Pacific region is poised for rapid growth, driven by the expanding middle class, increasing globalization, and the growing need for leadership training in emerging markets like China and India. The rise of new industries and a focus on corporate governance are also fueling demand for leadership development.

Latin America and Middle East & Africa: These regions are gradually embracing leadership development as businesses look to enhance operational efficiency and strengthen organizational leadership. Companies in Latin America and the Middle East are particularly focused on leadership development to drive digital transformation and address leadership gaps in fast-growing economies.

Challenges: While the leadership development market is experiencing rapid growth, there are several challenges that organizations face:

Lack of Personalization: Many leadership development programs take a “one-size-fits-all” approach, which may not be effective for all participants. Tailoring programs to individual leadership styles, industry-specific needs, and organizational culture can be a challenge for providers.

Measuring Effectiveness: It can be difficult for organizations to measure the direct impact of leadership development programs on organizational performance. Clear metrics and KPIs are needed to assess the success of these initiatives in terms of productivity, employee engagement, and business outcomes.

Employee Engagement: Leadership development programs must go beyond traditional training methods and actively engage employees to ensure retention and knowledge transfer. The challenge lies in creating programs that encourage sustained engagement and application of learned skills.

Technological Advancements: Several technological trends are transforming the leadership development market:

Artificial Intelligence and Data Analytics: AI is being used to personalize learning experiences, recommend tailored content, and track individual progress. Data analytics also help organizations assess the effectiveness of leadership training programs and identify areas for improvement.

Virtual Reality (VR) and Augmented Reality (AR): VR and AR technologies are becoming popular tools for immersive leadership training. These technologies enable participants to experience real-life leadership scenarios, such as crisis management or team decision-making, in a controlled environment.

Gamification: Gamified leadership training programs are gaining traction, using elements of game design to engage and motivate participants. This approach can enhance learning retention and improve the overall training experience.

Unsecured Business Loans Market

https://www.marketresearchfuture.com/reports/unsecured-business-loans-market-24673

Supply Chain Finance Market

https://www.marketresearchfuture.com/reports/supply-chain-finance-market-24696

Forex Prepaid Card Market

https://www.marketresearchfuture.com/reports/forex-prepaid-card-market-24849

Conclusion: The leadership development market is on a strong growth trajectory, with a projected value of USD 282,003.53 million by 2034. As businesses face new challenges in a rapidly changing global landscape, the need for effective leadership has never been more critical. The market is driven by factors such as the increasing demand for soft skills, the rise of digital transformation, and the growing importance of diversity and inclusion. With emerging technologies like AI, VR, and gamification transforming the way leadership training is delivered, organizations are poised to continue investing in leadership development to ensure they have the right leaders in place to drive success in the future.

The Evolving Leadership Development Market: Trends, Drivers, and Future Outlook The global leadership development market is witnessing significant growth, with the market size estimated at USD 106,571.47 million in 2024. It is expected to grow from USD 117,463.33 million in 2025 to USD 282,003.53 million by 2034, reflecting a robust compound annual growth rate (CAGR) of 10.2% during the forecast period from 2025 to 2034. As organizations worldwide face increasingly complex challenges in a dynamic business environment, the demand for effective leadership development programs has never been greater. This report explores the drivers, trends, challenges, and opportunities in the leadership development market. Here is the sample link for the above topic : https://www.marketresearchfuture.com/sample_request/23196 Market Drivers: Several factors are fueling the growth of the leadership development market: Increasing Focus on Organizational Agility: As businesses are confronted with rapidly changing market conditions, technological advancements, and global competition, there is an increasing need for leaders who can adapt and guide their organizations through periods of transformation. Leadership development programs are becoming essential for fostering agility, resilience, and effective decision-making within organizations, particularly in industries such as technology, finance, healthcare, and manufacturing. Growing Demand for Soft Skills: In today’s fast-paced business environment, technical skills are no longer enough for leaders to succeed. There is an increasing emphasis on developing soft skills such as communication, emotional intelligence, problem-solving, and conflict resolution. These skills are crucial for leaders to inspire teams, manage change, and build strong relationships within and outside of the organization. As a result, leadership development programs are evolving to integrate both hard and soft skills training. Emphasis on Diversity and Inclusion: Organizations are increasingly focusing on creating diverse and inclusive workplaces, and leadership development programs play a critical role in this effort. Leaders with a deep understanding of diversity and inclusion principles are better equipped to lead diverse teams, make inclusive decisions, and create a culture of belonging. This has led to a rise in leadership development programs that address issues such as unconscious bias, inclusive leadership, and cultural competency. The Rise of Digital Transformation: As digital transformation reshapes industries and business models, leaders must be equipped with the skills to navigate and leverage emerging technologies. This includes a deep understanding of data analytics, artificial intelligence, automation, and digital communication tools. Leadership development programs that offer training in these areas are becoming increasingly important for organizations seeking to stay competitive in the digital age. Talent Retention and Succession Planning: As the global talent pool becomes more competitive, organizations are investing in leadership development to retain top talent and ensure strong succession planning. By offering robust leadership development programs, companies can nurture internal talent, reduce turnover, and build a pipeline of future leaders. Organizations recognize that investing in leadership development not only enhances organizational performance but also contributes to employee engagement and satisfaction. Growth Projections: The leadership development market is expected to grow at a CAGR of 10.2% during the forecast period (2025–2034), reaching USD 282,003.53 million by 2034. This growth is driven by the increasing demand for leadership skills across industries, the shift towards more comprehensive leadership training programs, and the expansion of digital learning platforms. Market Segmentation: The leadership development market can be segmented based on delivery mode, end-user industry, and region: By Delivery Mode: Instructor-Led Training (ILT): Instructor-led training continues to be a popular mode of delivery for leadership development, particularly in corporate settings. It allows for personalized interaction, mentorship, and team-building exercises. However, ILT is often complemented by digital learning platforms in hybrid training models. E-Learning and Online Training: The growing adoption of digital learning solutions is reshaping the leadership development landscape. E-learning platforms provide scalable, flexible, and cost-effective solutions that allow leaders to access training at their convenience. Online training programs and virtual leadership coaching are expected to see significant growth, especially with the shift towards remote and hybrid work environments. Blended Learning: Many organizations are opting for blended learning models that combine face-to-face instructor-led sessions with online modules. This approach offers flexibility while still providing the in-depth engagement of in-person learning experiences. By End-User Industry: Corporate Enterprises: Large corporations are the primary adopters of leadership development programs, with a focus on enhancing executive leadership, middle management, and high-potential employees. Companies in sectors such as finance, technology, and manufacturing are particularly invested in leadership development to drive innovation and manage change effectively. Small and Medium Enterprises (SMEs): SMEs are also increasingly investing in leadership development to enhance organizational growth and competitive advantage. As SMEs scale, they recognize the importance of developing strong leaders who can navigate the complexities of expanding operations and managing diverse teams. Public Sector and Government: Leadership development programs are also crucial in the public sector, where leaders must address public policy challenges, manage public resources, and deliver essential services. Government agencies worldwide are adopting leadership training programs to build strong leaders capable of driving change in public administration. Education and Non-Profit Organizations: Educational institutions and non-profit organizations are increasingly offering leadership development programs to prepare the next generation of leaders. These programs focus on values-driven leadership and empowering individuals to make positive social impacts. By Region: North America: North America is expected to maintain its dominance in the leadership development market, driven by the presence of large corporations, extensive training infrastructure, and a high demand for executive coaching and leadership training services. The U.S. and Canada are key markets for leadership development programs. Europe: Europe is also a significant market, with strong demand for leadership development across various sectors, including finance, healthcare, and public services. Companies are increasingly focusing on digital leadership training and building diverse leadership teams. Asia-Pacific: The Asia-Pacific region is poised for rapid growth, driven by the expanding middle class, increasing globalization, and the growing need for leadership training in emerging markets like China and India. The rise of new industries and a focus on corporate governance are also fueling demand for leadership development. Latin America and Middle East & Africa: These regions are gradually embracing leadership development as businesses look to enhance operational efficiency and strengthen organizational leadership. Companies in Latin America and the Middle East are particularly focused on leadership development to drive digital transformation and address leadership gaps in fast-growing economies. Challenges: While the leadership development market is experiencing rapid growth, there are several challenges that organizations face: Lack of Personalization: Many leadership development programs take a “one-size-fits-all” approach, which may not be effective for all participants. Tailoring programs to individual leadership styles, industry-specific needs, and organizational culture can be a challenge for providers. Measuring Effectiveness: It can be difficult for organizations to measure the direct impact of leadership development programs on organizational performance. Clear metrics and KPIs are needed to assess the success of these initiatives in terms of productivity, employee engagement, and business outcomes. Employee Engagement: Leadership development programs must go beyond traditional training methods and actively engage employees to ensure retention and knowledge transfer. The challenge lies in creating programs that encourage sustained engagement and application of learned skills. Technological Advancements: Several technological trends are transforming the leadership development market: Artificial Intelligence and Data Analytics: AI is being used to personalize learning experiences, recommend tailored content, and track individual progress. Data analytics also help organizations assess the effectiveness of leadership training programs and identify areas for improvement. Virtual Reality (VR) and Augmented Reality (AR): VR and AR technologies are becoming popular tools for immersive leadership training. These technologies enable participants to experience real-life leadership scenarios, such as crisis management or team decision-making, in a controlled environment. Gamification: Gamified leadership training programs are gaining traction, using elements of game design to engage and motivate participants. This approach can enhance learning retention and improve the overall training experience. Unsecured Business Loans Market https://www.marketresearchfuture.com/reports/unsecured-business-loans-market-24673 Supply Chain Finance Market https://www.marketresearchfuture.com/reports/supply-chain-finance-market-24696 Forex Prepaid Card Market https://www.marketresearchfuture.com/reports/forex-prepaid-card-market-24849 Conclusion: The leadership development market is on a strong growth trajectory, with a projected value of USD 282,003.53 million by 2034. As businesses face new challenges in a rapidly changing global landscape, the need for effective leadership has never been more critical. The market is driven by factors such as the increasing demand for soft skills, the rise of digital transformation, and the growing importance of diversity and inclusion. With emerging technologies like AI, VR, and gamification transforming the way leadership training is delivered, organizations are poised to continue investing in leadership development to ensure they have the right leaders in place to drive success in the future.Sample Request for Leadership Development Market Size, Share and Trends 2034www.marketresearchfuture.comSample Request - Leadership Development Market is projected to reach USD 282003.53 Million at a CAGR of 10.2% by 2034, Global Leadership Development Industry Growth by Training Method, Industry, Job Level, Leadership Competency, Region0 Reacties ·0 aandelen ·425 Views ·0 voorbeeld -

The Enduring Power of Mainframes: Growth and Trends in the Global Market

The global mainframe market was valued at USD 4.55 billion in 2022 and is set to witness steady growth over the next decade. The market size is projected to grow from USD 4.79 billion in 2023 to USD 7.6 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.27% during the forecast period from 2024 to 2032. Despite the rise of newer technologies like cloud computing and distributed systems, mainframes continue to play a critical role in industries that require high reliability, security, and processing power, particularly in sectors such as finance, healthcare, and government.

Here is the sample link for the above topic : https://www.marketresearchfuture.com/sample_request/23155

Market Drivers:

Several factors contribute to the continued growth and adoption of mainframes:

Increasing Demand for High-Performance Computing: Mainframes are known for their ability to handle high volumes of transactions and provide unmatched reliability, which makes them ideal for industries like banking, insurance, and government services that require heavy computational power for mission-critical applications. The growth in data-intensive applications is driving the demand for mainframes, as they provide unparalleled processing speed and capacity for managing large-scale databases and real-time transactions.

Need for Legacy System Integration: Many large organizations, especially in the financial and government sectors, have relied on mainframes for decades. These legacy systems continue to be essential for core operations. As organizations increasingly look for ways to modernize their infrastructure, they often choose hybrid environments where mainframes are integrated with cloud-based solutions. This integration extends the lifecycle of mainframe systems and facilitates a smoother transition to more modern technologies without completely overhauling existing infrastructure.

Reliability, Security, and Scalability: Mainframes are known for their unmatched reliability and uptime, often exceeding 99.999% availability. This reliability is critical for industries where downtime can result in financial losses or compromised data. Furthermore, mainframes offer advanced security features that help protect sensitive data from cyber threats, making them especially important in sectors like finance, healthcare, and government. Additionally, mainframes can be scaled to meet the growing demands of businesses, allowing organizations to expand their computing resources as needed.

Cost-Effectiveness Over the Long Term: Although the initial investment for mainframes can be high, they offer cost-effective benefits over the long term. Mainframes can support thousands of users simultaneously without performance degradation, leading to significant savings in terms of infrastructure and operational costs when compared to other types of systems. For organizations with large-scale computing needs, mainframes remain a cost-efficient solution, especially as hardware advancements continue to improve processing capabilities and reduce maintenance costs.

Emerging Applications in AI, Big Data, and Analytics: As more industries adopt big data, AI, and analytics technologies, mainframes are emerging as crucial platforms for processing vast amounts of data. With the rise of machine learning and AI models, mainframes are able to handle the computational complexity of these technologies, providing the necessary infrastructure for real-time data analysis, decision-making, and data-driven insights.

Growth Projections: The mainframe market is projected to grow steadily, from USD 4.79 billion in 2023 to USD 7.6 billion by 2032, at a CAGR of 5.27%. The consistent demand for mainframes in traditional industries like banking, insurance, and government will continue to fuel this growth. As digital transformation efforts increase, there will also be greater demand for mainframe systems that can be integrated into hybrid IT environments, combining the power of traditional systems with the flexibility and scalability of modern technologies like the cloud.

Market Segmentation: The mainframe market can be segmented based on component, deployment, end-use industry, and region:

By Component:

Hardware: The hardware segment includes mainframe systems, processors, storage devices, and peripheral equipment. This segment is expected to remain dominant due to the high demand for powerful computing hardware in sectors that require heavy computational capacity.

Software: Mainframe software, including operating systems, virtualization tools, and middleware, will see significant growth. As mainframe environments become more integrated with cloud-based and hybrid IT architectures, software solutions that enable this integration will be in high demand.

Services: This includes consulting, maintenance, and managed services. As organizations continue to leverage mainframes alongside modern IT infrastructures, the need for professional services to manage and maintain these systems will increase.

By Deployment:

On-premise Deployment: Many enterprises still prefer on-premise deployment due to the high control and security it offers over their operations and data. This deployment is expected to maintain its share, particularly in highly regulated industries like banking and government.

Cloud Integration: The growing trend of hybrid IT environments and cloud adoption is also influencing the mainframe market. Organizations are increasingly integrating mainframe systems with cloud services to leverage both scalability and the reliability of legacy infrastructure.

By End-use Industry:

BFSI (Banking, Financial Services, and Insurance): The BFSI sector remains the largest consumer of mainframe systems due to the need for high-performance computing for processing financial transactions, risk analysis, and regulatory reporting.

Government and Public Sector: Governments across the world continue to rely on mainframes for critical functions such as tax processing, social security, defense operations, and more.

Healthcare: With the increasing volume of patient data and the need for secure storage and analysis, healthcare organizations use mainframe systems for managing large databases and supporting applications like electronic health records (EHR).

Retail and E-commerce: Retailers are adopting mainframe technology for handling large-scale transactions, inventory management, and customer data analysis.

By Region:

North America: North America remains a dominant region in the mainframe market, driven by the presence of key financial institutions, government agencies, and large enterprises. The U.S. continues to lead in terms of mainframe adoption, with significant investments in legacy systems and modernization efforts.

Europe: Europe is expected to see steady growth, particularly in industries such as finance and government, where mainframes continue to play a vital role in operations.

Asia-Pacific: The Asia-Pacific region is anticipated to witness significant growth due to the increasing digitalization of industries like banking, finance, and healthcare, particularly in countries such as China, India, and Japan.

Latin America and Middle East & Africa: These regions are gradually adopting mainframe technology, particularly as industries such as finance and government modernize their infrastructure and integrate more digital services.

Challenges: Despite the positive growth projections, the mainframe market faces several challenges:

High Initial Cost: The upfront investment required for mainframe systems, including hardware and software, can be a barrier, especially for small and medium-sized enterprises (SMEs).

Workforce Shortage: There is a growing shortage of professionals with the specialized skills required to maintain and operate mainframe systems, which could lead to challenges in system maintenance and support.

Integration with Modern Technologies: As organizations increasingly adopt cloud computing and other modern technologies, integrating mainframes with newer systems can be complex and costly. Ensuring seamless interoperability between legacy mainframes and modern IT infrastructures is crucial for businesses to fully leverage both worlds.

Technological Advancements: Several technological trends are shaping the future of the mainframe market:

AI and Automation: AI and machine learning are being integrated into mainframe systems to improve performance, automate routine tasks, and optimize resource allocation.

Hybrid IT Infrastructure: The integration of mainframe systems with cloud-based environments enables businesses to achieve a balance of scalability, flexibility, and the reliability of traditional systems.

Blockchain and Mainframes: Blockchain’s secure, transparent, and immutable ledger technology is being tested in mainframe environments to provide secure transaction processing for applications such as banking and supply chain management.

Unsecured Business Loans Market

https://www.marketresearchfuture.com/reports/unsecured-business-loans-market-24673

Supply Chain Finance Market

https://www.marketresearchfuture.com/reports/supply-chain-finance-market-24696

Forex Prepaid Card Market

https://www.marketresearchfuture.com/reports/forex-prepaid-card-market-24849

Conclusion: The mainframe market is expected to grow steadily, reaching USD 7.6 billion by 2032. Despite the growing adoption of cloud and distributed systems, mainframes continue to serve as a backbone for industries that require high performance, security, and reliability. As organizations modernize their IT infrastructure, integrating mainframes with cloud services and hybrid IT environments will ensure that these systems remain a vital part of enterprise computing. With technological advancements and a continued demand for secure, reliable, and scalable computing, the mainframe market is well-positioned for long-term growth.The Enduring Power of Mainframes: Growth and Trends in the Global Market The global mainframe market was valued at USD 4.55 billion in 2022 and is set to witness steady growth over the next decade. The market size is projected to grow from USD 4.79 billion in 2023 to USD 7.6 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.27% during the forecast period from 2024 to 2032. Despite the rise of newer technologies like cloud computing and distributed systems, mainframes continue to play a critical role in industries that require high reliability, security, and processing power, particularly in sectors such as finance, healthcare, and government. Here is the sample link for the above topic : https://www.marketresearchfuture.com/sample_request/23155 Market Drivers: Several factors contribute to the continued growth and adoption of mainframes: Increasing Demand for High-Performance Computing: Mainframes are known for their ability to handle high volumes of transactions and provide unmatched reliability, which makes them ideal for industries like banking, insurance, and government services that require heavy computational power for mission-critical applications. The growth in data-intensive applications is driving the demand for mainframes, as they provide unparalleled processing speed and capacity for managing large-scale databases and real-time transactions. Need for Legacy System Integration: Many large organizations, especially in the financial and government sectors, have relied on mainframes for decades. These legacy systems continue to be essential for core operations. As organizations increasingly look for ways to modernize their infrastructure, they often choose hybrid environments where mainframes are integrated with cloud-based solutions. This integration extends the lifecycle of mainframe systems and facilitates a smoother transition to more modern technologies without completely overhauling existing infrastructure. Reliability, Security, and Scalability: Mainframes are known for their unmatched reliability and uptime, often exceeding 99.999% availability. This reliability is critical for industries where downtime can result in financial losses or compromised data. Furthermore, mainframes offer advanced security features that help protect sensitive data from cyber threats, making them especially important in sectors like finance, healthcare, and government. Additionally, mainframes can be scaled to meet the growing demands of businesses, allowing organizations to expand their computing resources as needed. Cost-Effectiveness Over the Long Term: Although the initial investment for mainframes can be high, they offer cost-effective benefits over the long term. Mainframes can support thousands of users simultaneously without performance degradation, leading to significant savings in terms of infrastructure and operational costs when compared to other types of systems. For organizations with large-scale computing needs, mainframes remain a cost-efficient solution, especially as hardware advancements continue to improve processing capabilities and reduce maintenance costs. Emerging Applications in AI, Big Data, and Analytics: As more industries adopt big data, AI, and analytics technologies, mainframes are emerging as crucial platforms for processing vast amounts of data. With the rise of machine learning and AI models, mainframes are able to handle the computational complexity of these technologies, providing the necessary infrastructure for real-time data analysis, decision-making, and data-driven insights. Growth Projections: The mainframe market is projected to grow steadily, from USD 4.79 billion in 2023 to USD 7.6 billion by 2032, at a CAGR of 5.27%. The consistent demand for mainframes in traditional industries like banking, insurance, and government will continue to fuel this growth. As digital transformation efforts increase, there will also be greater demand for mainframe systems that can be integrated into hybrid IT environments, combining the power of traditional systems with the flexibility and scalability of modern technologies like the cloud. Market Segmentation: The mainframe market can be segmented based on component, deployment, end-use industry, and region: By Component: Hardware: The hardware segment includes mainframe systems, processors, storage devices, and peripheral equipment. This segment is expected to remain dominant due to the high demand for powerful computing hardware in sectors that require heavy computational capacity. Software: Mainframe software, including operating systems, virtualization tools, and middleware, will see significant growth. As mainframe environments become more integrated with cloud-based and hybrid IT architectures, software solutions that enable this integration will be in high demand. Services: This includes consulting, maintenance, and managed services. As organizations continue to leverage mainframes alongside modern IT infrastructures, the need for professional services to manage and maintain these systems will increase. By Deployment: On-premise Deployment: Many enterprises still prefer on-premise deployment due to the high control and security it offers over their operations and data. This deployment is expected to maintain its share, particularly in highly regulated industries like banking and government. Cloud Integration: The growing trend of hybrid IT environments and cloud adoption is also influencing the mainframe market. Organizations are increasingly integrating mainframe systems with cloud services to leverage both scalability and the reliability of legacy infrastructure. By End-use Industry: BFSI (Banking, Financial Services, and Insurance): The BFSI sector remains the largest consumer of mainframe systems due to the need for high-performance computing for processing financial transactions, risk analysis, and regulatory reporting. Government and Public Sector: Governments across the world continue to rely on mainframes for critical functions such as tax processing, social security, defense operations, and more. Healthcare: With the increasing volume of patient data and the need for secure storage and analysis, healthcare organizations use mainframe systems for managing large databases and supporting applications like electronic health records (EHR). Retail and E-commerce: Retailers are adopting mainframe technology for handling large-scale transactions, inventory management, and customer data analysis. By Region: North America: North America remains a dominant region in the mainframe market, driven by the presence of key financial institutions, government agencies, and large enterprises. The U.S. continues to lead in terms of mainframe adoption, with significant investments in legacy systems and modernization efforts. Europe: Europe is expected to see steady growth, particularly in industries such as finance and government, where mainframes continue to play a vital role in operations. Asia-Pacific: The Asia-Pacific region is anticipated to witness significant growth due to the increasing digitalization of industries like banking, finance, and healthcare, particularly in countries such as China, India, and Japan. Latin America and Middle East & Africa: These regions are gradually adopting mainframe technology, particularly as industries such as finance and government modernize their infrastructure and integrate more digital services. Challenges: Despite the positive growth projections, the mainframe market faces several challenges: High Initial Cost: The upfront investment required for mainframe systems, including hardware and software, can be a barrier, especially for small and medium-sized enterprises (SMEs). Workforce Shortage: There is a growing shortage of professionals with the specialized skills required to maintain and operate mainframe systems, which could lead to challenges in system maintenance and support. Integration with Modern Technologies: As organizations increasingly adopt cloud computing and other modern technologies, integrating mainframes with newer systems can be complex and costly. Ensuring seamless interoperability between legacy mainframes and modern IT infrastructures is crucial for businesses to fully leverage both worlds. Technological Advancements: Several technological trends are shaping the future of the mainframe market: AI and Automation: AI and machine learning are being integrated into mainframe systems to improve performance, automate routine tasks, and optimize resource allocation. Hybrid IT Infrastructure: The integration of mainframe systems with cloud-based environments enables businesses to achieve a balance of scalability, flexibility, and the reliability of traditional systems. Blockchain and Mainframes: Blockchain’s secure, transparent, and immutable ledger technology is being tested in mainframe environments to provide secure transaction processing for applications such as banking and supply chain management. Unsecured Business Loans Market https://www.marketresearchfuture.com/reports/unsecured-business-loans-market-24673 Supply Chain Finance Market https://www.marketresearchfuture.com/reports/supply-chain-finance-market-24696 Forex Prepaid Card Market https://www.marketresearchfuture.com/reports/forex-prepaid-card-market-24849 Conclusion: The mainframe market is expected to grow steadily, reaching USD 7.6 billion by 2032. Despite the growing adoption of cloud and distributed systems, mainframes continue to serve as a backbone for industries that require high performance, security, and reliability. As organizations modernize their IT infrastructure, integrating mainframes with cloud services and hybrid IT environments will ensure that these systems remain a vital part of enterprise computing. With technological advancements and a continued demand for secure, reliable, and scalable computing, the mainframe market is well-positioned for long-term growth.Sample Request for Mainframe Market Size, Share Report and Trends 2032www.marketresearchfuture.comSample Request - Mainframe Market is projected to reach USD 7.6 Billion at a CAGR of 5.27% by 2032, Global Mainframe Industry Growth by Technology, Application, Industry Vertical, Deployment Model, Processor Type, Region0 Reacties ·0 aandelen ·455 Views ·0 voorbeeld -

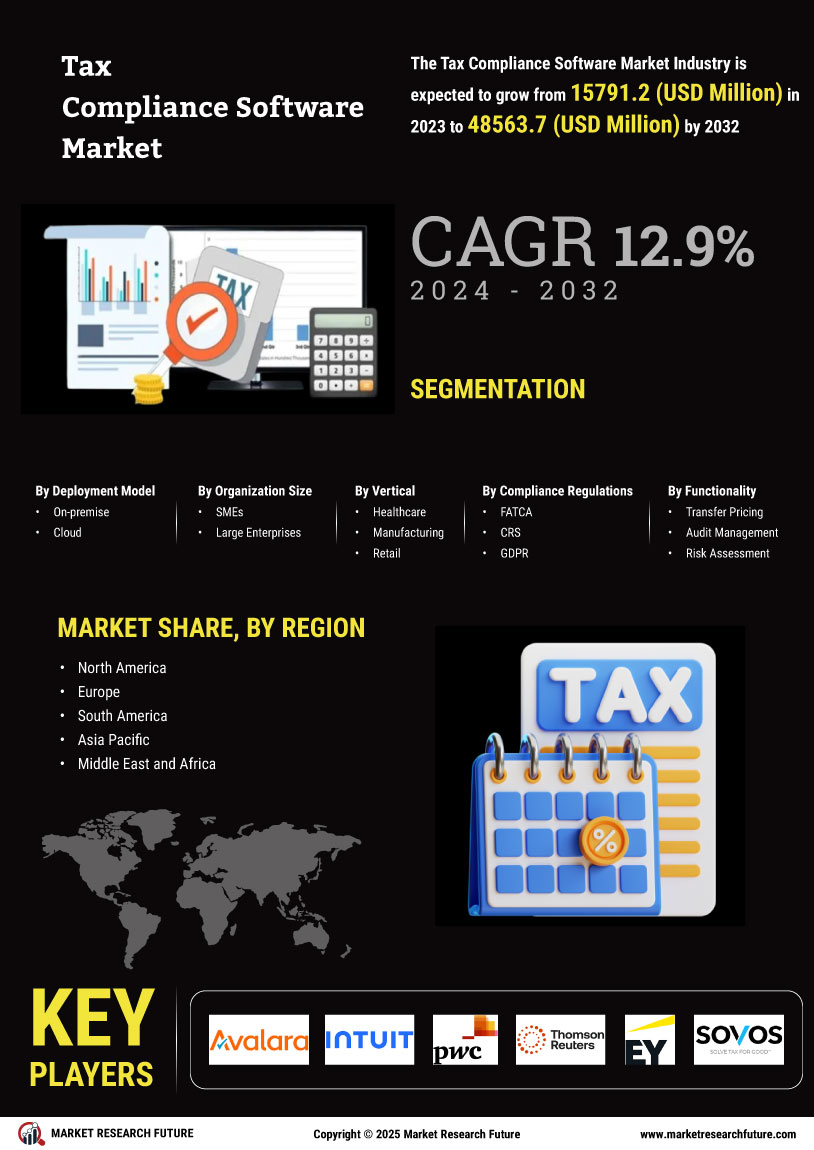

Navigating Complexities: Growth and Trends in the Tax Compliance Software Market

Tax Compliance Software Market Size was estimated at 13852.9 (USD Million) in 2022. The Tax Compliance Software Market Industry is expected to grow from 15791.2 (USD Million) in 2023 to 48563.7 (USD Million) by 2032. The Tax Compliance Software Market CAGR (growth rate) is expected to be around 12.9% during the forecast period (2024 - 2032).

To Browse the entire topic visit : https://www.marketresearchfuture.com/reports/tax-compliance-software-market-23062Navigating Complexities: Growth and Trends in the Tax Compliance Software Market Tax Compliance Software Market Size was estimated at 13852.9 (USD Million) in 2022. The Tax Compliance Software Market Industry is expected to grow from 15791.2 (USD Million) in 2023 to 48563.7 (USD Million) by 2032. The Tax Compliance Software Market CAGR (growth rate) is expected to be around 12.9% during the forecast period (2024 - 2032). To Browse the entire topic visit : https://www.marketresearchfuture.com/reports/tax-compliance-software-market-23062 Tax Compliance Software Market Size, Share Report and Trends 2032www.marketresearchfuture.comTax Compliance Software Market is projected to reach USD 48563.7 Million at a CAGR of 12.9% by 2032, Global Tax Compliance Software Industry Growth by Deployment Model, Organization Size, Vertical, Compliance Regulations, Functionality, Region0 Reacties ·0 aandelen ·199 Views ·0 voorbeeld

Tax Compliance Software Market Size, Share Report and Trends 2032www.marketresearchfuture.comTax Compliance Software Market is projected to reach USD 48563.7 Million at a CAGR of 12.9% by 2032, Global Tax Compliance Software Industry Growth by Deployment Model, Organization Size, Vertical, Compliance Regulations, Functionality, Region0 Reacties ·0 aandelen ·199 Views ·0 voorbeeld -

Powering the Future: Growth and Trends in the PoE Switches Market

The Power over Ethernet (PoE) switches market was valued at approximately USD 12.99 billion in 2024 and is projected to experience significant growth in the coming decade. The market is expected to expand from USD 14.54 billion in 2025 to USD 40.13 billion by 2034, reflecting a compound annual growth rate (CAGR) of 11.9% during the forecast period from 2025 to 2034. This remarkable growth is driven by the increasing adoption of PoE technology in various sectors, including enterprise networking, telecommunications, and smart cities, fueled by demand for enhanced connectivity and efficiency.

Here is the sample link for the above topic : https://www.marketresearchfuture.com/sample_request/22280

Rising Demand for High-Efficiency Networking: PoE technology allows both power and data to be transmitted over a single Ethernet cable, reducing the need for additional power supplies and making network installations more efficient and cost-effective. As businesses and organizations seek to optimize their networks, PoE switches have become an increasingly attractive option.

Growth of IoT and Smart Devices: The rise of the Internet of Things (IoT) and smart devices has fueled demand for PoE switches. Devices such as security cameras, VoIP phones, smart lighting systems, and wireless access points require both power and data connectivity, making PoE switches a practical solution for powering these devices in commercial and residential environments.

Smart Cities and Infrastructure Development: The increasing investment in smart city initiatives globally is another significant factor contributing to the growth of PoE switches. As cities become more connected, the need for PoE solutions to power smart surveillance systems, street lighting, and traffic management infrastructure has escalated.

Cost and Energy Efficiency: PoE switches offer substantial savings in terms of installation costs, maintenance, and energy consumption. Since power is transmitted over the same cable as data, businesses can avoid the need for additional power outlets, electrical cabling, and adapters. This reduces overall costs and simplifies network infrastructure.

Advancements in PoE Standards: The evolution of PoE standards, such as PoE+ (IEEE 802.3at) and the more recent IEEE 802.3bt (also known as PoE++), has expanded the power output capabilities of PoE switches. These advancements allow PoE switches to support a wider range of devices, from low-power devices to high-demand equipment like video conferencing systems, point-of-sale terminals, and advanced security systems.

Growth Projections: The PoE switches market is poised for substantial growth, with an expected CAGR of 11.9% from 2025 to 2034. By 2034, the market is projected to reach USD 40.13 billion, driven by technological advancements, increased adoption across various industries, and the growing demand for energy-efficient networking solutions. The market is expected to see widespread adoption not only in enterprise environments but also in homes and smart buildings as PoE technology becomes more ubiquitous.

Market Segmentation: The PoE switches market can be segmented based on power output, application, deployment, and region:

By Power Output:

PoE (IEEE 802.3af): Lower power output, suitable for devices like IP cameras, Wi-Fi access points, and VoIP phones.

PoE+ (IEEE 802.3at): Higher power output, supporting a broader range of devices, including high-performance wireless access points and PTZ cameras.

PoE++ (IEEE 802.3bt): The highest power output, ideal for demanding applications such as video conferencing systems and high-power security cameras.

By Application:

Enterprise Networking: PoE switches are extensively used in offices, data centers, and other business environments to power networking devices and support a wide range of applications.

Smart Buildings and Homes: With the rise of home automation and connected devices, PoE switches are increasingly used to power smart home devices, lighting systems, and security cameras.

Industrial Applications: Industrial sectors are utilizing PoE solutions to streamline operations, particularly in remote monitoring, security systems, and industrial automation.

By Deployment:

On-premise Deployment: PoE switches are typically installed in company data centers or network closets to support internal operations.

Cloud-based Solutions: The increasing adoption of cloud-based services is prompting some organizations to utilize PoE solutions in conjunction with cloud-based infrastructure for enhanced scalability and efficiency.

By Region:

North America: North America is expected to remain a dominant region due to the high concentration of businesses, technological adoption, and the growing demand for smart city infrastructure in the U.S. and Canada.

Europe: Europe is projected to experience steady growth driven by smart city initiatives and advancements in automation, particularly in countries like the UK, Germany, and France.

Asia-Pacific: The Asia-Pacific region, with its rapidly growing economies and increasing investment in infrastructure and IoT devices, is expected to be a major contributor to market growth.

Middle East & Africa and Latin America: These regions are witnessing increasing demand for PoE technology as part of infrastructure modernization and urban development projects.

Challenges: Despite the positive outlook, several challenges could impact the PoE switches market:

Compatibility Issues: As businesses upgrade their networks to adopt PoE solutions, compatibility issues with older equipment may arise. Ensuring seamless integration of PoE switches with legacy infrastructure can be challenging.

Security Concerns: The growing reliance on PoE-powered devices makes it crucial for organizations to implement robust security measures to protect against cyber threats. Vulnerabilities in PoE networks, particularly in IoT environments, could expose businesses to data breaches and hacking attempts.

High Initial Costs: While PoE switches offer long-term cost savings, the initial investment required for upgrading existing network infrastructure to accommodate PoE may be a concern for some businesses, particularly small enterprises.

Technological Advancements: The future of the PoE switches market will be shaped by several technological innovations:

IoT Integration: As IoT devices continue to proliferate across industries, PoE switches will evolve to support higher power demands and more devices, enhancing the flexibility and scalability of IoT networks.

AI and Automation: Integration of artificial intelligence (AI) and automation into PoE networks will allow for more efficient monitoring and management of connected devices, improving overall network performance.

Cloud-Managed PoE Solutions: The adoption of cloud-managed PoE switches is growing, allowing businesses to manage their networks remotely, improve scalability, and reduce on-site IT management efforts.

Unsecured Business Loans Market https://www.marketresearchfuture.com/reports/unsecured-business-loans-market-24673

Supply Chain Finance Market https://www.marketresearchfuture.com/reports/supply-chain-finance-market-24696

Forex Prepaid Card Market https://www.marketresearchfuture.com/reports/forex-prepaid-card-market-24849

Conclusion: The PoE switches market is positioned for rapid growth, with an expected market size of USD 40.13 billion by 2034. The increasing demand for smart devices, energy-efficient networking solutions, and advancements in PoE standards are driving adoption across a wide range of sectors, including enterprise networking, smart buildings, and industrial automation.