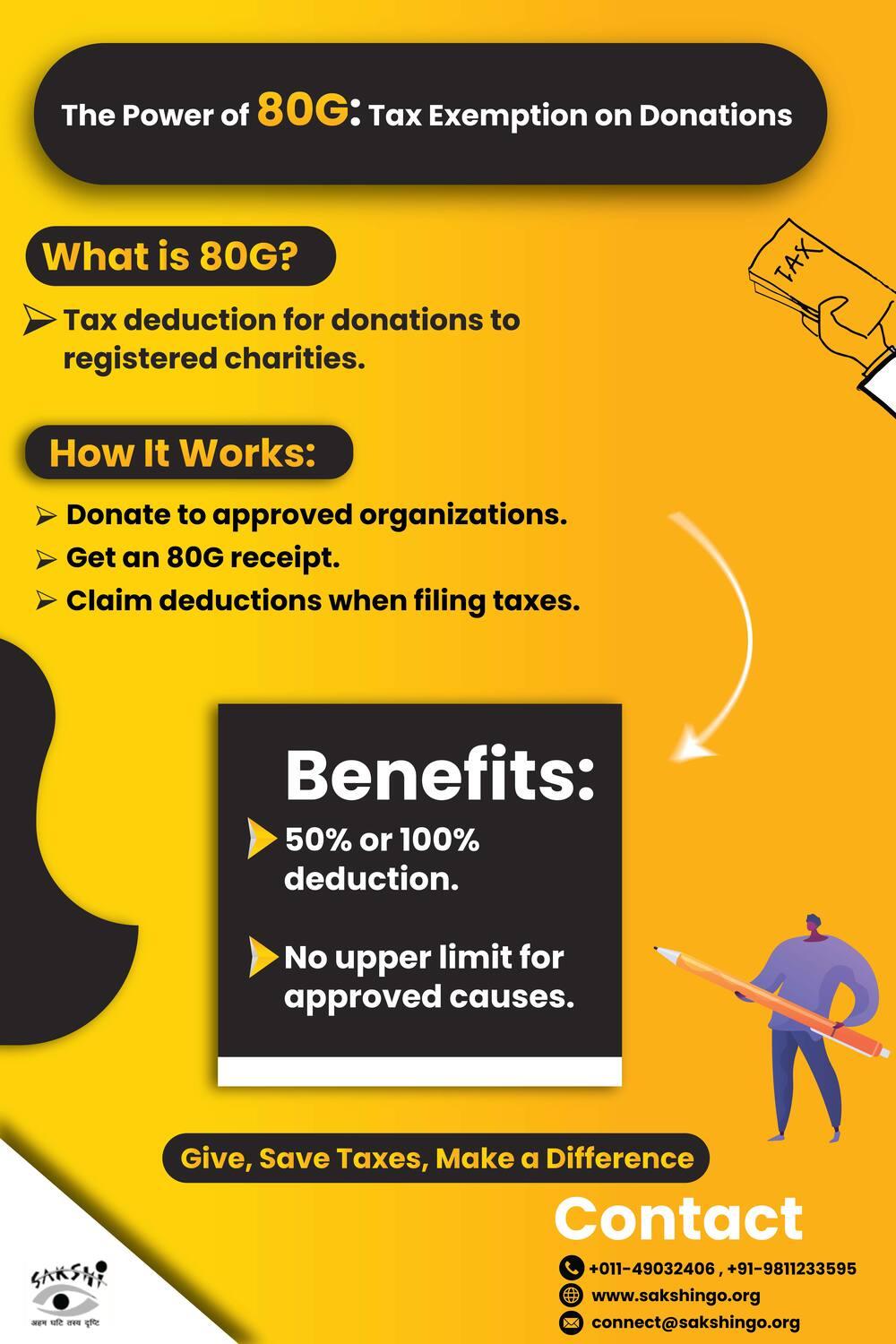

The Power of 80 G- Tax Exemption on Donation

Donating to a registered charity is not just a way to support a charitable cause; it also has financial benefits under Section 80G of the Income Tax Act. When you make a contribution to qualifying or registered NGOs and trusts, you can claim a tax exemption on donation, which reduces your taxable income. Simply you are receiving part of the donation as savings by filing your taxes.

To get the benefits of tax savings, always collect the donation receipt and make sure the nonprofit organization is 80G registered. Denoting is a smart way to help facilitate social change while obtaining social change savings. Give back while spending less with 80G benefits.

https://sakshingo.org/80g-tax-exemption-on-donation/

#taxexemption #80G #savetax #donatingtongo #taxexemptionondonation #taxexemptionthrough80G

Donating to a registered charity is not just a way to support a charitable cause; it also has financial benefits under Section 80G of the Income Tax Act. When you make a contribution to qualifying or registered NGOs and trusts, you can claim a tax exemption on donation, which reduces your taxable income. Simply you are receiving part of the donation as savings by filing your taxes.

To get the benefits of tax savings, always collect the donation receipt and make sure the nonprofit organization is 80G registered. Denoting is a smart way to help facilitate social change while obtaining social change savings. Give back while spending less with 80G benefits.

https://sakshingo.org/80g-tax-exemption-on-donation/

#taxexemption #80G #savetax #donatingtongo #taxexemptionondonation #taxexemptionthrough80G

The Power of 80 G- Tax Exemption on Donation

Donating to a registered charity is not just a way to support a charitable cause; it also has financial benefits under Section 80G of the Income Tax Act. When you make a contribution to qualifying or registered NGOs and trusts, you can claim a tax exemption on donation, which reduces your taxable income. Simply you are receiving part of the donation as savings by filing your taxes.

To get the benefits of tax savings, always collect the donation receipt and make sure the nonprofit organization is 80G registered. Denoting is a smart way to help facilitate social change while obtaining social change savings. Give back while spending less with 80G benefits.

https://sakshingo.org/80g-tax-exemption-on-donation/

#taxexemption #80G #savetax #donatingtongo #taxexemptionondonation #taxexemptionthrough80G

0 Comentários

·0 Compartilhamentos

·311 Visualizações

·0 Anterior