Patrocinado

Streamlining Financial Planning and Budgeting with Excel

Managing money effectively is a skill that impacts both personal and professional success. Whether you’re trying to save for a major purchase, track monthly expenses, or allocate resources for a business project, having a structured financial plan is essential. While advanced financial software is available today, Microsoft Excel Online Training continues to be a trusted choice for simplifying planning and budgeting. Its ease of use, flexibility, and robust features make it a powerful tool for anyone seeking better financial control.

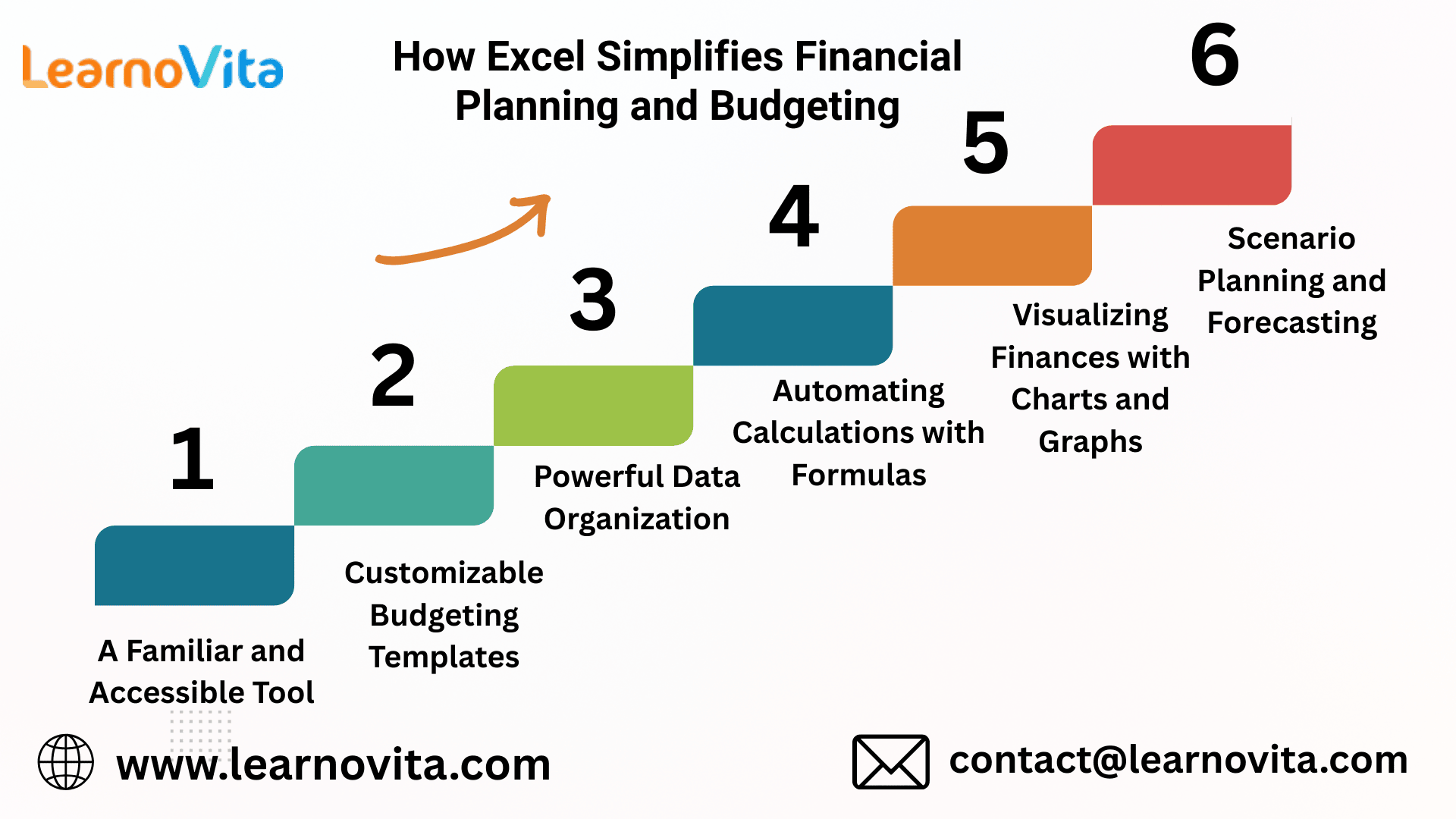

1. Easy to Learn and Widely Available

Excel’s biggest strength is accessibility. Almost every professional or student has encountered Excel at some point, making it less intimidating than other specialized financial tools. You don’t need advanced training to start using it basic knowledge of spreadsheets is enough to create simple budgets and track income or expenses. Since Excel is included in Microsoft Office, it’s also cost-effective compared to many paid budgeting platforms.

2. Ready-to-Use and Custom Templates

Budgeting doesn’t need to start from scratch. Excel offers a wide range of templates designed for different financial goals household budgets, business cash flow trackers, or personal savings plans. These templates can be easily customized, allowing users to adjust categories, formulas, or layouts to fit their needs. This adaptability ensures that Excel works equally well for individuals, families, freelancers, and companies.

3. Organizing Finances with Ease

Financial planning often means dealing with large amounts of data. Excel helps bring order to the chaos by structuring everything into rows, columns, and worksheets. Tools like sorting, filtering, and conditional formatting make it easy to spot spending trends or highlight areas where costs are rising. Having all financial data in one place provides a clear overview that simplifies decision-making.

4. Smarter Calculations with Formulas

One of the biggest advantages of Excel is automation through formulas. Instead of manually crunching numbers, users can apply functions to calculate totals, percentages, or forecasts instantly. More Software Training Institute advanced formulas can even compute interest, depreciation, or investment returns. This accuracy reduces errors and ensures consistency in financial reports, while also saving valuable time.

5. Turning Numbers into Insights

Spreadsheets filled with numbers can be overwhelming, but Excel solves this with its charting and visualization tools. With just a few clicks, users can convert raw data into pie charts, bar graphs, or line charts. Visual insights make it easier to understand spending patterns, track savings growth, or compare income against expenses helping users make smarter financial choices.

6. Planning Ahead with Forecasting Tools

Financial planning isn’t just about managing the present it’s about preparing for the future. Excel’s scenario analysis tools, such as Goal Seek and data tables, make it easy to explore “what-if” situations. Whether you’re testing the impact of a salary raise, adjusting loan repayments, or projecting investment growth, Excel allows you to forecast outcomes and set realistic financial goals.

Final Thoughts

Despite the availability of advanced financial apps, Excel remains one of the most reliable and versatile tools for managing money. Its blend of simplicity and powerful features allows individuals and businesses alike to track, plan, and forecast with confidence. From everyday budgeting to long-term financial strategies, Excel provides the clarity needed to stay on top of finances and move closer to financial success.

Categorias

Leia mais

https://ticketschool.com/blog/how-to-get-a-florida-hardship-license-online/ What is the fastest way to get a hardship license in Florida if your driver's license has been suspended? Take the most direct route to restore necessary driving privileges and get back to work or school faster with online options to complete your requirements.

Trekking in the Himalayas is unlike any other trip. Because of its breathtaking sights, spiritual trails, and mountains, hikers from across are welcome by the region. Whether you are arranging a moderate climb or a tough adventure, knowing the best time to plan the trip and select holiday packages to Hike Himalayas and packing the right goods are also important. This blog will give you an...