Credit card fraud has become more common in the digital age, and one of the reasons is the rise of underground markets involving stolen card data. You may have come across terms like “Bclub, Dumps and CVV2 Shop, credit cards” in cybersecurity discussions. While these keywords may not seem alarming at first, they represent a deeper and growing concern for everyday internet users.

So, what exactly are dumps and CVV2 shops? In simple terms, “dumps” are digital copies of data taken from the magnetic stripe of credit cards. Fraudsters use these to create cloned cards and make unauthorized purchases. On the other hand, CVV2 data refers to the three-digit code on the back of your card, commonly used in online transactions. When these two data points are combined and sold online, the chances of fraud skyrocket.

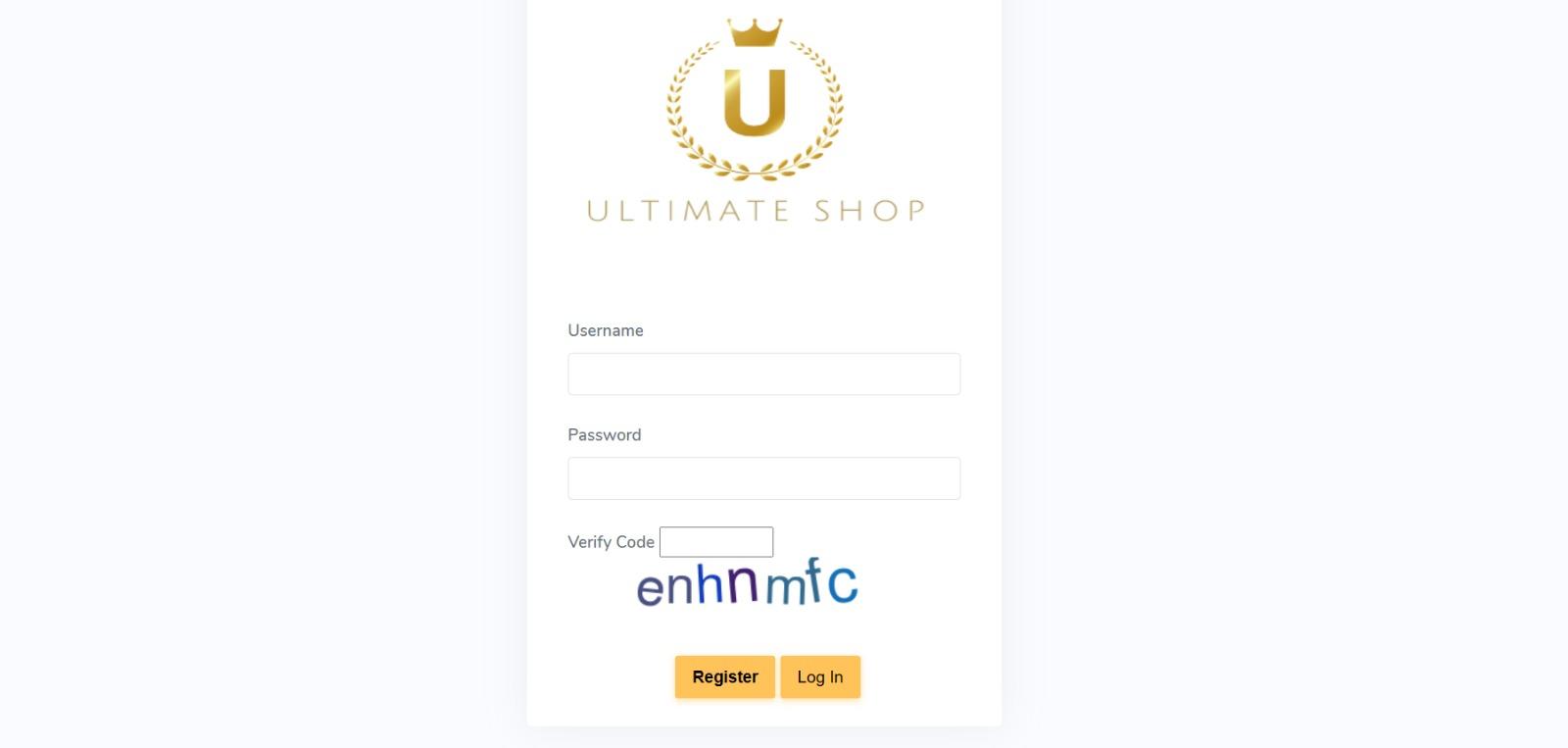

Bclub is a name often associated with these underground credit card data markets. It is not a traditional store or service. Instead, it’s a keyword often found in connection with illegal transactions and digital black markets. These platforms make it easy for bad actors to purchase stolen card details, sometimes in bulk, and exploit them for profit.

The process behind credit card theft is more organized than many think. Data is usually harvested through phishing attacks, compromised payment terminals, or malware. Once collected, the data is uploaded to these hidden markets. Buyers then use the information for online purchases or to withdraw cash from ATMs using cloned cards.

The impact on everyday people is serious. Many cardholders are unaware that their information has been stolen until they receive an alert from their bank—or worse, notice large unauthorized transactions. While banks may refund fraudulent charges, the stress and disruption it causes can be significant.

So how can you protect yourself from becoming a victim? Start by being cautious about where and how you use your card. Avoid sharing card details over phone calls, text messages, or unfamiliar websites. Always check for secure payment gateways (look for “https” in the URL), and never save card details on public devices or unsecured platforms.

It’s also important to monitor your card activity regularly. Enable SMS and email alerts from your bank so you’re notified immediately of any transaction. If something doesn’t look right, report it without delay. Another good practice is to use virtual cards for online purchases, which limit exposure and can be deactivated anytime.

In today’s digital world, awareness is your best defense. The existence of names like Bclub and CVV2 shops highlights the reality of online credit card theft. By staying informed and alert, you can protect your finances and avoid falling into the traps set by cybercriminals.