The Bitcoin Mining Hardware Market is anticipated to expand from USD 11.15 billion in 2025 to USD 69.10 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 22.46% during the forecast period (2025–2034). Moreover, the market was valued at USD 9.10 billion in 2024.

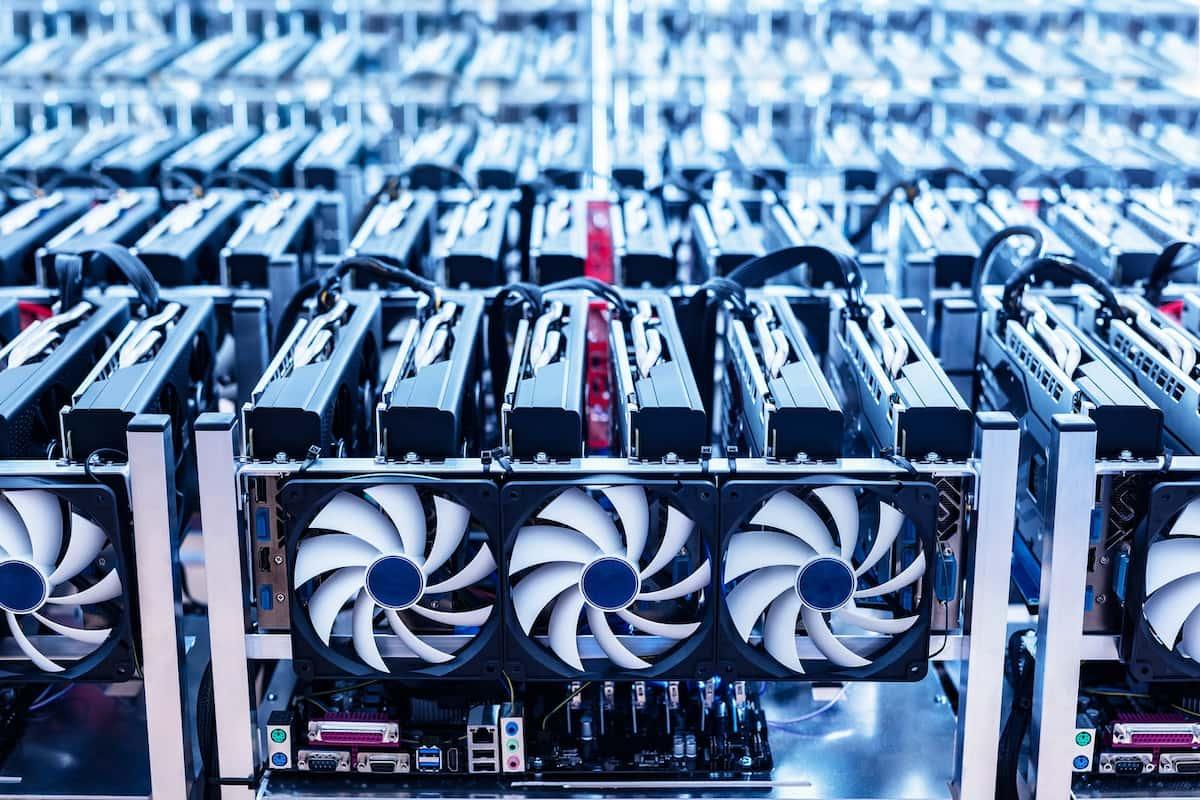

Bitcoin mining involves validating transactions and adding them to the blockchain ledger, a process that requires substantial computational power. This has led to the development of specialized hardware, such as Application-Specific Integrated Circuits (ASICs) and Graphics Processing Units (GPUs), designed to optimize mining efficiency. The market for these hardware solutions is expanding as more individuals and enterprises engage in cryptocurrency mining activities.

Request a Free Sample Copy or View Report Summary: https://www.marketresearchfuture.com/sample_request/27469

Market Scope

The Bitcoin mining hardware market encompasses various components and services:

-

Hardware Types: ASIC miners, GPU mining rigs, and Field-Programmable Gate Arrays (FPGAs).

-

Applications: Solo mining, pool mining, and cloud mining.

-

End-Users: Individual miners, mining farms, and enterprises

The market is influenced by factors such as cryptocurrency prices, mining difficulty levels, and energy costs.

Regional Insights

-

North America: Emerging as a significant player due to favorable regulatory environments, technological advancements, and access to affordable energy sources. The United States, in particular, has seen a surge in mining operations, especially in states like Texas and Wyoming

-

Asia-Pacific: Historically dominated by countries like China, Japan, and India. While regulatory crackdowns have impacted operations in some regions, others continue to invest in mining infrastructure.

-

Europe: Countries such as Germany and Russia are focusing on sustainable mining practices, aligning with environmental standards and integrating renewable energy sources.

-

Latin America and Middle East & Africa: These regions are exploring mining opportunities, leveraging affordable energy and favorable climates to attract investments.

Growth Drivers

-

Cryptocurrency Adoption: The increasing acceptance of cryptocurrencies as investment assets and payment methods is fueling demand for mining hardware.

-

Technological Advancements: Continuous improvements in chip design and cooling technologies are enhancing mining efficiency and profitability.

-

Renewable Energy Integration: The shift towards sustainable energy sources is making mining operations more environmentally friendly and cost-effective.

-

Institutional Investments: Growing interest from institutional investors is leading to the establishment of large-scale mining farms, boosting hardware demand.

Challenges

-

High Initial Investment: The substantial capital required for setting up mining operations, including hardware and infrastructure, can be a barrier for new entrants.

-

Regulatory Uncertainty: Varying regulations across countries can impact mining activities, with some regions imposing strict controls or bans.

-

Energy Consumption: The significant power requirements of mining operations raise environmental concerns and can lead to increased operational costs.

-

Market Volatility: Fluctuations in cryptocurrency prices can affect mining profitability, influencing hardware demand and investment decisions

Opportunities

-

Emerging Markets: Countries with low electricity costs and supportive regulations present new avenues for mining operations.

-

Cloud Mining Services: The rise of cloud-based mining offers individuals and businesses access to mining without significant hardware investments.

-

Energy-Efficient Hardware: Development of hardware that delivers high performance with reduced energy consumption is attracting environmentally conscious investors.

-

Diversification: Manufacturers are exploring multi-algorithm hardware capable of mining various cryptocurrencies, expanding market reach.

Buy Research Report (111 Pages, Charts, Tables, Figures) – https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=27469

Conclusion

The Bitcoin Mining Hardware Market is on an upward trajectory, propelled by technological innovations, increasing cryptocurrency adoption, and the integration of sustainable practices. While challenges such as regulatory uncertainties and high energy consumption persist, the market offers substantial opportunities for growth and diversification. Stakeholders focusing on energy-efficient solutions and exploring emerging markets are well-positioned to capitalize on the evolving landscape of cryptocurrency mining.