Minimally Invasive Surgical Instruments Market Challenges: Regulatory Hurdles Impacting Growth

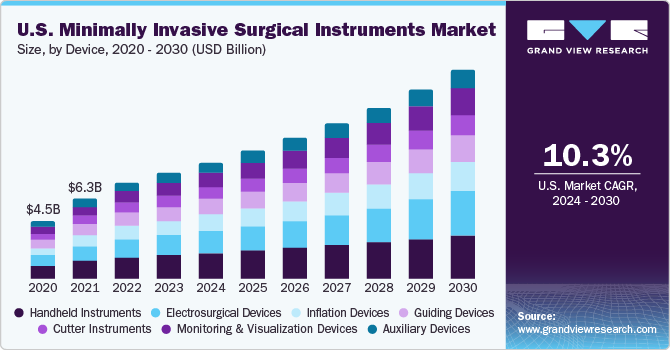

The global minimally invasive surgical instruments market size was estimated at USD 31.65 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.4% from 2024 to 2030. Surgical robots have revolutionized the field of minimally invasive surgeries (MIS) and their acceptance by the surgeons is rising globally. The cost of MIS procedures is significantly less than in-patient and conventional open surgeries with equal outcomes resulting in a significant increase in value for the patient as well as insurance providers.

This trend is likely to continue in the coming years. Increasing number of new product launches and a growing number of product approvals by several market players for gaining a larger market share are anticipated to create robust growth opportunities for the industry. For instance, in December 2022, Abbott announced the launch of Navitor, an advanced transcatheter aortic valve implantation system. The device has wide application scope in the management of aortic stenosis.

Gather more insights about the market drivers, restrains and growth of the Global Minimally Invasive Surgical Instruments Market

End-use Insights

Based on end-use, the global market is further segmented into hospitals and ambulatory surgical centers (ASCs). The hospitals end-use segment captured the largest revenue share of 68.8% in 2023 owing to an increase in the prevalence of chronic disorders among the elderly population, which led to a rise in the number of hospital admissions for the treatment of chronic ailments.

The ASCs end-use segment is anticipated to witness the fastest growth rate from 2024 to 2030. As per Becker's ASC review published in 2019, there are more than 5,480 Medicare-certified ambulatory surgery centers in the U.S. Thus, the availability of reimbursement policies for ambulatory surgical procedures is also one of the major factors driving segment growth.

Device Insights

Based on device, the market is segmented into handheld instruments, cutter instruments, monitoring & visualization devices, inflation devices, guiding devices, electrosurgical devices, and auxiliary devices. In 2023, the handheld instruments segment led the market with a revenue share of 22.1%. Handheld instruments reduce the damage to extraneous tissues, thereby speeding up patient recovery while reducing discomfort & other adverse effects. Most MIS handheld instruments are single-use products.

Application Insights

Based on application, the market is classified into cardiac, gastrointestinal, orthopedic, dental, cosmetic, vascular, thoracic, gynecological, urological, and others. Orthopedics was the largest application segment in 2023 and accounted for a revenue share of 23.6%. Minimally invasive surgery is typically utilized in knee and hip replacement procedures. Hospitals and surgeons prefer surgical procedures that have fewer operative and postoperative complications, as well as reduced hospitalization periods. On the other hand, patients seek surgical treatments that reduce trauma and facilitate speedy recovery.

Regional Insights

North America dominated the market with a share of 29.9% in 2023 due to the presence of well-established healthcare infrastructure, favorable government reimbursement policies, and high prevalence of chronic diseases. Asia Pacific is expected to witness the fastest CAGR of 10.8% from 2024 to 2030 owing to improving healthcare infrastructure and increasing government initiatives. Moreover, economic development in countries, such as India and Japan, are expected to contribute to regional market growth.

The presence of a large population pool with low per capita income in this region led to high demand for affordable treatment options. Many multinational companies are planning to invest in developing countries, such as India and China, to strengthen their positions in the overall market. Thus, increasing number of partnerships and strategic alliances is creating lucrative growth opportunities in the regional market.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- Medical Device Analytical Testing Outsourcing Market: The global medical device analytical testing outsourcing market size was estimated at USD 6.54 billion in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030.

- 3D Medical Imaging Devices Market: The global 3D medical imaging devices market size was estimated at USD 12.74 billion in 2024 and is expected to expand at a CAGR of 8.11% from 2025 to 2030.

Key Companies & Market Share Insights

Most market players have strong collaborations with manufacturers and suppliers to ensure uninterrupted global supply. Many companies are involved in strategic partnerships and mergers & acquisitions as their global strategies. For instance, in February 2023, Encision Inc. signed a Proof of Concept Services Agreement with Vicarious Surgical Inc. The Vicarious surgical robot design plans to boost precision, control, and visualization of instruments in robotic-assisted minimally invasive surgery. Also, in November 2022, New View Surgical, Inc. announced the closure of USD 12.1M Series to fund the commercialization of VisionPort System.

Key Minimally Invasive Surgical Instruments Companies:

- Medtronic

- Siemens Healthineer AG

- Ethicon, Inc. (Johnson & Johnson)

- Depuy Synthes

- GE Healthcare

- Abbott Laboratories

- Intutive Surgical, Inc.

- Nuvasive, Inc.

- Zimmer Biomet

Order a free sample PDF of the Minimally Invasive Surgical Instruments Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness