Heat Exchangers Market Size, Trends, and Business Outlook 2024-2030

The global heat exchangers market size was estimated at USD 18.19 billion in 2023 and is expected to expand at a compounded annual growth rate (CAGR) of 5.4% from 2024 to 2030.

Rising focus on efficient thermal management in various industries, including oil & gas, power generation, chemical & petrochemical, food & beverage, and HVAC & refrigeration, is expected to drive the demand for heat exchangers over the forecast period. Rising demand from chemical industry coupled with increasing technological advancements and a growing focus on improving efficiency standards is expected to drive heat exchangers market growth. Most processes in petrochemical facilities involve high pressure and temperature, thus, necessitating the optimization of heat transfer and enhancement of energy savings, which, in turn, is likely to boost the demand for energy-efficient heat exchangers.

Gather more insights about the market drivers, restrains and growth of the Heat Exchangers Market

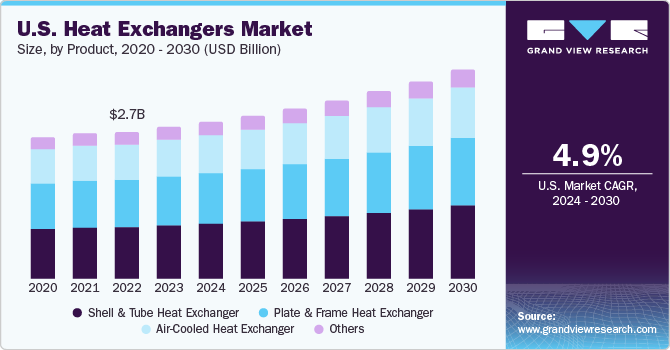

U.S. dominated the North America heat exchanger market in 2023, owing to high electricity demand, industrialization, and investments in renewable power generation. Rising investments by oil & gas companies in exploration & production activities in the U.S. are expected to boost the demand for these products in oil & gas industry.

Significant power markets such as China, U.S., India, Russia, and Japan are restructuring their operating models to adopt the structure of renewable energy and efficient utilization of energy by installing heat exchangers and shifting from traditional energy use. This is expected to drive the demand for heat exchangers.

Technological advancements such as tube inserts in heat exchangers are expected to complement the market growth. Furthermore, ongoing technological improvements to improve energy efficiency, total life cycle cost, durability, and compactness of heat exchangers are expected to drive industry growth.

Manufacturers of these products face a long list of difficult supply chain challenges, including increasing demand variability, intense global competition, more environmental compliance regulations, increasing human- and nature-based risks, and inventory proliferation. COVID-19 pandemic has created new challenges, which are compelling manufacturers to innovate their supply chains at a faster speed.

Heat Exchangers Market Segmentation

Grand View Research has segmented the global heat exchangers market report based on product, end-use, material and region:

Product Outlook (Revenue, USD Billion, 2018 - 2030)

• Plate & Frame Heat Exchanger

• Brazed Plate & Frame Heat Exchanger

• Gasketed Plate & Frame Heat Exchanger

• Welded Plate & Frame Heat Exchanger

• Others

• Shell & Tube Heat Exchanger

• Air-Cooled Heat Exchanger

• Others

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

• Chemical & Petrochemical

• Oil & Gas

• HVAC & Refrigeration

• Power GenerationFood & Beverage

• Pulp & Paper

• Others

Material Outlook (Revenue, USD Billion, 2018 - 2030)

• Metals

• Alloys

• Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o France

o Italy

o Spain

o UK

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o UAE

o South Africa

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

• The global wood plastic composites market size was estimated at USD 7.15 billion in 2023 and is expected to grow at a CAGR of 11.6% from 2024 to 2030.

• The global industrial fasteners market size was estimated at USD 95.57 billion in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030.

Key Companies & Market Share Insights

Global heat exchangers industry is characterized by presence of multinational as well as regional players that are engaged in designing, manufacturing, and distributing these products. Product manufacturers strive to obtain a competitive edge over their competitors by increasing application scope of their products.

Strategies adopted by manufacturers include new product development, diversification, mergers & acquisitions, and geographical expansion. These strategies aid the companies in expanding their market penetration and catering to changing technological demand across various end-use industries.

Key Heat Exchangers Companies:

• Alfa Laval

• Danfoss

• Kelvion Holding GmbH

• Güntner Group GmbH

• Xylem Inc

• API Heat Transfer

• Mersen

• Hisaka Works, Ltd.

• Chart Industries, Inc

• Johnson Controls International

• HRS Heat Exchangers

• SPX FLOW, Inc.

• Funke Wärmeaustauscher Apparantebau GmbH

• Koch Heat Transfer Company

• Southern Heat Exchanger Corporation

Recent Developments:

• For instance, in April 2023, Kelvion launched dedicated air cooler series for natural refrigerants. The CDF & CDH ranges are dual discharge air coolers highlighting a similar proficient tube system.

• In May 2023, Alfa Laval is enhancing its brazed plate heat exchanger capacity to bolster the global energy transition. The establishment of new facilities in Italy, China, Sweden, and the U.S. signifies significant progress in their initiative to advance manufacturing intelligence and efficiency throughout the entire supply chain.

• In January 2021, Alfa Laval, opened a new facility for the production of brazed heat exchangers in San Bonifacio, Italy. The new facility will have more capacity to fulfill the increasing customer demand.

Order a free sample PDF of the Heat Exchanger Market Intelligence Study, published by Grand View Research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness