Unlocking the Potential of HDPE Procurement: Trends

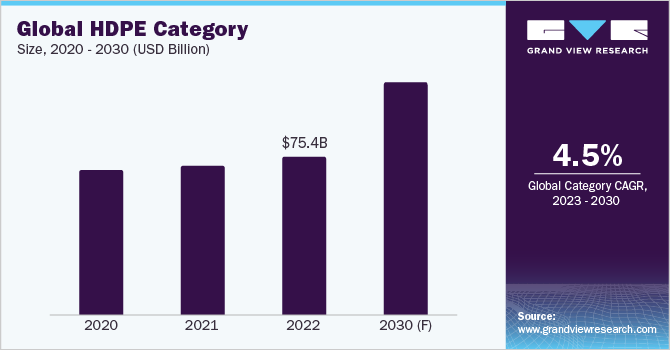

The HDPE category is expected to grow at a CAGR of 4.45% from 2023 to 2030. The APAC region accounts for the largest share in the category. Increasing growth of the Chinese economy stimulated by the increase in import & export, industrial output, capital investment, and consumer consumption in the region drives the demand for the category. Players are focusing on product innovation using continual R&D and making use of efficient technologies to increase productivity and enhance the properties of the product. For instance, in July 2022, ExxonMobil introduced a new range of HDPE products named ExxonMobil HMA706, which is distinguished by great dimensional stability and strong impact resistance. It was validated for fast cycling and food contact and its property of high gloss made it ideal for the packaging of food.

Companies are continuously focusing on partnering or developing their own technology to strengthen their market position and expand their global reach. For instance,

• In April 2022, U.S.-based Natural gas company, ExxonMobil introduced Exceed S Performance Polyethylene resins that provided toughness and stiffness properties. The new PE platform assisted in providing film designs and formulas while enhancing the conversion effectiveness of HDPE, film performance, and package durability in comparison to current market benchmarks.

• In January 2022, in a move that broadened its global reach and diversified its product line, WL Plastics purchased the HDPE extrusion pipe business from Charter Plastics. This acquisition expanded Charter Plastics' offering of HDPE pipes.

• In December 2021, India-based Four Star Industries, a manufacturer of High-Density Polyethylene conduit, was acquired by Atkore Inc. Atkore made this acquisition to diversify its product offering and better service-expanding sectors like the internet and renewable energy.

• In July 2021, a global manufacturer of HDPE conduits, Dura-Line Holdings, Inc. announced the inauguration of a new manufacturing facility in Georgia, U.S. This expansion was made to cater to the surging demand in the region.

• In February 2021, United Polyfab Gujarat Ltd launched a new series of HDPOE pipes which are of the size ¾ to 2 inches of iron pipes and old traditional copper tubes mainly for use in water supplies. It aimed to increase the sales of the company's HDPE pipes.

Order your copy of the HDPE Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Category growth is expected to be fueled by the increasing packaging demand in varied industries such as automotive, packaging, healthcare and pharmaceuticals, and construction. HDPE is majorly being used in the form of products such as detergent bottles, food wraps, shopping bags, and automobile fuel tanks, globally. The packaging industry holds the largest segment in the food, beverage, personal, and healthcare industries accounting for 45-50% of the total share.

HDPE Sourcing Intelligence Highlights

• The global HDPE category is fragmented, with numerous small and large players operating in different regions. The competition between players is intense as they strive to gain a wider customer base and improve customer experiences.

• The suppliers of the raw materials in this category have high bargaining power since raw materials constitute about 60%-70% of the product. There is a significant impact on the prices of the category if the supplier raises the prices.

• Raw materials, assets, and utilities costs form the most significant cost component in the category. The overall cost also depends on the type of machine used such as extrusion blow, injection blow, and injection stretch blow for production.

• Most service providers offer complete services from designing, manufacturing, quality check and licensing, and shipping of the product.

List of Key Suppliers

• Borealis AG

• Lotte Chemical Corporation

• The Dow Chemical Company

• PetroChina Company Limited

• Abu Dhabi Polymers Company Limited

• Formosa Plastics Corporation

• Exxon Mobil Corporation

• LyondellBasell Industries N.V.

• SCG Chemicals Public Company Limited

• INEOS AG

Browse through Grand View Research’s collection of procurement intelligence studies:

• HVAC Systems Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Crude Oil Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

HDPE Procurement Intelligence Report Scope

• HDPE Category Growth Rate: CAGR of 4.45% from 2023 to 2030

• Pricing Growth Outlook: 2% - 4% (Monthly)

• Pricing Models: Cost plus pricing model, volume-based pricing model

• Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

• Supplier Selection Criteria: By type, packaging options, operating capability, durability, quality measures, technology, certifications, regulatory compliance, and others

• Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness