إعلان مُمول

Europe LED Lighting Market Outlook (2025 To 2032) – Industry Growth Factors, Market Revenue and More

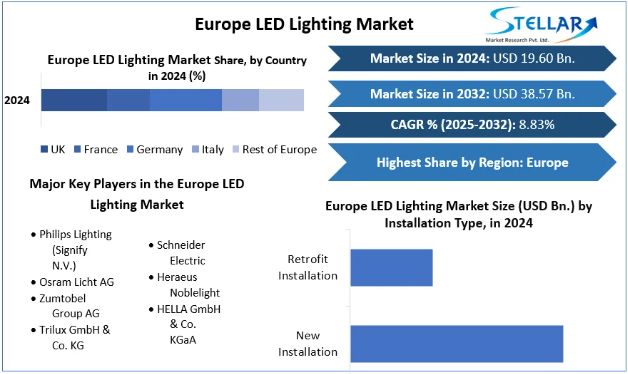

Europe LED Lighting Market size was valued at USD 19.60 Bn. in 2024 and is expected to reach USD 38.57 Bn. by 2032, at a CAGR of 8.83%.

Market Estimation & Definition

As defined in the underlying study, the Europe LED lighting market refers to the entire ecosystem of light-emitting diode (LED) lighting products, including the design, manufacture, distribution, and deployment of LED lamps, luminaires, and related systems across European countries. The market spans multiple application segments (indoor, outdoor), adoption contexts (new installations and retrofits), distribution channels (online, offline), and end-uses (residential, commercial, industrial, specialty).

In 2024, the market value was estimated at USD 19.60 billion. Over the forecast period 2025 to 2032, it is projected to grow to USD 38.57 billion, reflecting a strong upward trajectory based on regulatory, technological, and demand-side tailwinds.

Get your sample copy of this report now! https://www.stellarmr.com/report/req_sample/europe-led-lighting-market/2340

Market Growth Drivers & Opportunities

Key Growth Drivers

-

Stringent Regulatory Mandates & Energy Efficiency Standards

European Union regulations and national policies are phasing out inefficient lighting systems, pressuring stakeholders to transition to LED. The study emphasizes that the regulatory impetus is a primary driver of market expansion. -

Rising Demand for Energy Savings

LEDs offer energy savings up to 80% compared to traditional lighting technologies, and lower maintenance costs due to longer lifespans. This strong value proposition underpins adoption across residential, commercial, and municipal settings. -

Integration of Smart Lighting & IoT

The emergence of connected, controllable lighting (dimming, color tuning, scheduling, sensor integration) is accelerating demand. Product launches (e.g. smart bulbs, intelligent LED tubes) underscore the pivot toward smarter lighting systems. -

Technological Advancements

Improvements in LED efficacy, color rendering, lumen output, and efficiency are enabling new use cases and enhancing adoption. Newer generations of LED chips are reported to deliver up to 30 percent efficiency gains over older ones. -

Infrastructure Modernization & Urban Upgrades

Streetlight modernization programs, smart city initiatives, and renovation of public lighting infrastructure present substantial opportunities. For example, large investments in streetlight conversion and stadium LED upgrades are cited as catalysts.

Key Constraints / Challenges

-

High Upfront Capital Costs

Despite operational savings, the initial investment in LED systems is often 30–50 percent higher than traditional lighting, which can discourage adoption, especially in budget-constrained projects. -

Awareness & Adoption Barriers

Uneven awareness among end users about long-term benefits and total cost of ownership sometimes slows penetration, particularly in small-scale or less regulated markets.

Opportunities

-

Retrofit & Renovation Projects

Legacy lighting systems present a large addressable market for retrofits, particularly in older buildings, municipal lighting, and public infrastructure. -

Smart City Deployment

Incorporating LED lighting into broader smart city frameworks (with sensors, connectivity) opens additional value layers (e.g. adaptive lighting, integrated controls, data monetization). -

Cross-Sector Partnerships

Collaboration among lighting firms, telecom/IoT providers, municipalities, and energy utilities can foster bundled solutions, financing models, and energy-efficiency incentive schemes. -

Export and Component Trade

European manufacturers can leverage their technological leadership to export LED products and components globally, thus expanding the value chain beyond domestic consumption.

Segmentation Analysis

The report segments the Europe LED lighting market along several key axes. Key highlights by segment:

By Product Type

-

Lamps are the dominant product segment as of 2024, with widespread residential and commercial adoption, driven by energy savings and substitution from traditional bulbs.

-

Luminaires comprise ~40 percent of the market, mainly used in commercial and industrial settings due to better light distribution and performance characteristics.

By Installation Type

-

New Installations currently dominate, driven by integration into new construction and development projects.

-

Retrofit Installations account for roughly 35 percent of the segment, as existing infrastructure is upgraded with LED solutions.

By Distribution Channel

-

Online Stores lead the market share (exact share unspecified), fueled by ease of shopping, wide product selection, and consumer comfort with e-commerce.

-

Offline Stores still retain a significant presence (~45 percent), benefiting from in-person product trials and immediate availability.

By Application

-

Indoor Lighting holds the larger share (~70 percent), reflecting usage in homes, offices, retail, and other indoor environments.

-

Outdoor Lighting comprises ~30 percent, driven by street lighting, public spaces, and security lighting needs, especially under smart city development.

By End-Use

-

Residential leads at ~55 percent share in 2024, thanks to consumer adoption of energy-efficient and smart lighting.

-

Commercial follows (~30 percent), pushed by energy optimization in workplaces, retail, hospitality.

-

Industrial spans ~10 percent, where durable, high-output lighting is required in factories and warehouses.

-

Others (architectural, decorative, specialized lighting) command a smaller ~5 percent share.

These segmentation insights offer a granular view of where demand is concentrated and where growth pockets may lie.

For a comprehensive overview of this study, navigate to: https://www.stellarmr.com/report/europe-led-lighting-market/2340

Country-Level Analysis: Germany & (USA)

While the study focuses on Europe, the report’s regional breakdown highlights Germany as the dominant European market. Below is a tailored comparative discussion including Germany and, for broader context, a mention of the USA market (though the primary focus remains Europe).

Germany (Europe’s LED Lighting Powerhouse)

Germany commands the largest share in Europe’s LED lighting market, powered by:

-

Strong industrial and manufacturing base with leading lighting firms operating from Germany.

-

Progressive energy policies, subsidies, and regulatory frameworks that encourage LED adoption in public infrastructure and private buildings.

-

Innovative capabilities and deep R&D investment, driving product development (e.g. high-efficiency chips, intelligent lighting).

-

Germany also leads in import/export flows for LED components and finished products, reinforcing its role as a regional hub.

Due to these strengths, Germany often sets trends and benchmark adoption for other European countries. The presence of prominent players headquartered or with major operations in Germany further cements its leadership position.

USA (Contextual Reference)

Although not covered in the Europe-centric study, the United States LED lighting market is frequently cited in global industry reports as a mature, large-scale LED and smart lighting market. Key contrasts with Europe include:

-

Strong federal and state incentive programs (e.g., rebates, tax credits) encouraging LED infrastructure upgrades.

-

Extensive scale in commercial and municipal lighting retrofits.

-

High adoption of smart lighting and IoT integration, often acting as a technology pathfinder for lighting innovations.

For stakeholders operating across multiple geographies, the U.S. market serves as a useful benchmark for adoption curves, regulatory mechanisms, and financing models that could be adapted to European contexts.

“Commutator” (or “Commutator-Type”) Analysis

Although the report does not explicitly use the term “commutator” (which is more commonly a term in motors or electrical machines), it is possible you meant “comparator analysis,” “competitor analysis,” or “commutator analysis” as in comparing market players. Assuming the intention is to analyze competitive positioning among key companies, we provide a competitive / comparator analysis of LED lighting market players as described in the report.

Competitive / Comparator Analysis

The European LED lighting market is competitive, characterized by a mix of global majors, national leaders, and regional challengers. Key players profiled include:

-

Osram Licht AG — Known for its strong innovation focus, particularly in advanced chip and lighting technology.

-

Signify N.V. (Philips Lighting) — Offers a broad product portfolio and emphasizes sustainability and brand reach.

-

Trilux GmbH & Co. KG — A regional German player with specialized competence in architectural and industrial lighting.

-

Zumtobel Group AG — Austrian firm known for high-end lighting systems and design differentiation.

-

Schneider Electric, Heraeus Noblelight, HELLA GmbH & Co. KGaA — Additional players with niche specialties or complementary product lines.

In the competitive matrix, these firms differentiate via:

-

Product innovation (e.g. smart lighting, high-efficiency chips)

-

Brand reputation & distribution reach

-

Cost structure and economics (including scale and manufacturing optimization)

-

Partnerships and integration (e.g. with IoT, building management systems)

-

Sustainability credentials (e.g. energy savings, circular design)

Smaller regional or emerging players may target niche segments (e.g. decorative lighting, architectural integration, retrofit kits) and compete on agility, cost, or localized service.

In aggregate, this comparator analysis underscores that while the LED lighting market is growing, sustained success depends not only on technological excellence but also on channel strength, partnerships, and adaptability to evolving regulatory and smart infrastructure landscapes.

Explore Our Top Trends :

Malta Microprocessor And Gpu Market https://www.stellarmr.com/report/Malta-Microprocessor-and-GPU-Market/633

Asia Pacific Semiconductor Memory Market https://www.stellarmr.com/report/asia-pacific-semiconductor-memory-market/2291

Press Release Conclusion

The Europe LED lighting market is on a trajectory of strong, sustained growth from USD 19.60 billion in 2024 to USD 38.57 billion by 2032 (CAGR ~8.83 percent). Fueled by regulatory mandates, energy efficiency imperatives, smart lighting integration, and substantial infrastructure upgrade opportunities, the market presents significant upside for players across the value chain.

Segment analysis points to dominance in lamps, indoor application, new installations, and residential end-use, while retrofit, outdoor lighting, and smart city deployments offer white-space prospects. Germany emerges as a linchpin nation in Europe’s LED market, combining regulatory ambition, manufacturing strength, and innovation leadership.

Competitive dynamics highlight that leading firms must combine technical differentiation, sustainable credentials, broad distribution, and ecosystem partnerships to maintain advantage. Meanwhile, retrofit, smart city projects, and emerging application niches represent fertile ground for growth and strategic ventures.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656