إعلان مُمول

Income Tax Made Simple: What Is an Income Tax Return and Why It Matters

Every working professional and business owner encounters the term income tax, yet many people are unsure of what it truly entails. Equally confusing is the phrase income tax return, a key document that ensures you stay on the right side of the law while keeping your finances healthy.

This article breaks down the essentials of income tax and income tax returns in clear, practical language, helping you understand not only your obligations but also the opportunities to save money.

Understanding Income Tax

Income tax is a government-imposed charge on the money you earn. Your earnings might come from employment, self-employment, investments, rental property, or other sources. Unlike indirect taxes that apply when you spend money, income tax targets the money you receive.

Most countries use a progressive tax system, meaning the more you earn, the higher the rate you pay. For example, someone earning modest wages pays a lower percentage of tax than someone earning a high salary. Governments use the revenue from income tax to fund essential public services such as roads, education, healthcare, and national security.

To calculate income tax, your gross income is adjusted for deductions and credits. These deductions—such as retirement contributions, education costs, or business expenses—lower the amount of income subject to tax, helping you keep more of what you earn.

What Is an Income Tax Return?

An income tax return is the formal document or electronic form you file with the tax authority at the end of each tax year. It provides a detailed summary of your financial activity, including:

-

Total income: Salary, freelance earnings, business profits, interest, dividends, and rental income.

-

Allowable deductions and credits: Expenses like charitable donations, mortgage interest, and eligible business costs.

-

Taxes already paid: Any income tax withheld from your paycheck or advance payments you made.

When you submit this return, the tax authority compares the amount you actually owe with what has already been paid. If you have paid too much, you receive a refund. If you have paid too little, you must pay the balance.

How the Filing Process Works

1. Gather Your Financial Data

Collect all income statements, invoices, and receipts for deductible expenses. For businesses, include detailed ledgers and proof of operational costs.

2. Complete the Return

Enter your income and deductions on the official tax form or online portal. Double-check numbers and categories to avoid mistakes.

3. Calculate Your Liability

The system determines your total income tax after deductions and credits. Prepaid taxes or employer withholdings are subtracted from this figure.

4. Submit the Return

Once submitted, the tax office reviews it and sends a final assessment. If they find discrepancies, they may request additional information or issue a corrected bill.

5. Pay or Receive a Refund

If the assessment shows you overpaid, you receive a refund. If you underpaid, you settle the remaining amount within the deadline.

Why Filing an Income Tax Return Is Crucial

-

Legal Requirement

Filing your return is not optional. Missing the deadline can result in fines, interest charges, or even legal action. -

Financial Benefits

A return allows you to claim deductions and credits that can reduce your overall tax bill. Even if your income is below the taxable limit, filing ensures you receive any refunds you are entitled to. -

Proof of Income

Tax returns act as official documentation of your earnings. They are often required when applying for loans, mortgages, or visas. -

Prevention of Future Issues

Proper filing prevents unexpected tax demands and supports compliance if you are ever audited.

Key Strategies for a Smooth Filing

-

Stay Organized All Year: Keep a dedicated folder for invoices, receipts, and bank statements.

-

Understand Deductible Expenses: Education costs, retirement contributions, and certain healthcare expenses can significantly reduce taxable income.

-

Use Professional Help for Complex Cases: If you have multiple income streams, foreign earnings, or a small business, a tax advisor can help you avoid costly errors.

-

File Early or Request Extensions: Early filing reduces stress and provides time to correct mistakes.

Common Mistakes to Avoid

-

Omitting Income Sources: Even small freelance jobs or side hustles must be declared.

-

Claiming Unsupported Deductions: Ensure you have proper documentation for every deduction.

-

Missing Deadlines: Late filings almost always lead to penalties and interest.

-

Failing to Amend Errors: If you discover a mistake after submitting your return, file an amendment promptly.

The Bigger Picture: Benefits Beyond Compliance

Timely and accurate filing does more than keep you legal. It allows for strategic financial planning. By reviewing your annual income and expenses, you can identify areas to save or invest. Accurate records also give you leverage when negotiating credit terms or seeking investors for a business venture.

Summary

-

Income tax is a direct tax on your net earnings.

-

An income tax return is the yearly report that reconciles income earned with taxes already paid.

-

Filing on time protects you from penalties, secures refunds, and provides crucial proof of income.

-

Staying organized and understanding deductions are the best ways to keep the process stress-free.

Frequently Asked Questions

1. Do I need to file an income tax return if I had no income this year?

In many places, filing is still recommended if you had any taxes withheld or want to claim specific credits. Always check your local regulations.

2. What if I can’t pay the full amount I owe when filing?

You should still submit your return on time. Many tax authorities offer payment plans or installment agreements to avoid additional penalties.

3. How long should I keep my tax records?

It’s wise to keep all tax-related documents for at least five to seven years. This provides protection in case of audits or if you need to amend a previous return.

الأقسام

إقرأ المزيد

➤➤➤➤CLICK HERE TO ORDER NOW➤➤➤➤ Are you searching for a reliable source to Buy Modafinil online in the United States? Look no further than Mayomeds.com. Our website provides a seamless and secure platform for obtaining Modafinil prescriptions online. You can easily Order Modafinil 100 MG online, which is a highly effective medication for managing Attention-Deficit/Hyperactivity Disorder (ADHD)...

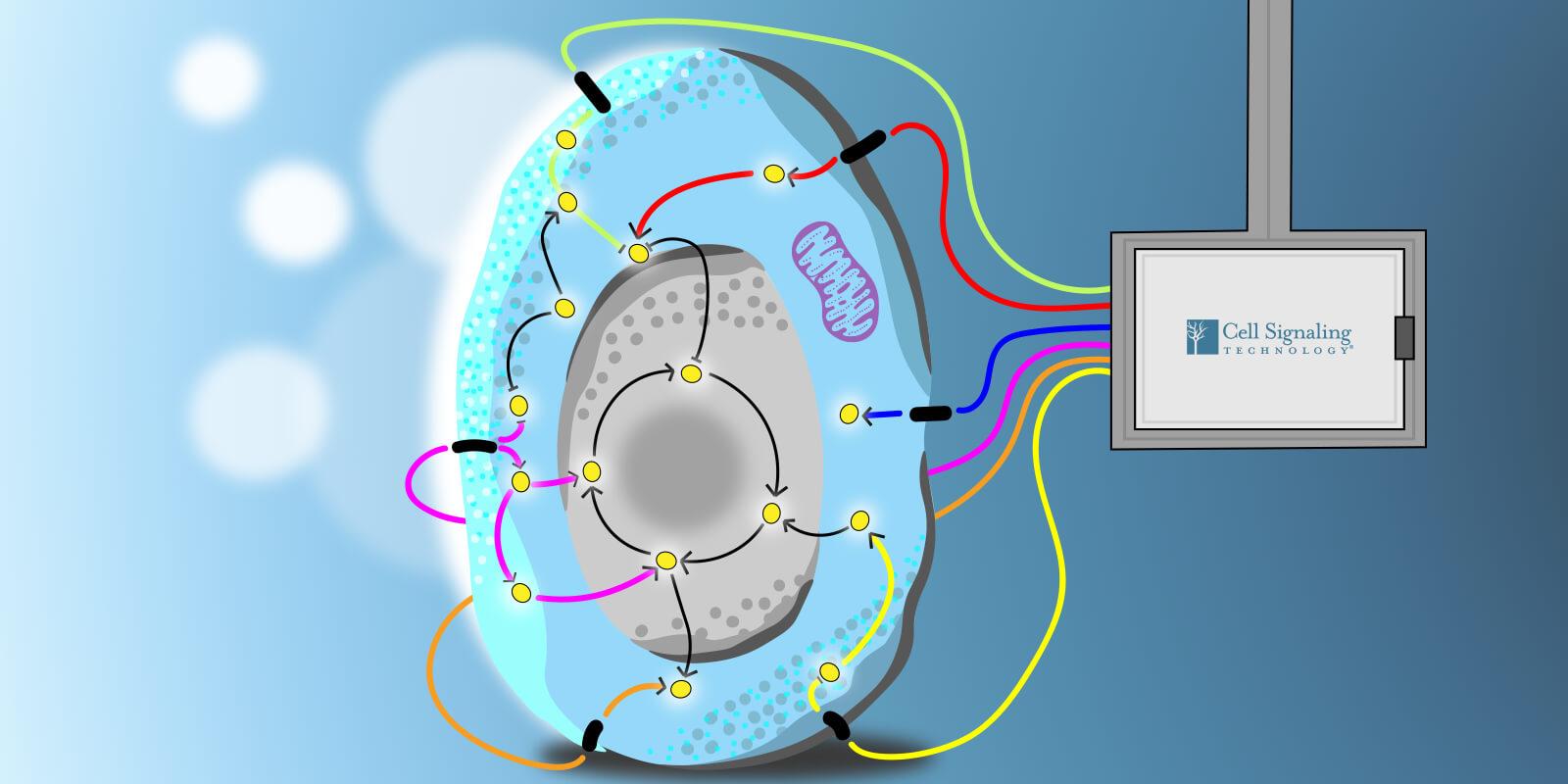

The cell signaling market encompasses a broad portfolio of products—including assays, kits, reagents, and analytical instruments—designed to interrogate complex intracellular communication pathways. Core products such as kinase activity assays, ELISA and multiplex immunoassay kits, fluorescent and luminescent probes, as well as high-content imaging systems, offer high specificity,...