Sponsored

Bookkeeping: The Backbone of Every Successful Business

Bookkeeping is one of the most essential elements of running any business. Without bookkeeping, entrepreneurs lose sight of their financial health and long-term stability. In fact, effective bookkeeping gives businesses the power to track income, expenses, and overall growth. Whether you are running a startup or managing an established company, bookkeeping ensures that every transaction builds a clear financial picture for the future.

Why Bookkeeping Matters More Than Ever

In today’s competitive market, bookkeeping is more than recording numbers. It is about creating a financial story that reflects the progress of a business. A strong bookkeeping system allows business owners to make smarter decisions, remain compliant with regulations, and prepare for growth opportunities.

Moreover, a professional bookkeeping service ensures accuracy and saves time that could otherwise be lost in managing spreadsheets or scattered financial documents. Businesses that ignore the importance of bookkeeping often face challenges like tax errors, missed payments, or poor cash flow management.

Bookkeeping and Long-Term Growth

A well-managed bookkeeping process helps businesses identify patterns, reduce unnecessary costs, and forecast future revenue. For instance, understanding seasonal fluctuations in sales can help a business prepare for both slow and busy periods.

Whether you’re operating a small bookkeeping business or running a large corporation, maintaining accurate records is key to scaling up. Companies with organized financial data are always better prepared to present their progress to investors, lenders, or regulatory authorities.

The Role of Technology in Modern Bookkeeping

Technology has revolutionized bookkeeping. Today, cloud-based tools and automation reduce human error and make financial data accessible in real time. Instead of manually recording every transaction, software solutions integrate directly with payment systems, banks, and payroll platforms.

For businesses that rely on outsourced HR and payroll services, integrated bookkeeping systems ensure smooth coordination. Payroll expenses, tax deductions, and employee benefits can all be tracked seamlessly alongside other financial data. This integration not only saves time but also reduces the risk of compliance issues.

Common Bookkeeping Mistakes to Avoid

Even though bookkeeping is straightforward, small mistakes can create long-term financial problems. Here are some common errors to avoid:

-

Mixing personal and business expenses

-

Forgetting to reconcile accounts

-

Ignoring small receipts and invoices

-

Relying on memory instead of documentation

-

Delaying regular updates

By steering clear of these mistakes, businesses can maintain accuracy and avoid the stress of year-end financial surprises.

Bookkeeping as a Strategic Tool

Instead of seeing bookkeeping as a back-office task, forward-thinking companies treat it as a strategic tool. Financial records provide valuable insights into profit margins, customer behavior, and cash flow. When paired with other data, bookkeeping creates a roadmap for making smarter business moves.

For example, identifying which products or services generate the highest revenue allows businesses to focus on their most profitable areas. Similarly, tracking recurring expenses highlights opportunities for cost reduction.

Why Every Business Needs Professional Bookkeeping

While small businesses sometimes attempt to manage bookkeeping themselves, the process can quickly become overwhelming. A dedicated bookkeeping service ensures that professionals handle complex tasks like tax compliance, payroll integration, and reporting with accuracy.

By outsourcing these functions, business owners can dedicate their energy to growth and strategy rather than struggling with numbers. This approach aligns financial clarity with overall business success.

Building Trust Through Accurate Records

Accurate bookkeeping not only benefits business owners but also builds trust with stakeholders. Investors, partners, and even employees rely on transparent financial records. A company that maintains strong bookkeeping practices sends a message of responsibility and reliability.

Moreover, proper records help businesses stay compliant with tax authorities. This reduces the risk of audits, penalties, or unexpected liabilities.

Final Thoughts

Bookkeeping is more than a requirement—it is the backbone of financial success. By maintaining accurate records, avoiding common mistakes, and embracing technology, businesses can secure long-term stability.

From startups to established enterprises, every organization benefits from strong bookkeeping practices. It ensures growth, transparency, and better decision-making. And in today’s fast-changing business environment, treating bookkeeping as a strategic advantage can make all the difference.

Categories

Read More

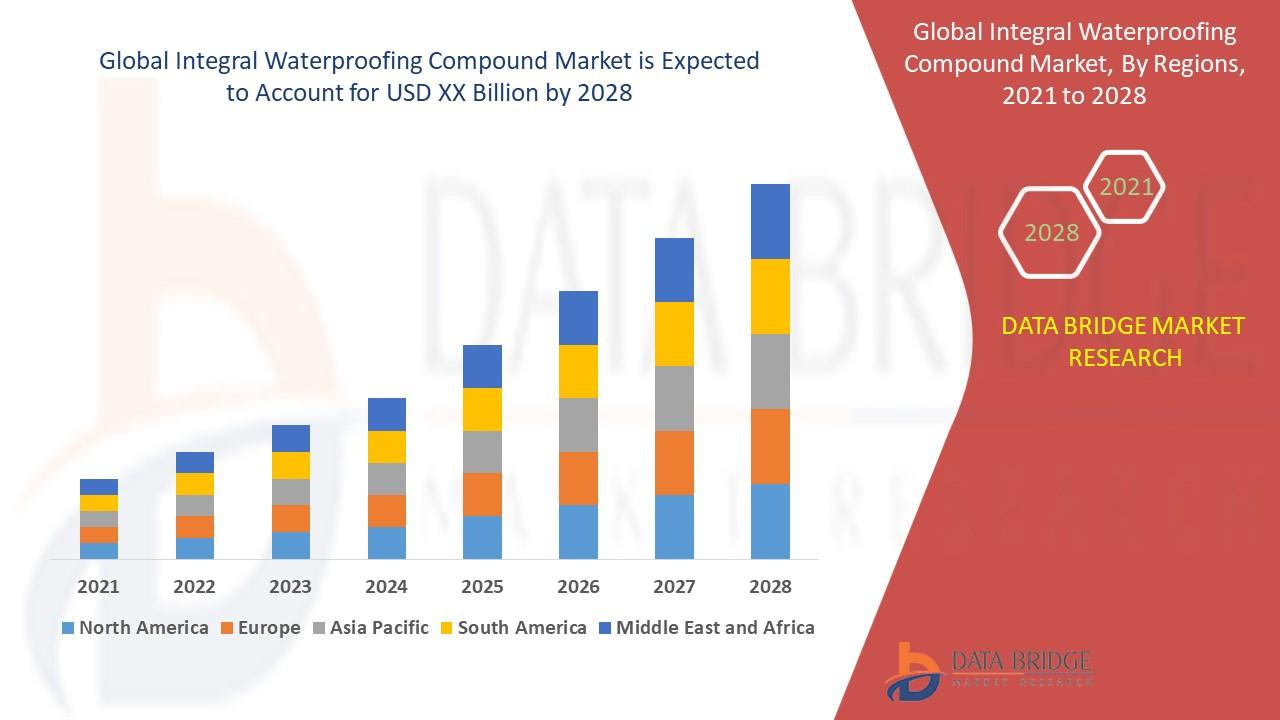

Integral Waterproofing Compound Market report brings into focus the chief market dynamics of the sector. This report is the best overview about global industry perspective, comprehensive analysis, size, share, growth, segment, trends and forecast. Estimations about the rise or fall of the CAGR value for specific forecast period, market drivers, market restraints, and competitive strategies are...

💧 إذا كنت تبحث عن حماية شاملة لخزان المياه، فإن شركة عزل خزانات المياه بالرياض هي خيارك المثالي! نحن متخصصون في تقديم خدمات عزل احترافية باستخدام أفضل المواد العازلة المقاومة للرطوبة والحرارة والتسربات، لنضمن لك خزانًا نظيفًا وآمنًا على مدار العام. 🧰 نعتمد على أحدث التقنيات وأعلى معايير الجودة في تنفيذ أعمال العزل سواء للخزانات العلوية أو الأرضية، مع فحص شامل قبل وبعد العزل...