Patrocinado

SP500 Heatmap: Visualizing Stock Market Trends and Sector Performance

Introduction

The S&P 500 index, featuring the 500 largest publicly traded companies in the United States, serves as a key benchmark for market performance. An SP500 heatmap is a visual tool that illustrates the performance of individual stocks and sectors within this index, using color codes to indicate gains and losses.

Heatmaps provide a quick, intuitive view of the market, making it easier for investors and traders to identify strong sectors, spot underperforming stocks, and gauge overall market momentum. This makes them an indispensable tool for both short-term traders and long-term investors.

What Is an SP500 Heatmap?

An SP500 heatmap is a graphical representation of the S&P 500 index. Key features include:

-

Color Coding: Green represents rising stocks, red indicates falling stocks, and darker shades reflect larger price changes.

-

Sector Organization: Stocks are grouped by industry, allowing investors to quickly compare sector performance.

-

Block Size: Usually proportional to market capitalization, showing which companies have the greatest influence on the index.

-

Interactive Features: Many heatmaps offer filtering by sector, performance, or market cap, along with real-time updates.

By visually summarizing market activity, heatmaps allow investors to understand trends without analyzing each stock individually.

How to Read an SP500 Heatmap

To interpret an SP500 heatmap effectively:

-

Color Indicators: Green signifies positive movement, red indicates negative movement.

-

Shade Intensity: Darker shades highlight stronger gains or losses.

-

Sector Grouping: Helps identify outperforming and underperforming industries.

-

Market Cap Representation: Larger blocks indicate companies with greater influence on the index.

By understanding these cues, traders can quickly assess sector strength, market sentiment, and emerging trends.

Benefits of Using an SP500 Heatmap

SP500 heatmaps offer numerous advantages:

-

Instant Market Overview: Quickly view performance for all 500 companies.

-

Trend Identification: Spot leading and lagging sectors effortlessly.

-

Investment Opportunities: Easily identify potential buy or sell candidates.

-

Portfolio Management: Adjust allocations based on sector and stock performance.

-

Market Sentiment Analysis: Determine whether the market is predominantly bullish or bearish.

This tool streamlines market analysis, saving time while enhancing accuracy in decision-making.

Recent Trends in SP500 Heatmaps

Recent SP500 heatmaps highlight evolving sector trends:

-

Technology & Healthcare: Often lead during innovation-driven or earnings-positive periods.

-

Energy & Financials: Sensitive to macroeconomic factors, including interest rates, oil prices, and regulatory news.

-

Consumer & Industrial Sectors: Reflect broader economic activity, such as consumer spending and industrial output.

Regularly monitoring heatmaps allows investors to adjust strategies, allocate capital effectively, and stay ahead of market trends.

How to Use SP500 Heatmaps in Trading

Investors and traders can utilize SP500 heatmaps in several ways:

-

Identify Strong Sectors: Focus investments on industries showing consistent gains.

-

Spot Weak Stocks: Detect underperforming companies for short-term trades or portfolio rebalancing.

-

Assess Market Momentum: Quickly evaluate bullish or bearish trends.

-

Optimize Portfolio Allocation: Shift holdings according to sector and stock performance.

-

Combine With Technical Analysis: Integrate heatmap insights with charts and indicators for a comprehensive trading strategy.

Heatmaps complement traditional analysis tools, providing a visual edge that improves market understanding and decision-making.

Conclusion

The SP500 heatmap is an essential tool for investors and traders seeking to understand sector performance, track stock movements, and assess overall market trends within the S&P 500 index. It offers a fast, intuitive way to monitor market conditions, identify opportunities, and make informed investment decisions.

Whether used for short-term trading or long-term portfolio planning, SP500 heatmap analysis enhances market awareness, supports better portfolio management, and provides actionable insights for navigating one of the world’s most important financial benchmarks.

Categorias

Leia mais

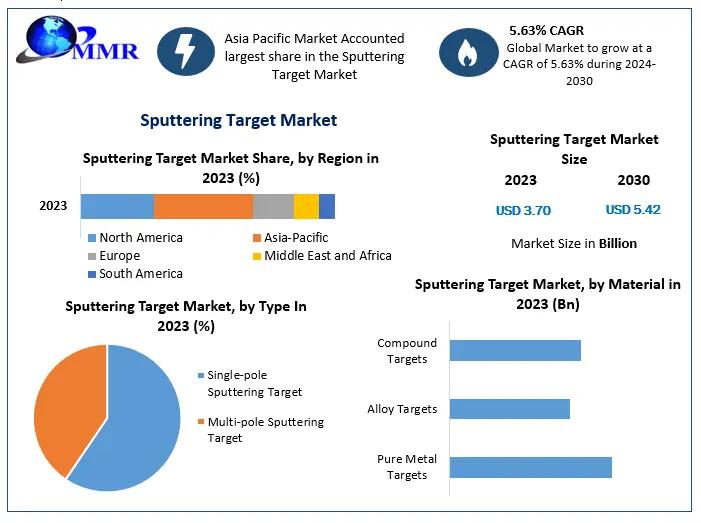

Global Sputtering Target Market Overviews Maximize Market Research is an Global Sputtering Target research firm that has published a detailed analysis of the “Global Sputtering Target Market”. The report includes pricing analysis, demand analysis, business insights, market trends, competitive landscape, and growth opportunities. The base year of the Global...

Amaze CBD Gummies Fixings contain 7500 mg of unadulterated, greatest strength hemp CBD! Dissimilar to so numerous other hemp items that are only segregates, this one is a FULL Range recuperating CBD. Implying that it contains probably the best, most impressive fixings. These staggering gummies are taken from the hemp plant. Which implies that they have no psychoactive impacts! Not at...