Patrocinado

Investors Eye Northern Trust Amid BNY Merger Buzz

The financial markets are abuzz as Northern Trust Shares surge amid rumors of BNY merger talks, signaling a potential shift in the U.S. banking landscape. Investors, analysts, and market watchers are closely observing these developments, eager to understand the implications for shareholders and the broader financial services sector. The sudden spike in Northern Trust’s stock price reflects optimism surrounding possible synergies, operational efficiencies, and market expansion opportunities that could arise from a strategic merger with BNY Mellon.

Market Reaction to Merger Speculation

The surge in Northern Trust shares has been one of the most notable market movements this quarter. Following reports that hint at discussions with BNY Mellon, Northern Trust’s stock gained momentum as investors responded to the potential for enhanced competitiveness and growth. Historically, merger rumors have caused notable volatility in stock prices, particularly for companies with strong financial fundamentals. In this case, the market reacted positively, demonstrating confidence in Northern Trust’s management, financial health, and strategic direction.

Understanding the Rumors

Though there has been no official confirmation from either institution, credible sources suggest that talks may involve exploring operational synergies, technology integration, and broader market expansion. Analysts speculate that a potential merger could strengthen both banks’ positions in wealth management, custodial services, and asset servicing. By combining resources, Northern Trust and BNY Mellon could enhance their product offerings and client experience, creating a powerful financial services entity capable of competing on a global scale.

Impact on Northern Trust’s Financial Performance

The surge in Northern Trust shares amid rumors of BNY merger talks has renewed investor focus on the bank’s financial performance. Northern Trust has consistently delivered strong revenue growth and robust profitability, supported by a diversified portfolio of wealth management and banking services. Analysts predict that a merger with BNY Mellon could amplify these strengths, unlocking additional value through cost efficiencies, expanded service capabilities, and increased scale. The stock’s performance reflects investor optimism and confidence in the potential strategic benefits of a merger.

BNY Mellon’s Strategic Position

BNY Mellon is a well-established player in asset servicing, investment management, and custody solutions. A potential merger with Northern Trust could accelerate BNY Mellon’s growth strategy, providing access to Northern Trust’s strengths in private banking, investment solutions, and client servicing. Market experts note that both institutions have complementary capabilities, which could allow them to create a combined entity that delivers enhanced client value, greater operational efficiency, and improved competitive positioning in the financial services sector.

Investor Sentiment and Market Trends

Investor sentiment surrounding Northern Trust shares amid rumors of BNY merger talks has been overwhelmingly positive. Market participants are considering the benefits of strategic consolidation, including cost savings, improved service delivery, and enhanced shareholder value. Analysts point out that the banking sector is experiencing a wave of consolidation aimed at achieving growth, streamlining operations, and navigating regulatory pressures. The speculation regarding Northern Trust and BNY Mellon aligns with this trend, making the surge in stock prices a reflection of broader market expectations.

Regulatory Considerations

While investor optimism is high, any potential merger between Northern Trust and BNY Mellon would be subject to regulatory scrutiny. Banking regulators are likely to review the merger’s impact on competition, client protection, and systemic stability. Previous large-scale mergers in the banking industry have undergone comprehensive regulatory assessment, ensuring compliance with antitrust laws and safeguarding market integrity. These regulatory factors could influence the timeline and structure of any potential merger, making it a critical consideration for both institutions.

Strategic Advantages of a Merger

A merger between Northern Trust and BNY Mellon could deliver significant strategic advantages. By combining complementary capabilities, the two banks could increase market share, improve operational efficiency, and offer a wider array of financial products and services. Technological integration could accelerate digital transformation initiatives, enhancing client experiences and operational agility. Analysts suggest that the merged entity could emerge as a leading global financial institution, well-positioned to serve a diverse client base while navigating competitive pressures and market volatility.

Potential Challenges and Risks

Despite the promising outlook, a merger of this magnitude comes with inherent challenges. Integration of operations, alignment of corporate cultures, and retention of key talent are critical factors that could affect the success of a merger. Additionally, unforeseen market fluctuations or regulatory obstacles could impact investor expectations and strategic execution. Nonetheless, the rise in Northern Trust shares amid rumors of BNY merger talks indicates that investors are confident in the long-term value creation potential of a successful consolidation.

Global Market Implications

A potential Northern Trust-BNY Mellon merger could have implications beyond the U.S. banking sector. Both banks operate internationally, and consolidation could create efficiencies across global markets, impacting asset management, custodial services, and private banking operations. Investors and analysts are closely monitoring global financial trends to assess how such a merger might influence international market dynamics, competitive positioning, and cross-border client offerings.

Expert Opinions on the Merger Speculation

Financial analysts and industry experts have provided insights into the potential impact of a merger. Many suggest that combining Northern Trust’s wealth management expertise with BNY Mellon’s custodial and investment capabilities could result in a robust and competitive institution. Experts note that while merger speculation often drives short-term stock price fluctuations, the long-term strategic benefits could include enhanced service offerings, operational efficiencies, and increased shareholder value if the merger materializes.

Future Outlook for Northern Trust

The outlook for Northern Trust remains positive amid ongoing speculation. Investors are optimistic about potential growth opportunities, enhanced market presence, and expanded product offerings that could result from a merger with BNY Mellon. Even without official confirmation, the current surge in stock prices reflects confidence in Northern Trust’s leadership, operational resilience, and strategic planning. Analysts believe that the company is well-positioned to navigate market changes while capitalizing on emerging opportunities in the financial services sector.

Key Takeaways for Investors

For investors, the recent developments highlight the importance of closely monitoring Northern Trust shares amid rumors of BNY merger talks. Strategic consolidation in banking can provide avenues for growth, efficiency, and value creation. Investors are advised to track official announcements, market performance, and regulatory developments to make informed decisions. The financial markets are highly responsive to strategic moves, and the speculation around Northern Trust and BNY Mellon underscores the influence of potential mergers on investor sentiment.

Final Notes on Market Dynamics

The surge in Northern Trust shares demonstrates the impact of market speculation and strategic developments on financial markets. Investors are increasingly focused on potential consolidation, technological innovation, and operational efficiency as drivers of stock performance. The rumors of a merger with BNY Mellon highlight the dynamic nature of the banking sector and the strategic considerations that can influence market behavior and investor confidence.

Read Full Article : https://bizinfopro.com/news/finance-news/northern-trust-shares-surge-amid-rumors-of-bny-merger-talks/

About Us : BizInfoPro is a modern business publication designed to inform, inspire, and empower decision-makers, entrepreneurs, and forward-thinking professionals. With a focus on practical insights and in‑depth analysis, it explores the evolving landscape of global business—covering emerging markets, industry innovations, strategic growth opportunities, and actionable content that supports smarter decision‑making.

Categorias

Leia mais

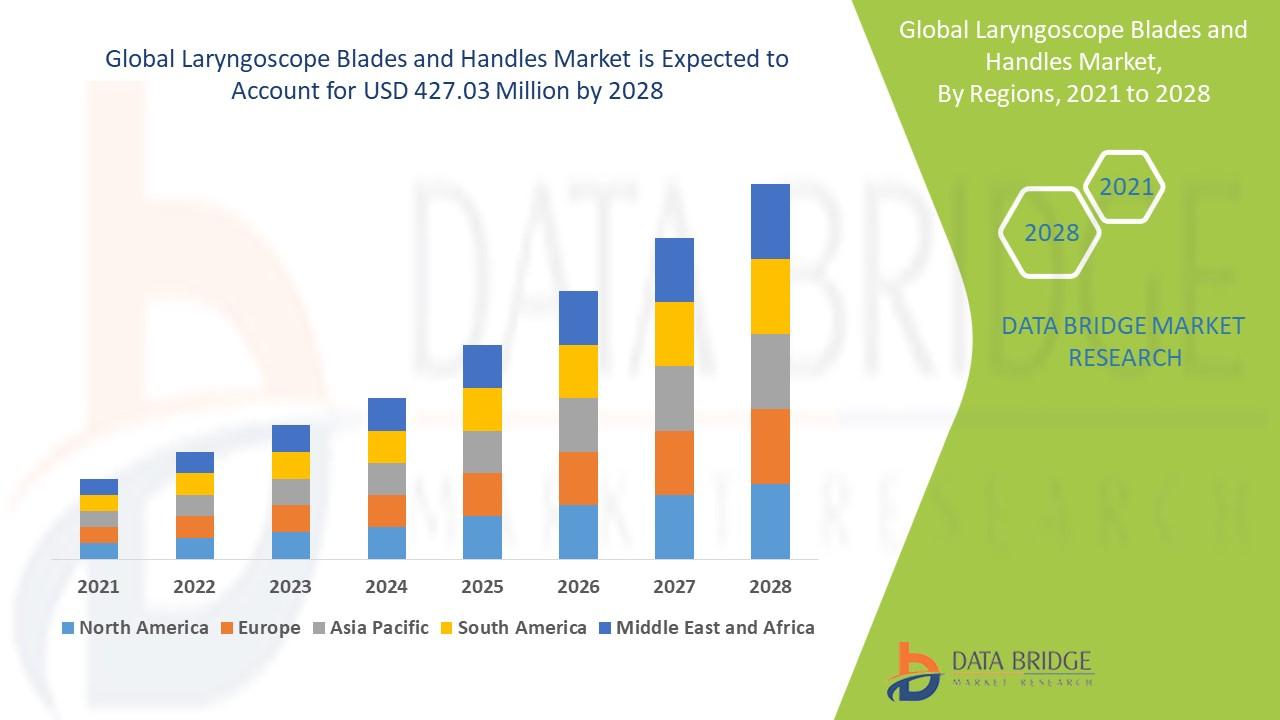

The Laryngoscope Blades and Handles Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2028. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and...

Addiction is a complex disease that affects the brain and behavior. When people use drugs, their brain's reward and motivation system is affected in a way that makes them want to keep taking the drug. Over time, continued drug use causes changes in the brain that can last long after a person stops taking drugs. These changes in the brain are what cause the harmful behaviors seen in people who...