إعلان مُمول

Leveraging Card Acquiring Solutions for Scalable Financial Growth

As businesses expand into new markets and digital platforms, the ability to process payments efficiently becomes crucial. Card acquiring solutions provide the tools needed to accept card-based payments with minimal friction. They ensure every transaction flows securely from the customer’s card to the business’s account.

For growing enterprises, card acquiring solutions offer scalability, reliability, and access to global networks. These systems simplify payment infrastructure while offering the flexibility to adapt to changing consumer behaviors and technologies.

Unlocking Value Through Streamlined Operations

One of the most compelling advantages of card acquiring solutions is the operational efficiency they bring. Businesses can reduce manual errors, cut down reconciliation time, and gain access to centralized dashboards that offer real-time visibility into payments.

Features like multi-currency support, integrated tax handling, and automated reporting allow businesses to focus on scaling without worrying about backend complexities. Whether it’s a growing online platform or a physical franchise chain, card acquiring solutions keep operations lean and responsive.

Integrating Card Issuing for Comprehensive Control

To gain a complete handle on the payment cycle, businesses are turning to card issuing solutions as well. These systems allow companies to issue their own branded cards, whether for customers, employees, or partners. These cards can be tailored with spending rules, rewards, and virtual wallet capabilities.

The integration of card issuing solutions with card acquiring solutions results in a seamless end-to-end payment framework. This setup gives businesses complete control—from issuing the card to processing the transaction—improving customer engagement and operational transparency.

Fintech companies often build platforms with both acquiring and issuing capabilities, enabling them to own the entire transaction journey and leverage user data for smart decision-making.

Enhancing the Customer Journey

Modern consumers are tech-savvy and expect a seamless, secure, and fast payment experience. Card acquiring solutions meet these demands by supporting contactless payments, QR code systems, and mobile wallets. They ensure that payments happen in seconds with high success rates and minimal failures.

Card issuing solutions further enrich the customer journey by offering advanced features such as instant card issuance, reward tracking, and card management through mobile apps. Customers feel empowered and in control, which increases satisfaction and brand loyalty.

Security at Every Stage

Cybersecurity threats are more sophisticated than ever, and payment systems are a prime target. Card acquiring solutions use secure communication protocols, risk scoring, and AI-based fraud detection systems to minimize exposure to threats.

Meanwhile, card issuing solutions give users the ability to safeguard their own cards with freeze options, biometric verification, and limited-time use features. Together, these technologies offer a layered defense system that covers every stage of the transaction lifecycle.

Conclusion

For businesses seeking to scale in a digitally connected world, card acquiring solutions provide the essential infrastructure to accept payments with speed and confidence.

When integrated with card issuing solutions, they offer a full-spectrum financial system that supports growth, enhances user experience, and ensures robust security. Together, these solutions redefine the future of business transactions by making them smarter, safer, and more customer-centric.

الأقسام

إقرأ المزيد

If you’ve ever considered stepping into the world of food franchises, the name "Haldiram's" likely comes to mind. Established as one of India's most beloved brands, Haldiram has built an empire around traditional Indian snacks, sweets, and fast food. With an extensive range of products, innovative business strategies, and strong brand recognition, owning a Haldiram franchise can...

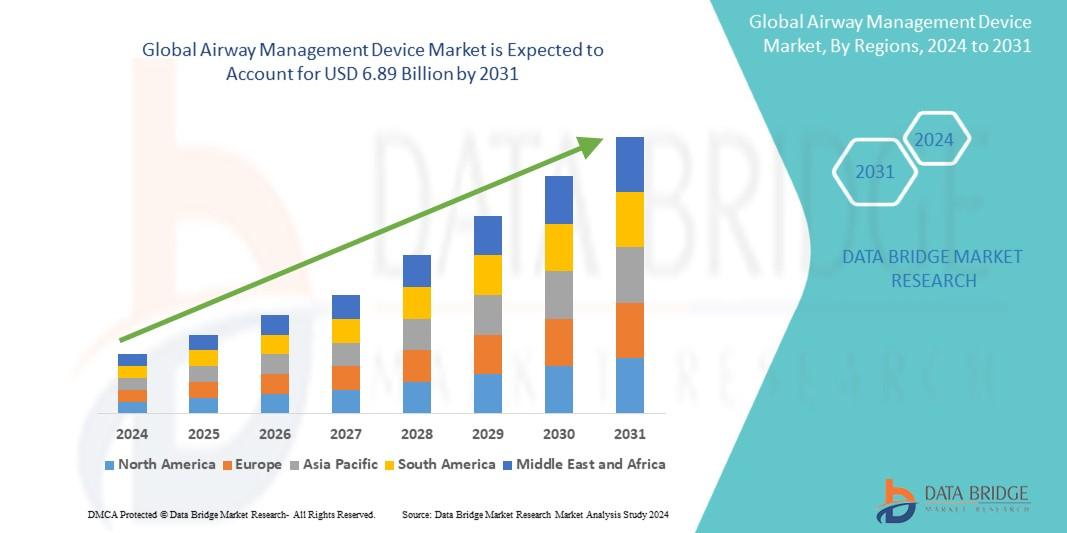

The Airway Management Device Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2031. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth...