Sponsor

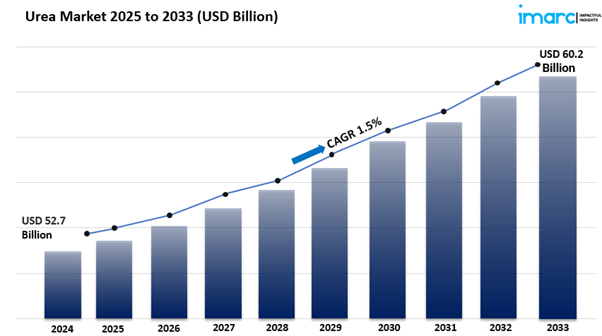

Urea Market Size is Projected to Exhibit Growth Rate 1.5% CAGR During 2025-2033

IMARC Group, a leading market research company, has recently released a report titled "Urea Market Report by Grade (Fertilizers Grade, Feed Grade, Technical Grade), Application (Nitrogenous Fertilizer, Stabilizing Agent, Keratolyte, Resin, and Others), End-Use Industry (Agriculture, Chemical, Automotive, Medical, and Others), and Region 2025-2033". The study provides a detailed analysis of the industry, including the urea market share, growth, size, trends and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

The global urea market size reached USD 52.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 60.2 Billion by 2033, exhibiting a growth rate (CAGR) of 1.5% during 2025-2033.

Request to Get the Sample Report: https://www.imarcgroup.com/urea-market/requestsample

Urea Market Trends

The Evolving Landscape of the Urea Market

The urea market is undergoing a pivotal transformation, shaped by advancements in agricultural practices and an increasing focus on environmental sustainability. By 2025, demand for urea will be heavily influenced by the adoption of precision farming techniques, which leverage technology to optimize fertilizer use. Innovations such as soil sensors, satellite imaging, and data analytics are enabling farmers to apply urea with pinpoint accuracy—delivering nutrients precisely where and when crops need them, thereby maximizing productivity and reducing environmental impact.

At the same time, the industry is responding to growing regulatory and consumer demands for eco-friendly agricultural inputs. Enhanced-efficiency products, including slow- and controlled-release urea, are gaining traction for their ability to minimize nitrogen runoff and promote long-term soil health. These sustainable solutions align with global environmental goals and reflect a broader shift toward greener farming methods.

Moreover, as climate change continues to disrupt growing conditions and increase pressure on food systems, urea’s adaptability and affordability will solidify its role as a core component in modern agriculture. In this evolving landscape, the urea market is positioned for continued growth and innovation, with producers investing in technologies that merge productivity with environmental responsibility.

Key Market Dynamics in the Urea Industry

1. Rising Global Food Production Demands

The surge in global food demand is a primary driver of growth in the urea market. With the world population projected to approach 10 billion by 2050, agricultural output must scale significantly to ensure food security. Urea remains a cornerstone of nitrogen-based fertilization, essential for maintaining soil fertility and increasing crop yields. By 2025, the agriculture sector is expected to accelerate urea usage, particularly in response to intensifying food production challenges.

Emerging markets in Asia and Africa are witnessing a rapid shift toward modern agricultural methods and mechanization, further amplifying urea consumption. These regions are prioritizing higher land productivity and efficient resource utilization, making affordable and reliable fertilizers like urea critical to success. In this context, urea’s widespread availability, ease of application, and effectiveness will continue to support its strong market performance and critical role in global food systems.

2. Sustainability and Regulatory Pressures

Environmental concerns are increasingly shaping the direction of the urea market. Rising awareness of nitrogen leaching, water contamination, and soil degradation has prompted governments to implement stricter regulations on fertilizer use. By 2025, this tightening regulatory environment will accelerate the transition toward more sustainable fertilization strategies.

In response, the industry is introducing innovative solutions such as slow-release and coated urea formulations, designed to reduce nutrient losses and environmental harm. These products offer improved nutrient efficiency and align with the growing trend toward regenerative and low-impact agriculture. The intersection of stricter policies, consumer expectations, and climate imperatives is redefining market dynamics—pushing producers to innovate while balancing productivity with ecological responsibility.

3. Technological Advancements in Production and Application

Technology is reshaping both the manufacturing and application of urea. On the production front, cutting-edge approaches like carbon capture and utilization (CCU) are enabling manufacturers to significantly lower greenhouse gas emissions associated with urea synthesis. These methods not only improve the environmental footprint of production but also enhance operational efficiency and compliance with climate goals.

On the application side, the rise of precision agriculture is revolutionizing how urea is used in the field. Technologies such as GPS-guided equipment, AI-driven analytics, and remote sensing tools are enabling farmers to apply fertilizers with greater precision and timing. This targeted approach enhances nutrient uptake, minimizes waste, and supports higher crop productivity. As digital agriculture becomes mainstream, the demand for high-performance, tech-integrated fertilizers will grow—positioning urea as a key player in smart, sustainable farming systems.

Urea Market Report Segmentation:

Breakup by Grade:

• Fertilizers Grade

• Feed Grade

• Technical Grade

Technical grade represented the largest segment, accounting for the majority of the market share for fertilizers, feed, and technical grades.

Breakup by Application:

• Nitrogenous Fertilizer

• Stabilizing Agent

• Keratolyte

• Resin

• Others

Nitrogenous fertilizer dominated the market, accounting for the largest share among applications like stabilizing agents, keratolytes, resins, and others.

Breakup by End-Use Industry:

• Agriculture

• Chemical

• Automotive

• Medical

• Others

Agriculture was the dominant end-use industry, accounting for the largest market share among segments like chemicals, automotive, medical, and others.

Breakup by Region:

● North America

● Asia Pacific

● Europe

● Latin America

● Middle East and Africa

Asia Pacific dominated the global urea market, holding the largest market share among regions like North America, Europe, Latin America, and the Middle East & Africa.

Top Companies Operated in Urea Industry:

The competitive landscape of the urea market size has been studied in the report with the detailed profiles of the key players operating in the market.

● Acron Group

● BASF SE

● BIP (Oldbury) Limited

● EuroChem

● Jiangsu Sanmu Group Co. Ltd.

● Koch Fertilizer LLC

● OCI N.V

● Petrobras

● Qatar Fertiliser Company

● SABIC

● Yara International ASA

Key Highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Categorii

Citeste mai mult

In recent years, Ashwagandha has gained immense popularity as a powerful adaptogen known for its stress-relieving and health-boosting properties. As more people seek natural solutions to enhance their well-being, finding a reliable Ashwagandha capsule brand in India has become increasingly important. Whether you’re looking to manage stress, boost energy, or improve overall...

Quake Are located with identity Software programs, may be a liberated to execute multi-player match, which unfortunately is dependent on a good tailored variant within the ancient Quake 3 Sector earliest man shooter, first revealed during 1999. This online game software programs meant for Quake Are located is offered as the cell phone plug-in meant for together Flock together with...