Forensic Accounting Services Market Research | Recent Developments and Market Dynamics

Forensic Accounting Services 2024

Forensic accounting is a specialized field that combines accounting expertise with investigative skills to detect and prevent financial fraud. It plays a vital role in legal matters, providing insights into financial discrepancies, fraud, embezzlement, and other financial crimes. Forensic accounting services not only help in uncovering financial misstatements but also assist in litigation support and provide expert testimony in court. As the global economy becomes increasingly complex and businesses face a wider range of financial challenges, the demand for forensic accounting services has grown significantly. Forensic Accounting Services Market Trends indicate that more organizations are turning to forensic accountants to safeguard their financial integrity and ensure compliance with regulations.

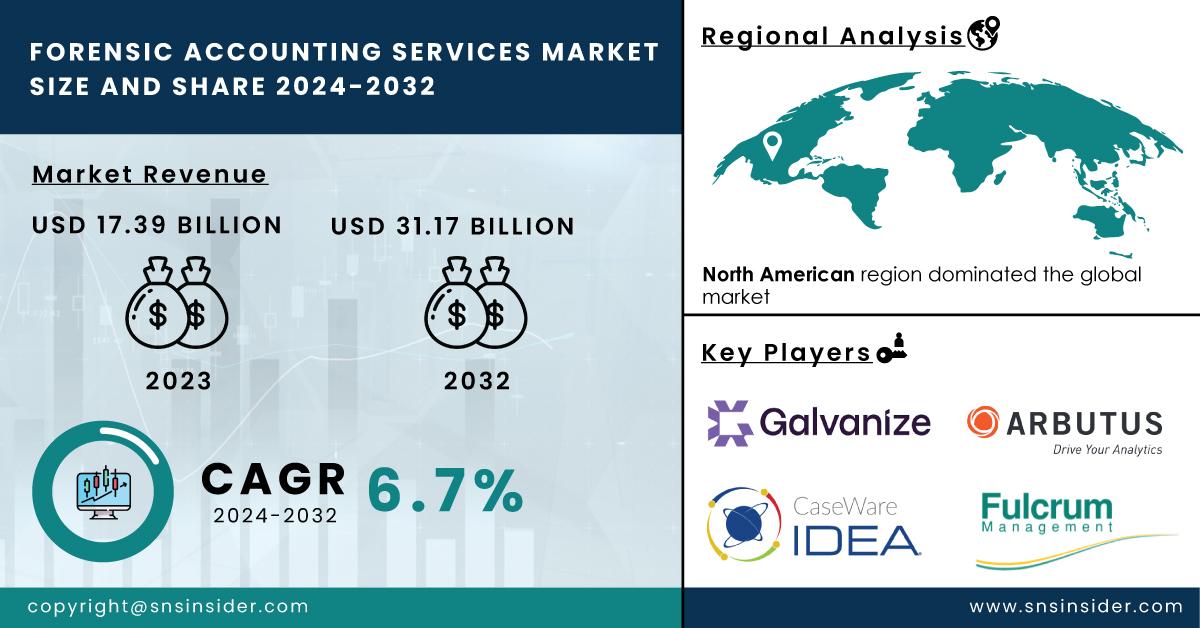

Forensic Accounting Services Market was valued at USD 17.39 Bn in 2023 and is expected to reach USD 31.17 Bn by 2032 and grow at a CAGR of 6.7% over the forecast period 2024-2032. This rapid growth underscores the increasing reliance on forensic accounting services in industries such as banking, insurance, and healthcare, where financial transparency and accurate reporting are paramount.

Understanding Forensic Accounting

Forensic accounting involves the application of accounting principles and investigative techniques to identify financial misconduct or irregularities. This includes activities such as analyzing financial records, identifying discrepancies, conducting interviews, and gathering evidence to support legal proceedings. Unlike traditional accounting, which primarily focuses on the preparation of financial statements, forensic accounting is used to investigate fraud, corruption, and other forms of financial crime.

Forensic accountants are skilled professionals who are trained not only in accounting but also in legal aspects. They must understand laws, regulations, and the judicial system to be able to prepare reports and deliver testimony that can stand up in court. In many cases, forensic accountants act as expert witnesses, offering their professional opinion on the financial aspects of a case.

The Role of Forensic Accounting in Fraud Detection

One of the primary roles of forensic accountants is to detect and investigate fraudulent activities. This can involve a wide range of crimes, from financial fraud and tax evasion to securities fraud and money laundering. Forensic accountants use advanced techniques to sift through large volumes of financial data, looking for signs of anomalies or suspicious transactions that may indicate fraudulent activity.

Forensic accounting is crucial in uncovering various forms of fraud. In corporate settings, it helps identify internal fraud, such as employee theft, false invoicing, or manipulation of financial records. In the public sector, forensic accountants assist in detecting bribery, embezzlement, and financial mismanagement. Moreover, forensic accountants are often hired by government agencies to investigate large-scale financial fraud cases, as their expertise helps ensure that the investigation is thorough and unbiased.

Forensic Accounting in Litigation and Dispute Resolution

In addition to fraud detection, forensic accounting plays a key role in litigation and dispute resolution. Businesses often encounter legal disputes related to financial issues, such as breach of contract, financial misrepresentation, or disputes between partners or stakeholders. Forensic accountants assist in evaluating the financial aspects of these cases by reviewing records, providing financial analysis, and offering expert testimony in court.

In divorce cases, forensic accountants can assess the financial situation of both parties to ensure that assets are accurately disclosed and equitably divided. They may also assist in intellectual property disputes, shareholder disputes, or any other legal situation that involves financial complexities. By offering detailed financial insights, forensic accountants help lawyers and judges understand the financial intricacies of a case, which can ultimately affect the outcome.

The Growing Demand for Forensic Accounting Services

The rise in corporate scandals, financial crimes, and economic uncertainties has significantly increased the demand for forensic accounting services. Organizations are now more proactive in employing forensic accountants to safeguard their operations and detect financial discrepancies before they escalate. This proactive approach is especially evident in industries such as banking, insurance, and healthcare, where regulatory compliance and financial integrity are critical.

Moreover, as financial fraud schemes become more sophisticated, the need for skilled forensic accountants with advanced tools and techniques has grown. The global market for forensic accounting services is expected to continue expanding, as both businesses and individuals require these services to manage risks, ensure financial compliance, and resolve disputes effectively.

The Future of Forensic Accounting

Looking ahead, the field of forensic accounting is poised for continued growth and innovation. Technological advancements, such as data analytics, artificial intelligence, and blockchain, are expected to enhance the capabilities of forensic accountants. These tools can help identify patterns, anomalies, and potential fraud more quickly and accurately, making forensic investigations more efficient.

As businesses become increasingly digital and the complexity of financial transactions grows, forensic accountants will need to stay ahead of evolving trends in cybersecurity and financial technology. The integration of forensic accounting services with other areas such as cyber forensics and fraud prevention is likely to be a key focus area for the industry’s growth.

In conclusion, forensic accounting services are a critical component of modern financial systems, offering businesses, governments, and individuals the expertise needed to detect fraud, resolve disputes, and ensure financial transparency. As the need for financial integrity and legal compliance continues to rise, forensic accounting will remain an essential tool in the fight against financial crime.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Trade Management Software Market Trends

- Forensic_Accounting_Services

- Forensic_Accounting_Services_Market

- Forensic_Accounting_Services_Market_Size

- Forensic_Accounting_Services_Market_Share

- Forensic_Accounting_Services_Market_Growth

- Forensic_Accounting_Services_Market_Trends

- Forensic_Accounting_Services_Market_Report

- Forensic_Accounting_Services_Market_Analysis

- Forensic_Accounting_Services_Market_Forecast

- Forensic_Accounting_Services_Market_Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness