India 2-Wheeler Market : Current Analysis and Forecast (2024-2032)

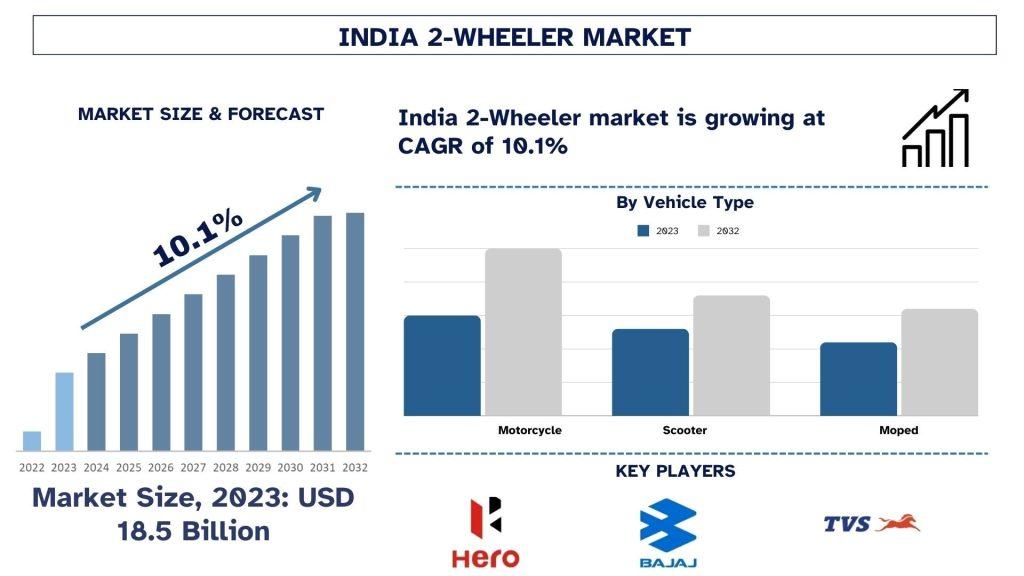

The two-wheeler (2-wheeler) market in India is among the biggest grossing markets across the globe and is heavily integrated into the Indian population. Affordable, convenient, and fuel-efficient, two-wheelers account for a dominant share of the number of vehicles owned by Indians. From the masses transport region to the countryside the need for motorcycles and scooters remains high. According to industry reports, India two-wheeler market size was over 150 million units in 2022 and hence, depicts the massive demand for such vehicles in Indian transportation. As consumers go for different products and services, various technologies being unveiled and the ever-shifting policies and regulations, the market is set to expand.

Market Overview and Key Drivers:

Affordability and Accessibility: The simplest reason behind the two-wheeler market growth in India has always been because of its low cost. Compared to cars, two-wheelers are cheaper, and thus available in the market for the broad population group. Besides, motorcycles are used by individuals living in rural regions as transport since access to public transport in such regions with harsh terrains is a challenge. In urban areas, people use scooters and bikes to move within the traffic-congested areas with ease. Much as they posed a financial strain when they were first imported require little money to own compared to other transport means, and have low maintenance requirements, two-wheelers have now become part of India’s transport systems.

Urbanization and Growing Middle Class: The use of two-wheelers has been on the rise in India primarily due to the increasing rate of urbanization and the increase in the size of middle-income earners. that as more people go into the cities for employment and other facilities such as education then more demand will result in personal transport. There are many users of scooters and other two-wheelers because they are easy to maneuver and economical in traffic-prone areas. Also, a higher disposable income packed on the middle-class buyer in India has resulted in early conversion and upgrade to the more upscale two-wheeler variants.

Fuel Efficiency and Environmental Impact: In a situation where fuel prices remain unpredictable in the country, two-wheelers are more fuel efficient as compared to four-wheelers. Scare awareness of the environment and its sustainability is leading to the increasing popularity of electric two-wheelers (E2-Wheelers). Recent measures for greener automobiles, specifically subsidies and incentives for electric vehicles (EVs) are making Indians consider E2-Wheelers. The shift towards electric mobility in the world and India especially in the two-wheelers has opened a great chance of development in each market particularly as the charging infrastructure is developed.

Government Initiatives and Regulations: The Indian government has implemented various policies to boost the automotive sector, including the two-wheeler market. Initiatives such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, tax benefits, and subsidies for EV purchases have been pivotal in promoting electric two-wheelers. Furthermore, stricter emission norms, such as the Bharat Stage (BS) VI regulations, have pushed manufacturers to innovate and produce cleaner, more efficient vehicles.

Market Segmentation

Motorcycles vs. Scooters: The motorcycle segment remains the most popular in India among all two-wheelers and commands more than 60% of the market share. There is a healthy market for motorcycles in rural areas because these vehicles are strong, and they can move in the rough terrains that are common in rural areas. On the other hand, scooters have particularly transformed and gained recognition within the urban setting due to factors such as flexibility of use, low costs of maintenance, and use of automatic transmission. Honda and TVS are the leading scooter makers while Bajaj Auto and Royal Enfield have premium and sports bike segments.

Electric Two-Wheelers (E2-Wheelers): Electric two-wheelers are also quickly gaining ground in the Indian market. With environmental worries and the drive for more sustainable means of transport, people are gradually transitioning from conventional ICE automobiles to electric ones. Ather Energy and Ola Electric have recently launched new generation electric scooters with powerful batteries at reasonable prices and the latest Bajaj electric scooter has a significantly higher range than its domestic competitors. Other factors that have boosted the sales of electric two-wheelers in India include battery swapping stations, government policies, and reduced cost of lithium-ion batteries.

Rural vs. Urban Demand: Another segment that looks large for the motorcycle industry in India is the rural markets which constitute 55% of two-wheeler sales. In these areas, there is heavy dependency on two-wheelers for traveling to and fro the workplace or for carrying goods. While in urban regions scooters are more in demand because of convenience and traffic conditions. The fact that the consumption pattern varies geographically makes it possible for manufacturers to provide for the two segments using different products.

Issues Affecting the Two-Wheeler Market

Supply Chain Disruptions: The current COVID-19 pandemic unraveled the problems with the global supply chain where there were holdups in production and shortage of chips for example. What this did for the two-wheeler industry was that it enhanced the duration of waiting for consumers and elevated the cost to the manufacturers. Despite this, there has been continuity within the market and disruptions including disruptions of supply chains for global trades and shortages of the materials that affect the two-wheelers’ supplies and costs.

Rising Competition in the Electric Segment: The increased usage of electric two-wheelers has attracted new entrants, hence additional competition in the industry. Players that earlier used to provide traditional two-wheelers are now facing competition from new-age startups and technology companies that are progressing rapidly in the e-mobility segment. The complexity with the established brands is to innovate on fuel-burning vehicles while at the same time investing in electric mobility solutions.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=3654

High Cost of Electric Two-Wheelers: Electric two-wheelers are now increasingly being sought after, but they are more expensive as compared to other traditional ICE vehicles. Even with government subsidies, affordability remains a major issue for consumers, and this has been well illustrated as far as rural consumers are concerned. Also, sentiments such as concern for battery capacity and lack of access to charging facilities in semi-urban and even rural areas affect the uptake of the product.

Stricter Emission Regulations: There are also well-intentioned actions such as tighter emission standards as the shift to BS VI has raised the price of two-wheelers because of increased costs of revamping engines and technologies.

Opportunities and Future Outlook

Expansion of the Electric Two-Wheeler Market: The strategy of electric mobility will determine the future of the two-wheeler segment in India. The government has been very sensitive to its emission reduction goals and the adoption of EVs in the country and therefore this sector of the electric two-wheelers market is expected to grow very soon. They provide infrastructure, battery, and charging technology, and research and development associated companies will be other major beneficiaries of the growth. Smart technologies consisting of IoT connection, digital displays, and enhanced, and connective services make these electric two-wheelers more attractive to consumers.

Innovation in Financing Options: Manufacturers have had to look for ways of further unlocking the two-wheeler market through employing strategies like low down payment, long-term loans, and ‘use and subscribe’. These options coupled with an extension of micro-financing facilities in rural areas can create demand, especially the electric two-wheelers. Such partnerships between the manufacturing firms and the institutions and the fintech have played the role of a funnel of providing affordable prices to consumers across different income levels.

Conclusion

India's two-wheeler market is a cornerstone of the country's transportation ecosystem, driven by affordability, convenience, and rising urbanization. The increasing focus on electric two-wheelers, government initiatives, and the continued growth of both rural and urban demand point to a promising future. While the industry faces challenges like supply chain disruptions and the high cost of electric vehicles, innovations in technology and financing will help drive further growth. As the market evolves, India’s two-wheeler industry is set to play a crucial role in the transition towards sustainable and accessible mobility.

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website -www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness