Sponsored

Tax Accountant Services: What They Offer and Why You Need Them

Tax accountants play a crucial role in the financial landscape, serving as trusted advisors for individuals and businesses navigating the complexities of tax laws and regulations. Their primary responsibility is to prepare and file accurate tax returns, ensuring that clients conform to all applicable tax laws while maximizing potential deductions and credits. Tax accountants possess in-depth familiarity with the tax code and stay updated on the newest changes, allowing them to provide expert advice on tax planning strategies that may minimize liabilities. This guidance is very valuable for businesses, where effective tax planning can significantly impact profitability and cash flow. By understanding the nuances of tax regulations, tax accountants help their clients make informed decisions that align with their financial goals.

One of the key advantages of dealing with a tax accountant is the ability to avoid costly mistakes. Tax laws are intricate and often subject to interpretation, which can result in errors if not handled by way of a professional. Mistakes on tax returns may result in penalties, interest charges, or even audits by tax authorities. Tax accountants meticulously review all financial information to make certain accuracy, reducing the chance of errors and the possibility of red flags that might trigger an audit. Additionally, they are equipped to deal with complex tax situations, such as for instance those involving multiple income streams, investments, or business ownership, where in fact the possibility of mistakes is higher. Their expertise not only ensures compliance but in addition provides peace of mind due to their clients.

In addition to preparing tax returns, tax accountants offer valuable advisory services that could help clients make strategic financial decisions through the entire year. This proactive approach to tax planning involves analyzing a client's financial situation, identifying opportunities for tax savings, and implementing strategies that may reduce tax liabilities over time. As an example, tax accountants might advise on the timing of income and expenses, investment decisions, or the structure of business transactions to reach optimal tax outcomes. By planning ahead, clients can take advantage of tax-saving opportunities that might not be offered by the past minute. This forward-thinking approach allows individuals and businesses to better manage their finances and plan for the future with confidence Tax Accountants in Frankston.

Tax accountants also play a vital role in assisting businesses with their broader financial operations. For small and medium-sized enterprises (SMEs), particularly, tax accountants could be invaluable partners in managing growth and ensuring long-term financial health. Beyond tax preparation and planning, they often provide services such as bookkeeping, financial statement preparation, and payroll management. These services help business owners maintain accurate financial records, adhere to regulatory requirements, and make informed decisions about the direction of their company. By taking on these essential tasks, tax accountants release business owners to concentrate on what they do best—running and growing their business.

Finally, the role of a tax accountant reaches representing clients in dealings with tax authorities. In the event of an audit or dispute, tax accountants serve as advocates because of their clients, leveraging their understanding of tax law and their knowledge of the client's financial situation to solve issues effectively. This representation may be crucial in protecting clients'interests and achieving favorable outcomes in negotiations with tax authorities. Whether it's responding to audit inquiries, negotiating settlements, or appealing tax decisions, tax accountants give you the expertise and support had a need to navigate these challenging situations. Their ability to deal with such matters efficiently can save clients time, money, and stress, further highlighting the value of having a talented tax accountant on one's financial team.

Categories

Read More

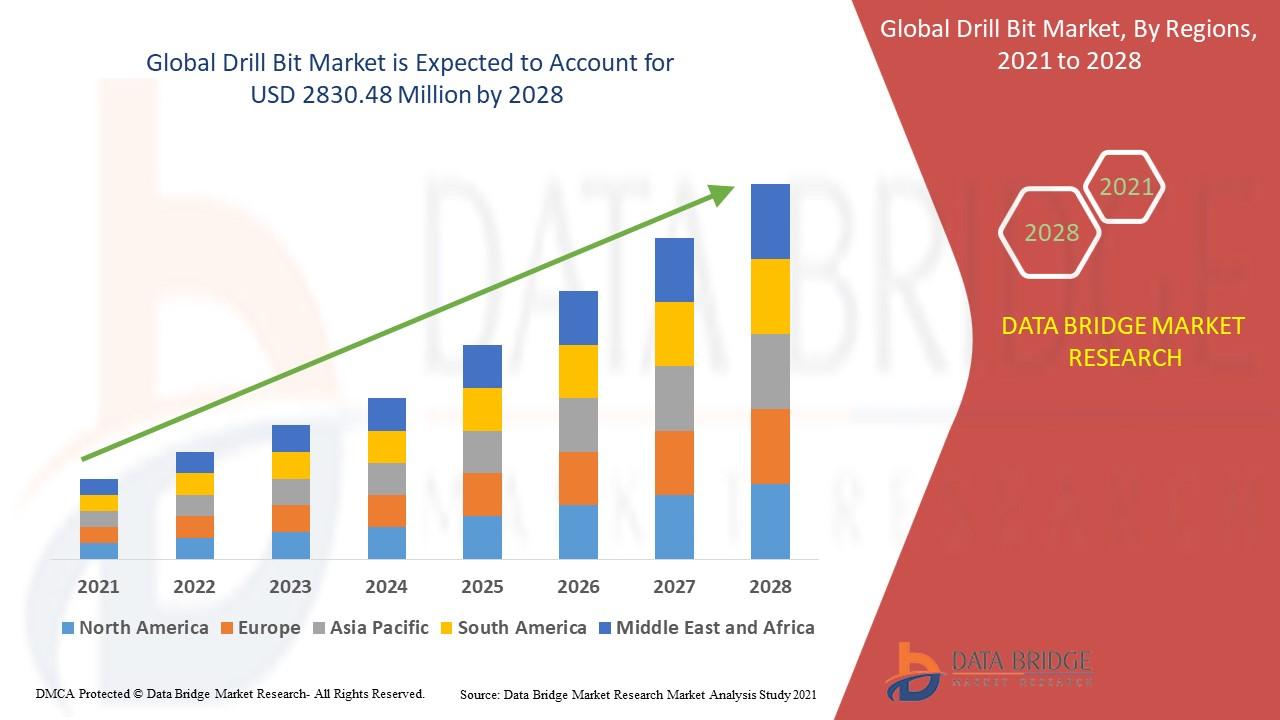

Drill Bit Market Growth, Demand and Forecast 2028 The Drill Bit Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2028. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and...

The biodegradable packaging materials market has gained tremendous traction in recent years, driven by growing environmental concerns and stringent regulations against plastic pollution. As consumers and industries alike shift towards more sustainable solutions, biodegradable packaging materials have emerged as a promising alternative to traditional plastics. Despite the strong growth...