How to Register a Company

Starting a company can be a thrilling journey. Registering your company is a crucial step. This guide will help you navigate the process efficiently. Deeksha Khurana from Taxlegit is an expert in pvt ltd company registration. Here’s how you can get started.

Step 1: Choose Your Company Type

First, decide on the type of company you want to register. A GST registration process is a popular choice due to its benefits. It offers limited liability protection to its shareholders, a separate legal entity status, and easier access to funding.

Step 2: Obtain Digital Signature Certificate (DSC)

You need a Digital Signature Certificate (DSC) for filing forms online. Ensure that all the directors of the company have their DSC. You can obtain a DSC from government-recognized certifying authorities.

Step 3: Acquire Director Identification Number (DIN)

The Director Identification Number (DIN) is mandatory for all directors. You can apply for DIN by filling Form DIR-3 on the MCA portal. Submit the form along with a self-attested copy of identity proof and address proof.

Step 4: Name Approval

Select a unique name for your company. You can check the availability of the desired name on the MCA portal. Apply for the name approval through Form SPICe+ (INC-32). You can provide up to two names in the order of preference.

Step 5: Prepare Documents

Prepare the following documents for company registration:

Memorandum of Association (MOA)

Articles of Association (AOA)

Proof of registered office address

Affidavit and declaration by the first subscribers and directors

Step 6: Filing Forms with MCA

File the incorporation forms along with the required documents on the MCA portal. The forms you need to file include:

SPICe+ (INC-32)

e-MOA (INC-33)

e-AOA (INC-34)

Step 7: Certificate of Incorporation

Once your documents are verified, you will receive the Certificate of Incorporation. This certificate confirms that your company is legally registered.

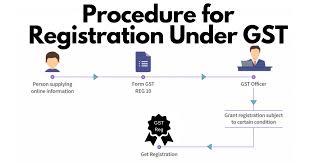

Step 8: GST Registration Process

After incorporation, you need to complete the GST registration process. GST is mandatory for businesses with a turnover exceeding the threshold limit. You can register for GST online through the GST portal. You will need:

PAN of the business

Proof of business registration

Identity and address proof of promoters

Address proof of the business place

Bank account statement

Step 9: Trademark Registration Process

A trademark is essential for protecting your brand. The trademark registration process involves:

Conducting a trademark search to ensure your brand name or logo is unique

Filing a trademark application with the Trademark Registry

Examination of the trademark application by the registry

Publication in the Trademark Journal

Registration and issuance of the Trademark Certificate

Step 10: Bank Account Opening

Open a bank account in your company’s name. Submit the Certificate of Incorporation, PAN card, and other relevant documents to the bank.

Why Choose Taxlegit?

Taxlegit, with Deeksha Khurana, offers the best pvt ltd company registration services. Their expertise ensures a seamless registration process. They also provide comprehensive assistance with the GST registration process and the trademark registration process.

Starting a company involves multiple steps, but with the right guidance, it can be smooth. Taxlegit and Deeksha Khurana are here to help you every step of the way. Register your company with confidence and set the foundation for your business success.

Categories

Read More

Dental Imaging Market Report Scope & Overview: In-depth analysis of market size, share, and trends, as well as analyses of industry trends, are included in the global Dental Imaging Market analysis report. Additionally, the data system is mostly used for statistical and numerical analysis in the report's graphics. A market analysis focuses on the leading rivals as well as...

According to a recent research, Industry revenue for Aerospace And Defense Telemetry is expected to rise to $4.1 billion by 2030 from $2.5 billion of 2023. The revenue growth of industry players is estimated to average at 7.1% annually for period 2023 to 2030. Growing end-industry applications in major countries like U.S., Russia and China, is driving the market demand high....