Sponsored

Core Banking Solution Market to Witness Increase in Revenues by 2023 - 2030

Market Research Future Insights:

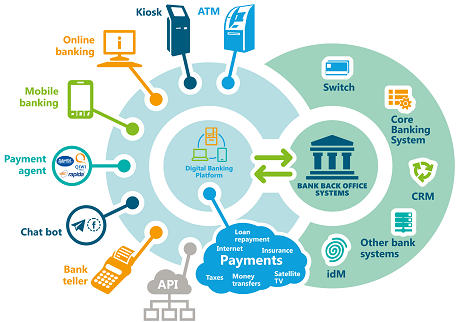

By 2030, the market for core banking solutions is anticipated to be worth USD 36.75 billion, expanding at a 14.5% CAGR (2022 to 2030). The back-end procedure that follows a banking transaction amongst several bank branches on a common platform is known as the core banking process. Online transactions and the widespread use of the internet in recent years have been the primary factors driving the growth of the core banking solutions market. Following the flow of banking activities, such as payments, transactions, updates to user accounts, and the history of financial records, is the back-end function of the banking solution.

Many bank-related activities, such as accessing debts, loans, loan processing, and accounts, may now be possible with the help of a banking solution.

Retail banks are eagerly anticipating the implementation of core banking solutions as a result, to be in a better position to provide enhanced solutions to their customers, ranging from credit and lending to payments and deposits. Because smartphones make it possible for banking customers to use the core banking solutions provided by retail banks, the proliferation of smartphones is also emerging as one of the key factors driving the growth of the market. Some retail banks are forming alliances with suppliers of retail core banking solutions. For instance, Temenos Headquarters SA, a provider of retail core banking solutions, and BlueShore, a personal loan service provider, extended their agreement in September 2020.

The significant demand for financial services as banks place more emphasis on client connection and engagement to ensure customer retention and solutions that can creatively address pressing challenges while demystifying them for their clients have been playing the role of the key drivers of this market.

Regional analysis:

The Core Banking Solution Market trends are dominated by the Asia Pacific region. This is due to the Asia Pacific area using online transactions more frequently than other regions overall. People started using this banking solution in many places as a result of the growth in technological innovation and the improvement in the standards of online transactions.

North America and Europe are the second-largest regions after the Asia-Pacific. This is due to the rapid development and expansion of the financial and international capital markets.

The other regions are projected to be able to work hard in the future to make up for the other largest shareholding regions.

Market Segmentation:

The Core Banking Solution Market is ideally categorized into 2 parts based on deployment and component. The segmentation based on deployment is further sub-categorized based on Premise and Cloud. Whereas the component-based market is further divided into Solution and Service sectors.

Key Players:

Some of the important key companies in the Core Banking Solution Companies are present on the international scene and have made contributions to raising market revenue. These significant pivotal figures are UNISYS (US), Jayam Solutions Private Limited (India), SAP SE (Germany), Infosys Limited (India), Fiserv, Inc. (US), HCL Technologies Limited (India), Capgemini SE (France), Tata Consultancy Services (India), Oracle Financial Services Software Limited (India).

Top Trending Reports:

Web3 in E-Commerce & Retail Market Research Report - Global Forecast till 2032

Web3 in Telecommunications Market Research Report- Global Forecast to 2032

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

we are launching “Wantstats” the premier statistics portal for market data in comprehensive charts and stats format, providing forecasts, regional and segment analysis. Stay informed and make data-driven decisions with Wantstats.

Contact:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

Categories

Read More

Well before the web based betting upheaval and, surprisingly, before the increase in ancestral club, a club voyage was the main legitimate method for betting in the US other than Las Vegas and Atlantic City club. These days, betting on a riverboat club is only one of the numerous choices that the sporting card shark faces when he wants to shoot dice. The historical backdrop of club...

The Asia-Pacific semolina market is experiencing steady growth, driven by the region's burgeoning population and changing dietary preferences. Semolina, valued for its versatility and nutritional benefits, is increasingly finding application in a wide range of cuisines across Asia-Pacific. The market is propelled by rapid urbanization, expanding middle-class population, and growing consumer...