Carbon Credit Trading Platform Market Global Trends, and Opportunities Forecast by 2030

Carbon Credit Trading Platform Market Scope & Overview

The market research on Carbon Credit Trading Platform provides fresh viewpoints on the prospects and challenges in the drastically altered post-COVID-19. The previews include a wealth of information, including market data templates, competing brand profiles, topic expert profiles, and business trends. This study examines the most recent market trends in each sub-segment and estimates revenue growth at the global, regional, and national levels.

The current and future state of the industry, as well as fresh strategies for expanding the market, are highlighted in the Carbon Credit Trading Platform research study. The research includes a review based on Porter's Five Forces model as well as information on market determinants and causes, the business climate, entry barriers and risks, suppliers, production networks, issues and opportunities. Investigated include top manufacturers, growth rates, export value, and important regions.

Get a Sample Report of Carbon Credit Trading Platform Market 2023 @ https://www.snsinsider.com/sample-request/2794

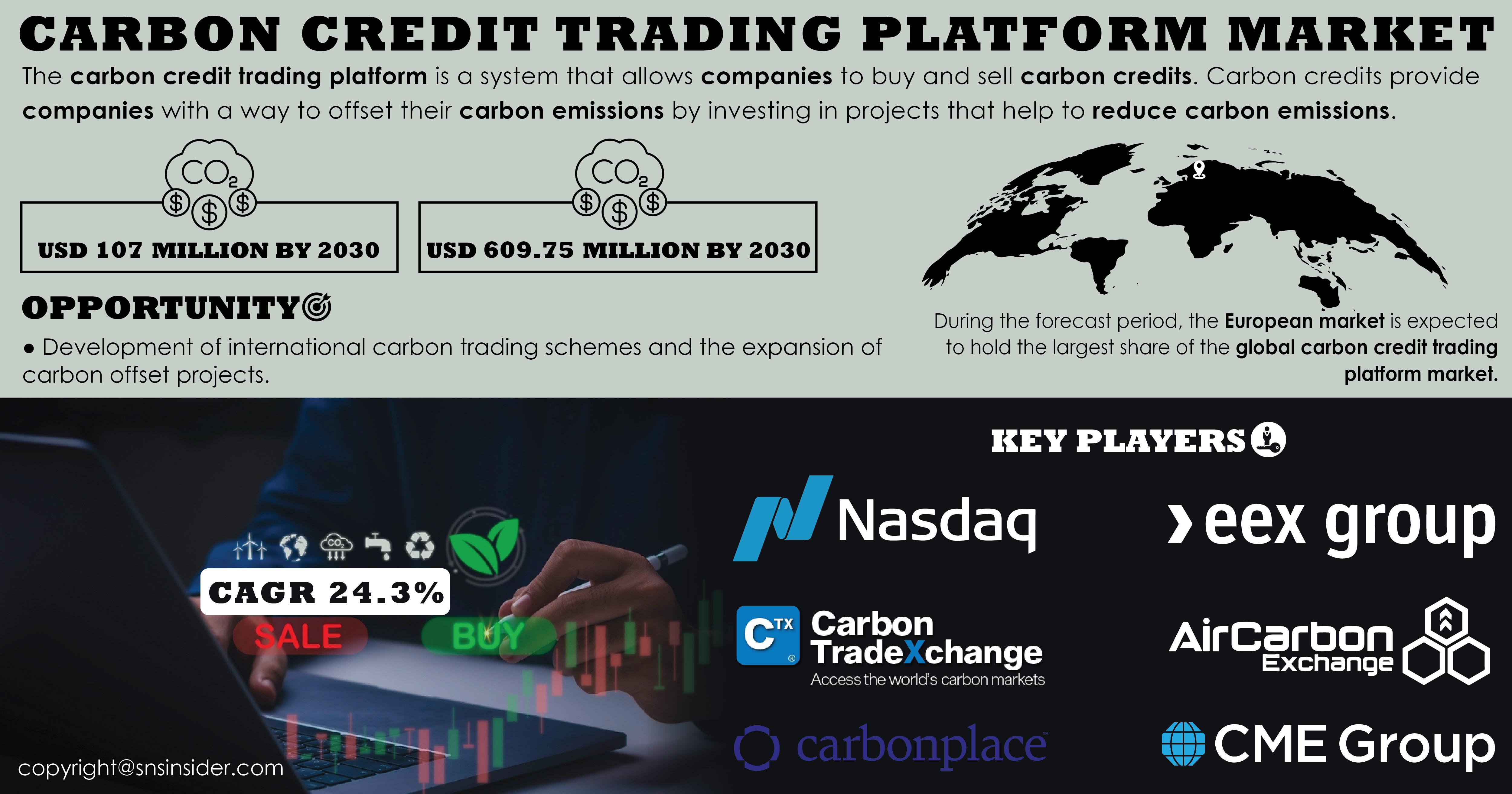

Key Players included are:

Nasdaq, Inc., Eex Group, Carbon Trade Exchange, Air Carbon Exchange (Acx), Carbonplace, CME Group, Xpansiv, Climate Trade, Planetly, Toucan, Carbon Credit Capital., Flowcarbon, Likvidi, Carbonex, Betacarbon, and other key players

Market Segmentation

The market study on Carbon Credit Trading Platform examines market trends, manufacturer share, market competition, and size growth rates by type and segment by application. The study also covers market share by revenue, consumption by nation and area, an examination of the industrial supply chain, and recent advancements. In addition to providing data on regional and county-level segmentation for other regions, this study also has a global market focus.

Market Segmentation and Sub-Segmentation included are:

By Type:

Voluntary Carbon Market

Regulated Carbon Market

By System Type:

Cap & Trade

Baseline & Credit

By End-use:

Utilities

Industrial

Aviation

Petrochemical

Energy

Others

Regional Overview

This research study includes information on significant industry participants as well as strategic alliances, plans, new product launches, partnerships, and joint ventures. Customers, retailers, marketers, service providers, and distributors will all benefit from the report. In-depth analyses of all divisions, geographic divisions, national studies, and data on all topics were performed. The purpose of this Carbon Credit Trading Platform research report is to examine growth patterns, alluring opportunities, substantial obstacles, and potential outcomes.

Competitive Coverage

The global, regional, and overall growth prospects of the Carbon Credit Trading Platform industry are all examined in the market report. It also sheds light on the general competitive environment of the global market. The reader will be able to identify firm footprints in the market during the projected period by learning about worldwide supplier share, global demand, and player production.

The study report made use of key sales, gross margin, output value, distribution networks, production capacity, regional footprint, growth rate, and compound annual growth rate. The study report contains a thorough overview of the sector. In addition, a variety of concepts and planning strategies are included in the Carbon Credit Trading Platform research.

Major Highlights of Carbon Credit Trading Platform Market Report

· A statistical analysis to have a better understanding of the market situation right now.

· A thorough analysis of the target market's rivals along with their recent activities.

· Recognize and respond to business marketing strategies like a SWOT analysis and leveraging strengths.

Table of Contents – Major Key Points:

1. Introduction

2. Research Methodology

3. Market Dynamics

4. Impact Analysis

o COVID-19 Impact Analysis

o Impact of Ukraine- Russia war

o Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter’s 5 Forces Model

7. PEST Analysis

8. Carbon Credit Trading Platform Market Segmentation, By End-use

9. Carbon Credit Trading Platform Market Segmentation, By System Type

10. Carbon Credit Trading Platform Market Segmentation, By Type

11. Regional Analysis

12. Company Profile

13. Competitive Landscape

14. Conclusion

Buy Single User PDF of Carbon Credit Trading Platform Market Report 2023 @ https://www.snsinsider.com/sample-request/2794

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact US:

Akash Anand

Head of Business Development & Strategy

Ph: +1-415-230-0044 (US)

Email: info@snsinsider.com

- Carbon_Credit_Trading_Platform_Market

- Carbon_Credit_Trading_Platform_Market_Size

- Carbon_Credit_Trading_Platform_Market_Share

- Carbon_Credit_Trading_Platform_Market_Growth

- Carbon_Credit_Trading_Platform_Market_Trends

- Carbon_Credit_Trading_Platform_Market_Report

- Carbon_Credit_Trading_Platform_Market_Analysis

- Carbon_Credit_Trading_Platform_Market_Forecast

- Carbon_Credit_Trading_Platform_Industry

- SNS_Insider

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness