Emotional and Personality Reasons Why Traders Lose

When it comes to trading, emotional and personal factors often play a significant role in determining success or failure. While technical reasons are commonly attributed to trading losses, it is important to recognize that emotional risks can have a substantial impact. Traders who lack proper education and knowledge often find themselves taking excessive risks, trading beyond their means, and entering random positions without a solid plan. This lack of understanding leads to frustration, stress, and an inability to navigate the ups and downs of the market effectively.

Emotional self-control is undoubtedly important, but it alone cannot guarantee trading success. It must be accompanied by comprehensive education and sufficient practice to develop the necessary trading skills. Let's explore some of the emotional and personality reasons why traders tend to lose.

Acting on Basic Emotions Related to Money

Fear and greed are two primary emotions that often cause traders to lose control of their performance. Fear of losing money that one cannot afford to lose leads to premature closing of positions and cutting profits too soon. On the other hand, fear can also result in holding losing positions for too long in the hope that the market will turn around. Greed becomes problematic when traders become overly ambitious during a winning streak, leading to overtrading and ultimately giving back the hard-earned profits.

Additionally, the need for quick wealth and unrealistic expectations can drive traders to project false expectations onto the market, assuming that forex trading will make them rich in no time.

Fear of Taking Losses

Many traders view taking a loss as a personal failure, as if being labeled a "loser." However, losses are an integral part of forex trading, and traders must plan carefully to avoid compromising their long-term performance. Accepting losses is essential since no one can control the market's movements entirely. Traders need to be the masters of their own reactions and acknowledge that they will occasionally make incorrect predictions.

Trading Based on Hunches

Relying on gut feelings and emotions to enter trades instead of following a well-thought-out plan often leads to disaster. Revenge trading, which involves making impulsive trades to recover previous losses, falls into this category. Without considering the bigger picture or the specific time frame being observed, traders make irrational decisions based on emotions. This pattern of behavior usually results in consecutive losses, intensifying fear and triggering a cycle of impulsive trades in hopes of recouping losses.

Lack of Confidence

Confidence in trading can only be built through positive results, which can only be achieved through thorough education and experience. A few lucky trades are insufficient to instill true confidence since they may lead to overconfidence, blurring perspective and giving traders a false sense of ease. Overconfidence often leads to careless trading without a solid plan, leaving traders unprepared for the inevitable big losses.

Overanalysis

Overcomplicating market analysis and developing intricate theories can hinder traders' ability to see and trade what is genuinely happening. Keeping trading strategies simple and focused on observable trends is crucial for effective decision-making.

Excessive Trading Time

Spending excessive time in front of the trading screen without proper rest impairs focus and leads to stress and fatigue. Traders need to be fully alert and focused when entering trades, but this can only be sustained for a limited time. Trading while tired or distracted by other daily concerns reduces the ability to make sound decisions. It is essential to spend less time observing the charts but be fully present and alert during those trading sessions.

Failure to Follow Trading Rules

A well-defined trading plan is only as good as the trader's ability to stick to its rules. Traders who consistently find excuses to bend or break the rules based on emotional reactions lack discipline and tend to have poor long-term results.

Fear of Taking Action

Even with a well-thought-out plan, some traders hesitate to execute trades when their strategy signals an entry. This hesitation often results in missed opportunities for profitable trades. While not trading may avoid losses, it also means missing out on potential profits. Traders must trust their plans and have the courage to act when the timing is right.

Moving Stops

Moving stops, which involves widening the predetermined stop-loss level, is a dangerous practice rooted in a hopeful and desperate mindset. Moving stops only amplifies impending losses, and it is important to adhere to the initial risk management strategy established. If the preplanned stop is hit, it is essential to reassess risk management rather than adjusting stops in the hope of a reversal.

Giving Up Due to Disappointment

Trading should be approached as a business, requiring discipline and a commitment to a set schedule, regardless of individual trade outcomes. Starting the day with a loss should not deter traders from continuing with their daily plan.

Counting Profits Before They Materialize

While it is crucial to set realistic goals, fixating on potential profits or worrying about potential losses serves no purpose. Traders need to focus on executing their plans, waiting for the trigger, and concentrating on each trade until it reaches its completion.

Seeking Adrenaline

Some individuals are drawn to forex trading because of the emotional rush it provides, akin to the excitement experienced by gamblers. However, this attitude is detrimental to decision-making and can have disastrous effects. A calm and focused mind is required to make sound trading decisions, and traders should strive for a relaxed state rather than seeking an adrenaline rush.

Constant Need to Be in the Market

Taking trades without valid triggers or simply to satisfy the urge to be "in the market" is akin to random trading. When there are no clear reasons to trade, it is better to wait patiently until suitable setups emerge.

External Reasons Why Traders Lose

Apart from emotional and personal factors, external reasons can also contribute to trading losses. Two significant external factors are:

Choosing the Wrong Broker

Before entering the forex market, it is essential to thoroughly research and select a reputable broker. Gathering information about potential brokers helps avoid scams or unethical practices by bucket shops.

Inappropriate Stop Placement

Even with a reliable broker, poorly placed stops can lead to frequent stop-hunting. It is crucial to set stops at levels that are not easily targeted or too tight for the selected time frame. Adequate breathing space for trades is necessary for favorable outcomes.

Conclusion

While technical reasons are often emphasized in trading losses, emotional and personal factors play a significant role in determining success or failure. Traders must address emotional pitfalls, such as fear, greed, lack of confidence, and impulsive decision-making. Additionally, external factors like choosing a reliable broker and setting appropriate stops contribute to overall trading success. By understanding and managing these emotional, personality, and external factors, traders can improve their chances of achieving consistent profitability in the forex market.

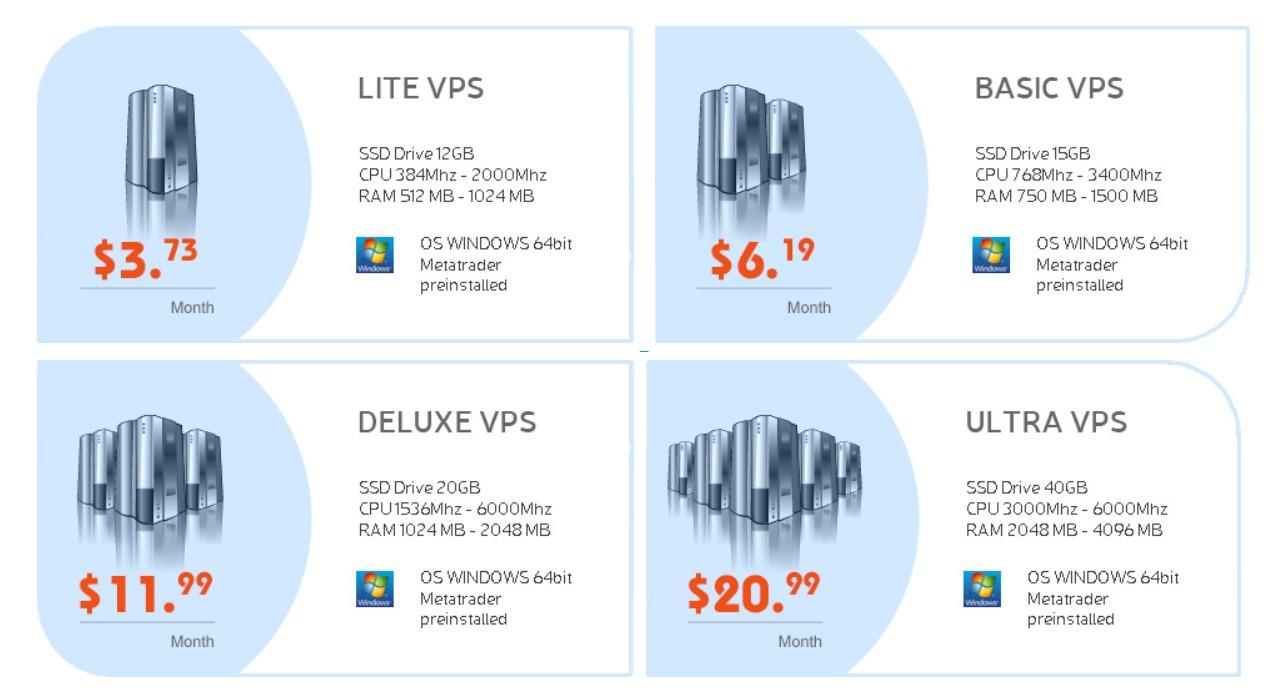

Keywords: forex cheap vps, vpsforex, cheap forex, cheapest vps forex, cheap vps forex, forex vps, forex trading servers, forex vps Malaysia, best trading vps,