Home Equity Line of Credit in Toronto

Introduction

When it comes to financing major expenses or projects, a home equity line of credit toronto can be an excellent option for homeowners in Toronto. Whether you're planning home improvements, consolidating debt, or funding education, a HELOC offers flexibility and accessibility. In this article, we will explore the concept of home equity, delve into the specifics of a HELOC, discuss its advantages, factors to consider when applying, steps to apply for one, how it can be used, and important risks to be aware of. So, let's dive into the world of home equity and discover the benefits of a HELOC.

Understanding Home Equity

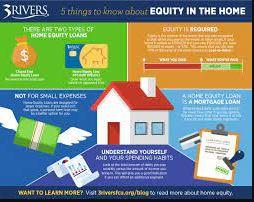

What is Home Equity?

Home equity refers to the difference between the market value of your home and the outstanding mortgage balance. It represents the portion of your property that you truly own. As you make mortgage payments and the value of your home appreciates, your equity grows. This accumulated equity can be utilized to secure a line of credit, known as a home equity line of credit Toronto.

Benefits of Home Equity

Home equity is an asset that can be leveraged to access funds for various purposes. Some key benefits of home equity include:

1.Low-Interest Rates: Since a HELOC is secured by your home, it typically offers lower interest rates compared to other forms of credit, such as credit cards or personal loans.

2.Flexibility: With a HELOC, you have the freedom to borrow and repay funds as needed within the predetermined credit limit, giving you financial flexibility.

2.Potential Tax Benefits: In certain situations, the interest paid on a HELOC may be tax-deductible, making it an attractive financing option for homeowners.

Home Equity Line of Credit (HELOC)

Explaining HELOC

A HELOC is a revolving line of credit that allows homeowners to borrow against their home equity. It provides a flexible source of funds that can be accessed as needed, up to a predetermined credit limit. Similar to a credit card, a HELOC allows borrowers to withdraw funds, repay them, and reuse the credit line repeatedly during the draw period, usually around 5-10 years.

How HELOC Works

When approved for a HELOC, you are given a credit limit based on the value of your home and your creditworthiness. You can borrow any amount within this limit, and interest is only charged on the amount withdrawn. As you repay the principal, the credit becomes available for future borrowing. The interest rates on a HELOC are typically variable, meaning they can fluctuate over time.

Advantages of HELOC

Flexibility and Accessibility

One of the significant advantages of a HELOC is the flexibility it provides. You can use the funds for various purposes, such as:

Home Improvements and Renovations: Upgrade your home, enhance its value, or make necessary repairs using the funds from your HELOC.

Debt Consolidation: Pay off high-interest debts by consolidating them into a single, lower-interest HELOC.

Education Financing: Fund your or your family's education expenses, such as tuition fees or other educational costs.

Lower Interest Rates

Compared to other forms of credit, a HELOC often offers lower interest rates due to its secured nature. By leveraging the equity in your home, you can access funds at a more affordable cost.

Potential Tax Benefits

In certain cases, the interest paid on a HELOC may be tax-deductible, subject to local tax regulations. Consult with a tax professional to understand the potential tax advantages based on your specific situation.

Factors to Consider When Applying

Applying for a HELOC requires careful consideration of various factors. The following aspects should be taken into account:

Credit Score and Income

Lenders typically consider your credit score and income level to evaluate your creditworthiness. A good credit score and a stable income increase your chances of obtaining a favorable HELOC.

Property Value and Equity

The value of your property and the amount of equity you have built are crucial factors. Higher property values and greater equity may lead to a larger credit limit.

Loan-to-Value Ratio

The loan-to-value (LTV) ratio is the percentage of your property's value that you can borrow. Lenders may have specific LTV requirements, and a lower ratio might result in more favorable terms.

Steps to Apply for a HELOC

To apply for a HELOC, follow these steps:

Research and Compare

Research different lenders and compare their offerings, including interest rates, repayment terms, fees, and credit limits. Choose a lender that best suits your needs.

Gather Necessary Documents

Prepare the required documentation, which may include income verification, property valuation reports, and proof of ownership. Having these documents ready will streamline the application process.

Submitting the Application

Complete the lender's application form accurately and submit it along with the required documents. Be prepared to provide additional information if requested by the lender.

Using a HELOC

Once you have secured a HELOC, you can utilize the funds for various purposes. Here are a few common uses:

Home Improvements and Renovations

Tap into your HELOC to finance home improvements, renovations, or upgrades. Enhancing your property not only improves your living environment but also increases its market value.

Debt Consolidation

Consolidate high-interest debts, such as credit card balances or personal loans, into a HELOC with lower interest rates. This can help simplify your finances and potentially save money on interest payments.

Education Financing

Covering education costs can be a significant financial burden. A HELOC can serve as a reliable source of funds to support your or your family's educational aspirations.

Risks and Considerations

While a HELOC offers various advantages, it's essential to be aware of the associated risks and considerations:

Variable Interest Rates

The interest rates on a HELOC are typically variable and can fluctuate with market conditions. This means your monthly payments may change over time, potentially increasing your borrowing costs.

Potential Debt Accumulation

As a revolving line of credit, a HELOC can tempt borrowers to accumulate more debt. It's crucial to exercise responsible borrowing practices and avoid overextending yourself financially.

Impact on Credit Score

Applying for a HELOC may have a temporary impact on your credit score. Make timely payments and manage your credit responsibly to maintain a healthy credit rating.

Conclusion

A home equity line of credit Toronto offers homeowners a versatile financing option. By leveraging the equity in their homes, individuals can access funds for various purposes, benefiting from lower interest rates and potential tax advantages. However, careful consideration of factors such as credit score, property value, and responsible borrowing practices is crucial. A HELOC can be a valuable tool for home improvements, debt consolidation, and education financing, but borrowers must be aware of the risks associated with variable interest rates and debt accumulation. Overall, a HELOC can provide financial flexibility and se

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness